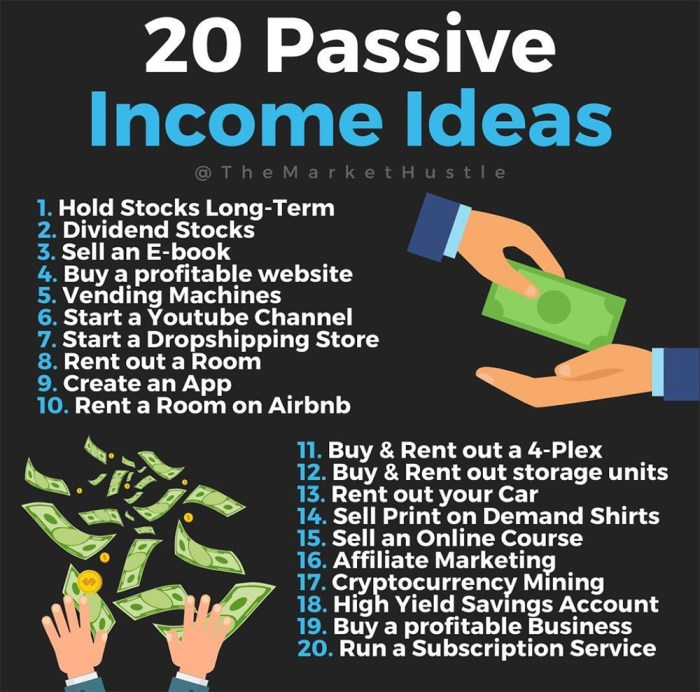

Diving into the world of Passive income ideas, get ready to explore various ways to make money while you sleep. From real estate investments to online businesses, this guide will show you how to generate income passively and secure your financial future.

Whether you’re a hustler looking to diversify your income streams or a savvy investor seeking to build wealth, this guide has got you covered with all the tips and tricks you need to succeed in the passive income game.

Introduction to Passive Income Ideas

Passive income is money earned with little to no ongoing effort required from the individual receiving it. This type of income allows for financial freedom and flexibility as it continues to generate revenue even when you’re not actively working.

Some benefits of earning passive income include:

– Ability to generate additional income streams

– Opportunity to build wealth over time

– Potential for financial stability and security

Popular Passive Income Sources

- Investing in Dividend-Paying Stocks: By investing in companies that pay dividends, you can earn a regular income without having to actively trade stocks.

- Rental Properties: Owning rental properties allows you to earn passive income through rent payments from tenants.

- Peer-to-Peer Lending: Platforms like Lending Club allow you to earn interest on money lent to others.

- Creating and Selling Digital Products: Generating passive income by creating and selling digital products like e-books, online courses, or stock photos.

Real Estate Investment

Investing in real estate is a popular way to generate passive income. By owning properties, individuals can earn money through rental income, property appreciation, and tax benefits without actively managing the properties on a day-to-day basis.

Rental Properties

Owning rental properties is a common way to earn passive income in real estate. By purchasing residential or commercial properties and renting them out to tenants, investors can generate consistent cash flow each month.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are another option for passive real estate investing. REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investors can buy shares of REITs on the stock exchange, allowing them to earn dividends without directly owning physical properties.

Stock Market Investments

Investing in the stock market can be a great way to earn passive income. By purchasing shares of companies, you can benefit from capital appreciation and dividend payments over time.

Dividend Stocks

Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders on a regular basis. These payments can provide a steady stream of passive income for investors. Look for companies with a history of consistent dividend payments and a strong financial position.

- Research and identify dividend-paying companies with a track record of increasing dividends over time.

- Consider diversifying your portfolio by investing in different sectors and industries to reduce risk.

- Reinvest dividends to take advantage of compound growth and maximize your passive income potential.

Building a Passive Income Portfolio with Stocks

Building a passive income portfolio with stocks involves selecting a mix of dividend-paying stocks and growth stocks to create a balanced investment strategy.

