Diving into the world of Understanding inflation rates, buckle up as we explore the ins and outs of this crucial economic concept. From measuring inflation rates to its impact on financial planning, get ready for a wild ride through the realm of economics.

Definition of Inflation Rates

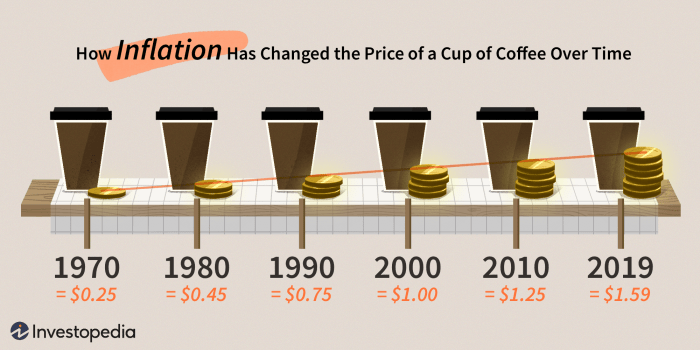

Inflation rates refer to the percentage increase in prices of goods and services over a certain period of time, typically measured on an annual basis. This increase in prices leads to a decrease in the purchasing power of a currency.

Impact of Inflation Rates on the Economy

- Inflation can erode the value of savings and investments as the purchasing power of money decreases.

- High inflation rates can lead to uncertainty in the economy, affecting consumer confidence and spending patterns.

- Businesses may struggle to plan for the future and set prices effectively in an inflationary environment.

- Inflation can also impact interest rates, with central banks adjusting rates to control inflation levels.

Significance of Understanding Inflation Rates for Financial Planning

- Understanding inflation rates is crucial for individuals to plan for retirement and set financial goals that account for the impact of inflation.

- Investors need to consider inflation when making investment decisions to ensure their returns outpace the rate of inflation.

- Businesses must factor in inflation when budgeting and setting prices to maintain profitability in changing economic conditions.

- Governments use inflation data to make policy decisions and implement measures to control inflation and stabilize the economy.

Factors Influencing Inflation Rates

Inflation rates are influenced by a variety of factors that can impact the overall economy. Understanding these key factors is crucial in analyzing the changes in inflation rates.

1. Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds the available supply, leading to an increase in prices. This can be caused by factors such as increased consumer spending, investment, or government spending.

2. Cost-Push Inflation

Cost-push inflation occurs when the cost of production increases, leading producers to raise prices to maintain their profit margins. This can be caused by factors such as rising wages, increased raw material costs, or higher energy prices.

3. Monetary Policies

Monetary policies implemented by central banks play a crucial role in controlling inflation rates. By adjusting interest rates, open market operations, and reserve requirements, central banks can influence the money supply and ultimately impact inflation rates.

4. Fiscal Policies

Government fiscal policies, such as taxation and government spending, can also influence inflation rates. By managing its budget and implementing appropriate tax policies, governments can help control inflation and stabilize the economy.

5. External Factors

External factors, such as international trade, exchange rates, and global economic conditions, can also impact inflation rates. Changes in global markets and trade agreements can have ripple effects on domestic inflation rates.

6. Inflation Expectations

Inflation expectations play a significant role in shaping actual inflation rates. If consumers and businesses anticipate higher inflation in the future, they may adjust their behavior, leading to changes in prices and inflation rates.

Types of Inflation

Inflation can manifest in various forms, each impacting the economy and consumers differently. Let’s explore the different types of inflation and their implications.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds the supply, leading to an increase in prices. This can happen during periods of economic growth or when there is excess money in circulation. For example, when consumers have more disposable income due to a booming economy, they may compete for limited goods, driving up prices.

Cost-Push Inflation

Cost-push inflation occurs when the cost of production increases, causing businesses to raise prices to maintain their profit margins. This can happen due to factors like rising wages, increased raw material costs, or higher taxes. For instance, if the price of oil spikes, transportation costs go up, leading to higher prices for goods and services.

Built-In Inflation

Built-in inflation, also known as wage-price inflation, occurs when workers demand higher wages to keep up with rising prices. As businesses raise prices to cover increased labor costs, workers demand even higher wages, creating a cycle of inflation. This type of inflation is often linked to inflation expectations and can be challenging to break.

Each type of inflation has its own set of implications for consumers and businesses. Demand-pull inflation can erode purchasing power and reduce the standard of living for consumers. Cost-push inflation can squeeze profit margins for businesses, leading to potential layoffs or reduced investments. Built-in inflation can create a vicious cycle of rising prices and wages, making it difficult for both consumers and businesses to plan for the future.

Effects of Inflation Rates

High inflation rates can have significant effects on individuals’ purchasing power, savings, investments, and retirement planning. As prices rise, the value of money decreases, leading to a decrease in the ability to buy goods and services.

Impact on Purchasing Power

Inflation erodes the purchasing power of money, meaning that the same amount of money can buy fewer goods and services over time. This can impact individuals’ ability to afford essential items and maintain their standard of living.

Impact on Savings and Investments

Inflation can erode the value of savings and investments. If the rate of return on savings or investments does not keep pace with inflation, the real value of the funds will decrease. This can affect long-term financial goals and the ability to build wealth.

Impact on Retirement Planning

For individuals planning for retirement, inflation can pose a challenge. The cost of living during retirement is likely to be higher in the future due to inflation. Without accounting for inflation, retirees may find that their savings are not sufficient to cover expenses in later years.

Strategies to Protect Finances

– Invest in assets that tend to perform well during inflationary periods, such as real estate or commodities.

– Consider investing in inflation-protected securities like Treasury Inflation-Protected Securities (TIPS).

– Diversify investments to spread risk and potentially mitigate the impact of inflation.

– Review and adjust financial plans regularly to account for changing economic conditions, including inflation rates.