Dive into the world of personal loan interest rates where the numbers dance and the costs vary. Get ready for a rollercoaster ride filled with surprises and strategies to navigate the financial landscape.

Let’s break down the factors affecting interest rates, explore the different types, and uncover the secrets to securing the best rates.

Importance of Personal Loan Interest Rates

When it comes to borrowing money, personal loan interest rates play a crucial role in determining the overall cost for the borrower. These rates are essentially the price you pay for the privilege of using someone else’s money, and they can significantly impact the total amount you end up repaying.

Impact on Total Cost

Personal loan interest rates directly affect the total cost of borrowing. A higher interest rate means you will pay more in interest over the life of the loan, increasing the overall amount you have to repay. On the other hand, a lower interest rate can save you money in the long run by reducing the total cost of the loan.

- For example, let’s say you borrow $10,000 for a personal loan with a 5% interest rate over a 5-year term. Your monthly payment would be around $188, and you would pay a total of approximately $1,280 in interest over the life of the loan.

- Now, if the interest rate on the same loan were 10%, your monthly payment would increase to about $212, and the total interest paid would jump to around $2,720. That’s over double the amount of interest paid compared to the 5% rate.

- On the flip side, if you were able to secure a loan with a 3% interest rate, your monthly payment would drop to approximately $179, and the total interest paid would decrease to roughly $680. That’s a significant savings compared to the 5% rate.

Factors Influencing Personal Loan Interest Rates

When it comes to personal loan interest rates, there are several key factors that lenders take into consideration before determining the rate for a borrower. Understanding these factors can help individuals make informed decisions when applying for personal loans.

Credit Scores

Credit scores play a significant role in determining the interest rate on a personal loan. Lenders use credit scores to assess the risk associated with lending money to an individual. Borrowers with higher credit scores are considered less risky and may qualify for lower interest rates, while those with lower credit scores may end up with higher interest rates to compensate for the perceived risk.

Loan Amount and Term Length

The loan amount and term length also play a crucial role in influencing personal loan interest rates. Typically, borrowers seeking larger loan amounts or longer repayment terms may face higher interest rates compared to those seeking smaller amounts or shorter terms. This is because larger loans and longer terms pose a higher risk for lenders, who may charge higher interest rates to offset that risk.

Types of Interest Rates for Personal Loans

When it comes to personal loans, the type of interest rate you choose can have a significant impact on your overall repayment amount. Understanding the difference between fixed and variable interest rates is crucial in making an informed decision that aligns with your financial goals.

Fixed Interest Rates

Fixed interest rates remain the same throughout the entire duration of the loan, providing borrowers with predictable monthly payments. This stability makes it easier to budget and plan for the future, as you know exactly how much you need to pay each month.

- Pros:

- Security: Borrowers are protected from sudden interest rate hikes, providing peace of mind.

- Predictability: Monthly payments remain consistent, making budgeting easier.

- Cons:

- No Benefit from Rate Decreases: If market interest rates drop, borrowers with fixed rates do not benefit from lower rates.

- Potential to Pay More: In some cases, borrowers may end up paying more interest over time compared to variable rates.

Variable Interest Rates

Variable interest rates can fluctuate based on market conditions, meaning your monthly payments can change over time. While this may seem risky, variable rates can sometimes offer lower initial rates compared to fixed rates.

- Pros:

- Potential for Lower Rates: If market rates decrease, borrowers with variable rates can benefit from lower interest payments.

- Opportunity for Savings: In some cases, borrowers can save money in the long run if interest rates remain low.

- Cons:

- Uncertainty: Monthly payments can vary, making it harder to budget and plan ahead.

- Risk of Rate Increases: If market rates rise, borrowers may end up paying more than they initially expected.

How to Get the Best Personal Loan Interest Rates

When it comes to getting the best personal loan interest rates, there are a few key strategies you can use to secure a lower rate and save money in the long run.

One important factor to consider is your credit score. Lenders typically offer lower interest rates to borrowers with higher credit scores, as they are seen as less risky. To improve your credit score, make sure to pay your bills on time, keep your credit card balances low, and avoid opening new lines of credit unnecessarily.

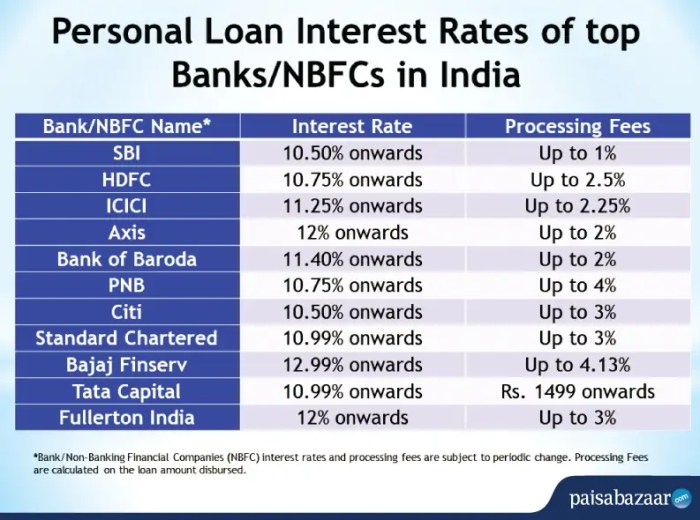

Another crucial step is to compare offers from different lenders. Shopping around and getting quotes from multiple lenders can help you find the best deal and potentially negotiate a lower interest rate. Be sure to look at not just the interest rate, but also any fees or charges associated with the loan.

Additionally, offering collateral can often help you secure a lower interest rate on a personal loan. Collateral provides the lender with a form of security, reducing their risk and potentially leading to a lower interest rate for you. Just make sure you are confident in your ability to repay the loan, as the collateral could be at risk if you default.

Importance of Improving Credit Scores

Improving your credit score is crucial when it comes to getting the best personal loan interest rates. Lenders use your credit score to assess your creditworthiness, and a higher score typically results in lower interest rates. By taking steps to boost your credit score, such as paying bills on time and reducing debt, you can increase your chances of qualifying for a lower rate and saving money over the life of the loan.