Yo, diving into the world of loan interest rate calculation, where numbers and factors collide to determine the cost of borrowing that cash. From fixed-rate to adjustable-rate loans, we’re about to break it down for you.

Let’s roll with the factors influencing those rates, the difference between APR and interest rate, and how compounding plays a role in the game. Get ready to level up your financial knowledge!

Loan Interest Rate Calculation Methods

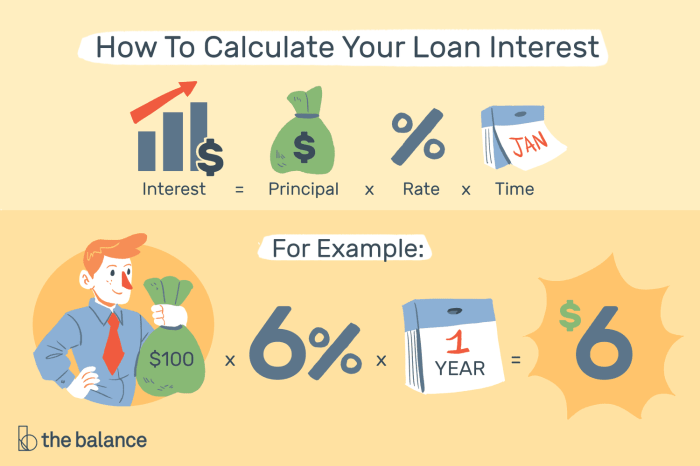

When it comes to calculating loan interest rates, there are various methods used by lenders to determine the amount of interest borrowers will pay over the life of the loan. Understanding how interest rates are calculated is crucial for borrowers to make informed decisions and effectively manage their finances.

Fixed-Rate Loans

Fixed-rate loans have interest rates that remain constant throughout the life of the loan. The interest rate is determined at the time of loan origination and remains unchanged, regardless of market fluctuations. For example, a borrower with a fixed-rate mortgage of 4% will pay the same interest rate every month until the loan is fully repaid.

Adjustable-Rate Loans

On the other hand, adjustable-rate loans have interest rates that can change periodically based on market conditions. These loans typically have an initial fixed-rate period, after which the interest rate adjusts at regular intervals. For instance, a borrower with an adjustable-rate mortgage may have a fixed rate of 3% for the first five years, then the rate could adjust annually based on an index.

Importance of Understanding Interest Rate Calculation

It is essential for borrowers to comprehend how interest rates are calculated to assess the total cost of borrowing and make informed financial decisions. By understanding the method of interest rate calculation, borrowers can compare different loan offers, evaluate the impact of changing interest rates, and plan for potential fluctuations in their monthly payments.

Factors Influencing Loan Interest Rates

When it comes to determining loan interest rates, several key factors come into play. Factors such as credit scores, loan amount, loan term, and market conditions all play a crucial role in influencing the final interest rate that borrowers will have to pay. Additionally, inflation and economic indicators also have a significant impact on the overall interest rates offered by lenders.

Credit Scores

One of the most important factors that influence loan interest rates is the borrower’s credit score. Lenders use credit scores to assess the risk of lending money to an individual. The higher the credit score, the lower the risk for the lender, which often results in a lower interest rate for the borrower. On the other hand, a lower credit score may lead to higher interest rates or even denial of the loan application.

Loan Amount

The loan amount is another crucial factor that affects interest rates. In general, larger loan amounts tend to come with lower interest rates, as lenders can spread the risk over a larger sum of money. Smaller loans, on the other hand, may have higher interest rates to compensate for the perceived higher risk associated with lending a smaller amount.

Loan Term

The loan term, or the length of time over which the loan will be repaid, also plays a role in determining interest rates. Shorter loan terms typically come with lower interest rates, as the lender is exposed to less risk over a shorter period. Conversely, longer loan terms may have higher interest rates to account for the increased risk of default over a longer repayment period.

Market Conditions

Market conditions, such as the overall state of the economy, the level of competition among lenders, and the current interest rate environment, can also influence loan interest rates. During times of economic stability and low-interest rates, borrowers may be able to secure more favorable loan terms. However, during periods of economic uncertainty or high-interest rates, borrowers may face higher interest rates on their loans.

Inflation and Economic Indicators

Inflation and various economic indicators, such as the unemployment rate, GDP growth, and the Federal Reserve’s monetary policy, can impact interest rates as well. Inflation erodes the purchasing power of money over time, leading lenders to charge higher interest rates to compensate for the decrease in the value of the money they will be repaid. Economic indicators provide insights into the overall health of the economy, which can affect lenders’ willingness to lend and borrowers’ ability to repay, ultimately influencing interest rates.

Understanding APR vs. Interest Rate

When it comes to loans, it’s crucial to understand the difference between Annual Percentage Rate (APR) and the interest rate. While they may seem similar, they serve different purposes and can impact the overall cost of borrowing money.

Annual Percentage Rate (APR)

APR encompasses not only the interest rate charged on the loan but also any additional fees or costs associated with borrowing. These can include origination fees, points, mortgage insurance, and other charges that borrowers may incur. Essentially, APR gives a more comprehensive picture of the total cost of borrowing, making it a useful tool for comparing loan offers from different lenders.

Interest Rate

The interest rate, on the other hand, is simply the cost of borrowing the principal amount. It does not take into account any additional charges or fees associated with the loan. While the interest rate is a significant factor in determining the monthly payment amount, it does not provide a complete picture of the overall cost of the loan.

Example Illustration

- Imagine you are comparing two mortgage offers. Offer A has an interest rate of 4.5% with no additional fees, while Offer B has an interest rate of 4.25% but includes origination fees and closing costs.

- Calculating the APR for both offers will give you a better idea of the total cost of borrowing. Even though Offer B has a lower interest rate, the inclusion of fees may result in a higher APR than Offer A, making it more expensive in the long run.

Impact of Compounding on Interest Calculation

When it comes to understanding how interest is calculated on a loan, the concept of compounding plays a crucial role. Compounding refers to the process where the interest that accrues on the principal amount is added to the principal, and then interest is calculated on this new total. This can significantly affect the total amount of interest paid over the life of a loan.

Comparing Simple Interest with Compound Interest

In simple interest calculations, interest is only calculated on the initial principal amount throughout the loan term. On the other hand, compound interest takes into account the interest that has already accumulated, resulting in a higher overall interest cost. This means that with compound interest, borrowers end up paying more in interest over time compared to simple interest.

Impact of Compounding Frequency

The frequency at which compounding occurs can have a notable impact on the total interest paid on a loan. The more frequently interest is compounded, the higher the overall interest cost will be. For example, a loan with monthly compounding will result in a higher total interest paid compared to a loan with annual compounding, even if the stated interest rate is the same. This is because more frequent compounding means that interest is being added to the principal more often, leading to a larger total amount owed in the end.