Get ready to dive into the world of passive income ideas, where the money flows while you kick back and relax. This guide is all about stacking those dollars without breaking a sweat, so buckle up for a wild ride through the realm of financial freedom.

Now, let’s break down the different types of passive income streams and explore the endless possibilities that await you.

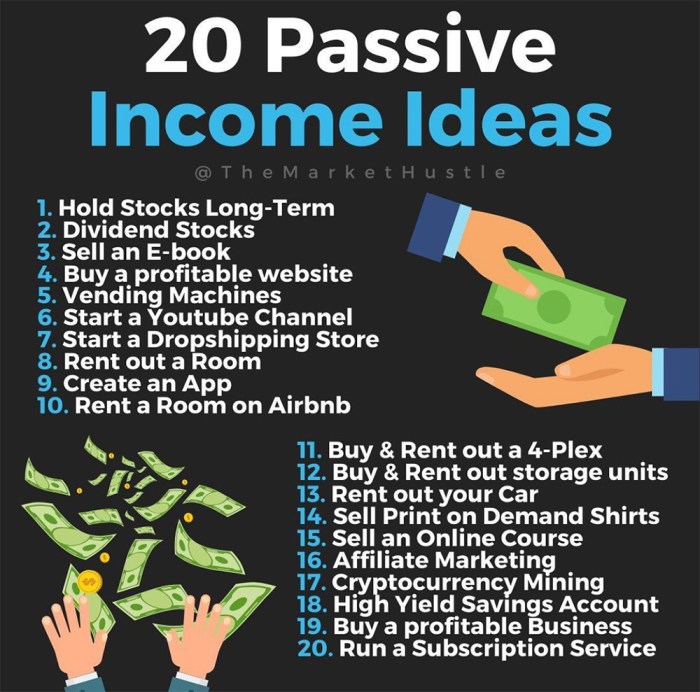

Passive Income Ideas

Passive income is money earned with minimal effort or ongoing work. It allows individuals to generate income while they sleep or focus on other activities. Here are five different types of passive income streams:

Rental Properties

Owning rental properties and collecting monthly rent is a popular form of passive income. Real estate can provide a steady stream of income and potential for long-term appreciation.

Dividend Stocks

Investing in dividend-paying stocks allows investors to earn passive income through regular dividend payments. This can provide a source of income without needing to sell the stock.

Peer-to-Peer Lending

Peer-to-peer lending platforms enable individuals to lend money to others in exchange for interest payments. It’s a way to generate passive income by acting as a lender.

Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral. It’s a popular way to earn passive income online.

Creating Digital Products

Creating digital products like e-books, online courses, or software can generate passive income through sales. Once the product is created, it can be sold repeatedly without much additional effort.

Having multiple passive income sources offers several benefits. It diversifies your income streams, reducing reliance on a single source. It provides more stability and security, especially in times of economic uncertainty. Additionally, having multiple streams of passive income can increase your overall earnings potential and financial flexibility.

Passive income differs from active income in that active income requires ongoing work and time investment to earn money. In contrast, passive income is generated with minimal ongoing effort once the initial work has been done to set up the income stream. This distinction allows individuals to earn money passively, freeing up time for other pursuits or activities.

Real Estate Investments

Investing in real estate can be a lucrative way to generate passive income. Here are some examples of passive income opportunities in real estate:

Rental Properties

- Pros:

- Steady monthly income from rental payments

- Potential for property value appreciation over time

- Tax benefits such as deductions for mortgage interest and property depreciation

- Cons:

- Initial high cost of purchasing property

- Property maintenance and management responsibilities

- Risk of dealing with difficult tenants or vacancies

Real Estate Crowdfunding

Real estate crowdfunding allows investors to pool their resources together to invest in properties without the need for direct ownership or management. It can be a passive income strategy for those looking to diversify their investment portfolio without the hassle of being a landlord.

By investing in real estate crowdfunding platforms, individuals can access real estate opportunities with lower capital requirements and reduced risk compared to traditional property ownership.

Online Business Ventures

Creating an online business can open up various opportunities for generating passive income. Whether it’s through affiliate marketing, e-commerce platforms like Shopify, or selling digital products, there are multiple avenues to explore in the digital realm.

Steps to Create a Successful Affiliate Marketing Website

Affiliate marketing can be a lucrative way to earn passive income by promoting products or services and earning a commission for every sale made through your referral. Here are some steps to create a successful affiliate marketing website:

- Choose a niche that aligns with your interests and expertise.

- Research and select reputable affiliate programs to join.

- Create high-quality content that provides value to your audience.

- Optimize your website for search engines to attract organic traffic.

- Promote your affiliate links strategically within your content.

- Track and analyze your performance to optimize your strategies.

Potential of Passive Income Through E-Commerce Platforms like Shopify

E-commerce platforms like Shopify offer individuals the opportunity to set up online stores and sell products without the need to handle inventory or shipping. Here’s why Shopify can be a great source of passive income:

- Easy to set up and customize your online store.

- Access to a wide range of tools and apps to enhance your store’s functionality.

- Ability to reach a global audience and scale your business easily.

- Automated features for order processing, payments, and shipping.

- Potential for recurring revenue through subscription services or digital products.

Creating and Selling Digital Products for Passive Income

Selling digital products, such as e-books, online courses, templates, or software, can be a profitable way to generate passive income. Here are some key points to consider when creating and selling digital products:

- Identify a market demand and create products that offer solutions or value.

- Set up a user-friendly platform to sell your digital products, such as a website or marketplace.

- Market your digital products through content marketing, social media, and email campaigns.

- Ensure high-quality and valuable content to build trust and credibility with your audience.

- Regularly update and improve your digital products to meet evolving customer needs.

Investment Opportunities

Investing is a key strategy for generating passive income. By carefully selecting different investment vehicles, individuals can build a diversified portfolio that generates income without active involvement. Let’s explore various investment opportunities for passive income.

Stocks, Bonds, and Index Funds

- Stocks: Investing in individual company stocks can provide passive income through capital appreciation and dividends.

- Bonds: Bonds offer a fixed income stream through interest payments, making them a stable option for passive income.

- Index Funds: Index funds track the performance of a specific market index, providing diversification and passive income through dividends and capital gains.

Dividend Investing

Diversified Investment Portfolio

Building a diversified investment portfolio is essential for mitigating risk and maximizing passive income. By spreading investments across different asset classes and sectors, investors can reduce volatility and ensure a stable income stream.

Passive Income through Content Creation

Creating and monetizing content online can be a lucrative way to generate passive income. Whether it’s through blogging, YouTube channels, or online courses, there are various avenues to explore in the digital realm.

Monetizing a Blog or YouTube Channel

Creating a blog or YouTube channel around a specific niche or topic that you are passionate about can attract a dedicated audience. By consistently posting valuable content, you can grow your following and eventually monetize your platform through ads, sponsorships, affiliate marketing, and even selling products or services.

Creating and Selling Online Courses

Another way to earn passive income through content creation is by developing and selling online courses. If you have expertise in a particular field or skill, you can create in-depth courses that provide value to your audience. Platforms like Udemy, Teachable, or Skillshare offer opportunities to reach a wide audience and earn revenue from course sales.

Leveraging Social Media Platforms

Social media platforms like Instagram, Facebook, Twitter, and TikTok can also be used to generate passive income. By building a strong presence and engaging with your followers, you can promote affiliate products, sponsored posts, or even your own products/services. Collaborating with brands or influencers can also open up new avenues for passive income streams.