Step into the world of Mutual funds vs. ETFs where financial jargon meets real-world application. Get ready to dive deep into the nuances of these investment options and discover which one may be right for you.

In this guide, we’ll explore the key disparities between mutual funds and ETFs, shedding light on their structures, management styles, costs, tax implications, and more.

Overview of Mutual Funds and ETFs

Mutual funds and ETFs are both investment vehicles that allow individuals to pool their money together to invest in a diversified portfolio of stocks, bonds, or other securities.

Key Differences between Mutual Funds and ETFs

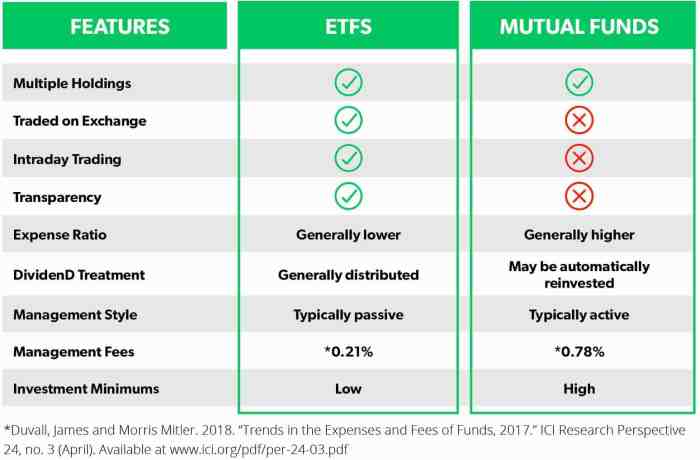

- Mutual funds are actively managed by fund managers who make investment decisions, while ETFs are passively managed and typically track a specific index.

- Mutual funds are priced once a day at the end of the trading day, while ETFs are traded on an exchange throughout the day like a stock.

- Mutual funds may have minimum investment requirements and sales charges, while ETFs can be purchased for the cost of one share plus any brokerage fees.

Popular Mutual Funds and ETFs Examples

- Mutual Funds: Vanguard Total Stock Market Index Fund, Fidelity Contrafund, American Funds Growth Fund of America.

- ETFs: SPDR S&P 500 ETF Trust (SPY), Invesco QQQ Trust (QQQ), Vanguard Total Stock Market ETF (VTI).

Structure and Management

When it comes to mutual funds and ETFs, understanding how they are structured and managed is key to making informed investment decisions.

Mutual Funds Structure and Management

Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, and other assets. These funds are actively managed by professional fund managers who make investment decisions based on the fund’s objectives and strategies. Fund managers aim to outperform the market and generate returns for investors. They conduct research, analyze market trends, and adjust the portfolio holdings accordingly. Investors in mutual funds typically pay management fees and other expenses to cover the costs of fund management.

ETFs Structure and Management

ETFs are similar to mutual funds in that they also pool money from investors to invest in a basket of securities. However, ETFs are passively managed and aim to replicate the performance of a specific index or benchmark. This means that the holdings in an ETF are fixed and do not change frequently. ETFs are traded on stock exchanges like individual stocks, allowing investors to buy and sell shares throughout the trading day. Since ETFs are passively managed, they generally have lower expense ratios compared to actively managed mutual funds.

Comparison of Fund Managers in Mutual Funds and ETFs

In mutual funds, fund managers play a crucial role in actively managing the portfolio, making investment decisions, and trying to beat the market. They have the flexibility to adjust the holdings based on market conditions and their research. On the other hand, in ETFs, fund managers have a more passive role as they aim to track the performance of a specific index. They focus on maintaining the portfolio to mirror the index composition and performance. This difference in management style also reflects in the fees charged to investors, with mutual funds generally having higher expense ratios due to active management.

Liquidity and Trading

When it comes to liquidity and trading, mutual funds and ETFs have some key differences that investors should be aware of. Let’s dive into how liquidity differs between these two investment options and explore the trading process for each.

Liquidity

In terms of liquidity, mutual funds are typically less liquid than ETFs. This is because mutual funds are only priced and traded at the end of the trading day, based on the net asset value (NAV) calculated at that time. On the other hand, ETFs are traded on stock exchanges throughout the day, allowing investors to buy and sell them at market prices whenever the market is open. This makes ETFs more liquid and provides investors with more flexibility in their trading activities.

Trading Process

The trading process for mutual funds involves placing buy or sell orders with the fund company directly. These orders are executed at the NAV price at the end of the trading day. In contrast, trading ETFs is similar to trading stocks, where investors can place orders through a brokerage account to buy or sell ETF shares at market prices during market hours. This real-time trading feature of ETFs gives investors the ability to react quickly to market movements and adjust their positions accordingly.

Ease of Buying and Selling

When it comes to buying and selling, ETFs offer greater ease and flexibility compared to mutual funds. Investors can buy and sell ETF shares at market prices throughout the trading day, allowing for quick transactions and the ability to capitalize on intraday price movements. Mutual funds, on the other hand, can only be bought or sold at the end of the trading day, which may result in missed opportunities or delayed execution of trades. Overall, the ease of buying and selling ETFs makes them a more attractive option for investors looking for liquidity and trading flexibility in their investment portfolios.

Costs and Expenses

When it comes to investing in mutual funds, there are various costs to consider. One of the primary costs is the expense ratio, which includes management fees, administrative costs, and other operational expenses. Additionally, investors may incur sales charges, also known as loads, when buying or selling mutual fund shares.

Expense Ratios of ETFs

Expense ratios for ETFs are typically lower compared to mutual funds. This is because ETFs are passively managed and often track an index, requiring less active management. As a result, investors can benefit from lower fees, which can have a positive impact on their overall return on investment.

Impact of Fees on Investment Returns

Fees play a significant role in determining the overall return on investment for both mutual funds and ETFs. High fees can eat into returns and reduce the net gains for investors. It is essential for investors to consider the fees associated with each investment option and choose the one that aligns with their investment goals and risk tolerance.

Tax Efficiency

When it comes to investing, tax efficiency is a key consideration that can impact your overall returns. Let’s dive into how mutual funds and ETFs differ in terms of tax implications.

Tax Implications of Investing in Mutual Funds

Mutual funds are known for their tax inefficiency due to their structure. When mutual fund managers buy or sell securities within the fund, it can trigger capital gains taxes for all investors, even if they did not personally sell any shares. This can lead to unwanted tax liabilities for investors, especially in years with high turnover or capital gains distributions.

ETFs: More Tax-Efficient Alternative

On the other hand, ETFs are considered more tax-efficient compared to mutual funds. ETFs typically have lower turnover rates because of their unique creation and redemption process, which allows investors to avoid capital gains taxes unless they sell their own shares. This means that investors have more control over when they realize capital gains, leading to potentially lower tax burdens.

Tax Advantages of ETFs Over Mutual Funds

- ETFs have the ability to minimize capital gains distributions, reducing tax liabilities for investors.

- Investors in ETFs can strategically manage their tax consequences by choosing when to buy or sell shares, unlike mutual fund investors.

- ETFs offer tax efficiency through in-kind redemptions, allowing investors to exchange shares for underlying securities without triggering capital gains taxes.