- Set clear investment goals and objectives to guide your stock selection process.

- Regularly review and rebalance your portfolio to ensure it aligns with your financial objectives and risk tolerance.

- Consider investing in index funds or ETFs for a diversified approach to passive income investing.

Online Business and E-Commerce

In today’s digital age, online business and e-commerce have opened up a world of opportunities for generating passive income. Whether it’s through affiliate marketing or monetizing a blog, there are various ways to make money online without constant active involvement.

Affiliate Marketing

Affiliate marketing is a popular passive income stream where you earn a commission by promoting other company’s products or services. Here are some key points to consider:

- Choose a niche that aligns with your interests and expertise to attract the right audience.

- Research and select reputable affiliate programs that offer competitive commissions.

- Create high-quality content that provides value to your audience while subtly integrating affiliate links.

- Track your affiliate links’ performance and optimize your strategies based on data and analytics.

Monetizing a Blog

Monetizing a blog can be a lucrative passive income source if done right. Here are some tips to help you get started:

- Focus on creating valuable and engaging content that resonates with your target audience.

- Explore different monetization methods such as display advertising, sponsored posts, and selling digital products or services.

- Build a strong online presence and grow your blog’s traffic through optimization and social media marketing.

- Engage with your audience through comments, emails, and social media to build a loyal community around your blog.

Create and Sell Digital Products

Creating and selling digital products can be a lucrative way to generate passive income. By leveraging your skills and knowledge, you can develop products that can be sold repeatedly without the need for continuous effort. Here’s how you can get started:

Creating Digital Products

- Identify your expertise: Determine what skills or knowledge you possess that can be valuable to others.

- Create valuable content: Develop digital products such as e-books, online courses, templates, or software that provide solutions to common problems.

- Ensure quality: Focus on delivering high-quality content that adds value to your target audience.

- Consider outsourcing: If you lack certain skills, consider hiring freelancers or experts to help you create top-notch digital products.

Platforms for Selling Digital Products

- Online marketplaces: Platforms like Etsy, Amazon, or eBay allow you to list and sell your digital products to a wide audience.

- Digital product marketplaces: Websites like Gumroad, Teachable, or Podia specialize in selling digital products and offer tools to help you market and sell your products.

- Your own website: Setting up your own website and using tools like WooCommerce or Shopify can give you full control over your product listings and sales process.

Marketing Strategies for Digital Products

- Build an email list: Collect email addresses from interested customers and use email marketing to promote your digital products.

- Utilize social media: Leverage social media platforms to showcase your digital products, engage with your audience, and drive traffic to your product listings.

- Create engaging content: Produce blog posts, videos, or podcasts that highlight the benefits of your digital products and attract potential buyers.

- Collaborate with influencers: Partner with influencers or industry experts to promote your digital products to their followers and expand your reach.

Peer-to-Peer Lending

Peer-to-peer lending is a form of investing where individuals lend money to others in exchange for interest payments. It allows investors to earn passive income by providing loans to borrowers through online platforms.

Different Peer-to-Peer Lending Platforms

- Lending Club: One of the largest peer-to-peer lending platforms, offering a variety of loan options and competitive returns.

- Prosper: Another popular platform that connects investors with borrowers, providing opportunities for diversification.

- Upstart: Utilizes artificial intelligence to assess borrower creditworthiness, potentially reducing default risks.

It is important to research and compare different peer-to-peer lending platforms to find the one that best fits your investment goals and risk tolerance.

Tips for Mitigating Risks in Peer-to-Peer Lending

- Diversify your investments across multiple loans to reduce the impact of defaults on your overall returns.

- Conduct thorough due diligence on borrowers by reviewing their credit history and financial background.

- Consider investing smaller amounts in each loan to spread out the risk and minimize potential losses.

- Regularly monitor your investments and reinvest returns to maximize your passive income potential.