Ready to dive into the world of stock quotes? Understanding how to read a stock quote is essential for anyone looking to navigate the complexities of the stock market. From decoding stock symbols to analyzing performance metrics, this guide will equip you with the knowledge you need to make informed investment decisions.

Let’s break down the components of a stock quote and explore the fascinating insights they provide into the financial health of companies.

Introduction to Stock Quotes

A stock quote is a snapshot of a stock’s current price and trading activity on the stock market. It provides valuable information to investors and traders about a particular stock’s performance.

Components of a Stock Quote

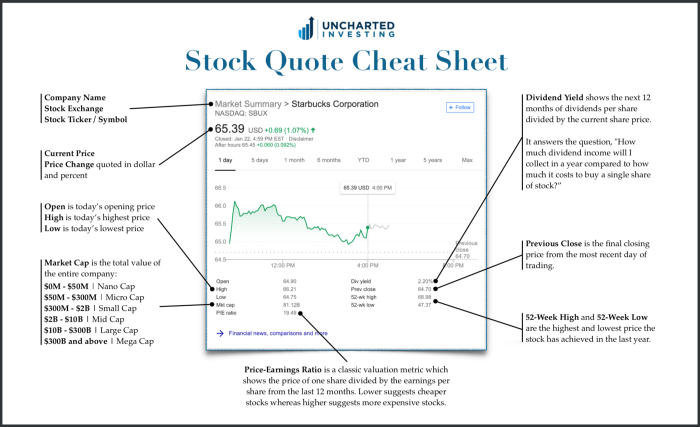

A stock quote typically includes the following components:

- Ticker symbol: A unique abbreviation used to identify a particular stock.

- Stock price: The current price at which the stock is trading.

- Volume: The number of shares traded in a specific period.

- High and low prices: The highest and lowest prices at which the stock traded during the day.

- Market capitalization: The total value of a company’s outstanding shares.

Importance of Understanding Stock Quotes

Understanding stock quotes is crucial for investors and traders to make informed decisions about buying or selling stocks. By analyzing stock quotes, individuals can track stock performance, identify trends, and assess the overall health of the market.

Stock Market Basics

In the world of finance, the stock market plays a crucial role in allowing companies to raise capital and investors to buy and sell ownership in businesses. Stock exchanges are the platforms where these transactions take place, providing vital information through stock quotes.

Role of Stock Exchanges

Stock exchanges like the New York Stock Exchange (NYSE) or Nasdaq act as intermediaries between buyers and sellers of stocks. They facilitate the trading of securities and ensure fair and transparent transactions. Stock exchanges also play a key role in determining stock prices, which are reflected in stock quotes.

Relationship between Stock Prices and Stock Quotes

Stock prices represent the current value of a company’s stock, determined by various factors such as supply and demand, company performance, and market conditions. Stock quotes, on the other hand, display the most recent price at which a particular stock traded. Stock quotes provide real-time information on the performance of a stock, helping investors make informed decisions.

Decoding Stock Symbols

When looking at a stock quote, the stock symbol is a key piece of information that investors need to understand. Stock symbols are unique combinations of letters that represent a particular company’s stock on a stock exchange.

Interpreting Stock Symbols

Stock symbols are typically 1-5 characters long and can include letters, numbers, or a combination of both. These symbols are used to quickly identify a specific company’s stock when trading.

- For example, Apple Inc. is commonly known by its stock symbol “AAPL” on the NASDAQ stock exchange.

- Another well-known stock symbol is “GOOGL” for Alphabet Inc., the parent company of Google, also listed on the NASDAQ.

Significance for Investors

Understanding stock symbols is crucial for investors as it allows them to track the performance of specific companies in the stock market. By using stock symbols, investors can easily search for information, place trades, and monitor their investments.

Stock symbols are like the fingerprints of companies in the stock market – unique and essential for identification.

Understanding Price Data

When looking at a stock quote, it’s important to understand the various price data points that are provided. These include the bid price, ask price, and last price, which all play a crucial role in making trading decisions and understanding market trends.

Bid Price

The bid price represents the highest price that a buyer is willing to pay for a stock at a given moment. It is essentially the price at which you can sell your shares if you’re looking to offload them.

Ask Price

On the other hand, the ask price is the lowest price at which a seller is willing to sell their shares. This is the price you would need to pay if you’re looking to buy shares of a particular stock.

Last Price

The last price is the most recent price at which a transaction occurred for a particular stock. It gives you an idea of the most recent value at which the stock was traded.

Influence on Trading Decisions

- Investors often use bid and ask prices to determine the best time to buy or sell a stock. A wider spread between the two prices may indicate lower liquidity in the market.

- The last price can help investors gauge the current market sentiment towards a stock. A rising last price may indicate bullish trends, while a declining last price may signal bearish trends.

Impact of Market Trends

Market trends can have a significant impact on stock prices, influencing bid, ask, and last prices. For example, positive earnings reports or industry developments can lead to an increase in stock prices, while negative news can cause a decline.

Analyzing Volume and Market Cap

When analyzing a stock quote, two key aspects to consider are volume and market capitalization. These metrics provide valuable insights into a stock’s liquidity and overall value in the market.

Importance of Volume

- Volume refers to the number of shares of a particular stock that are traded during a given period, typically a day.

- High volume indicates a high level of investor interest and activity in the stock, making it easier to buy or sell shares without significantly impacting the price.

- Low volume, on the other hand, may indicate lower investor interest and could lead to wider bid-ask spreads and potential price fluctuations.

Importance of Market Cap

- Market capitalization, or market cap, is the total value of a company’s outstanding shares of stock, calculated by multiplying the current stock price by the total number of shares.

- Market cap provides an indication of a company’s size and value in the market, with larger market cap companies often considered more stable and less volatile.

- Investors often use market cap to categorize stocks into different investment categories, such as large-cap, mid-cap, and small-cap, based on their market capitalization.

Understanding volume and market cap data can help investors make informed decisions about the liquidity and value of a stock, ultimately guiding their investment strategies.

Interpreting Performance Metrics

In the world of stock quotes, performance metrics play a crucial role in helping investors understand the financial health of a company and make informed decisions. Metrics like the P/E ratio, EPS, and dividend yield provide valuable insights that are reflected in a stock quote.

P/E Ratio

The Price-to-Earnings (P/E) ratio is a key performance metric that compares a company’s current stock price to its earnings per share (EPS). A high P/E ratio may indicate that investors have high expectations for future growth, while a low P/E ratio could suggest undervaluation.

EPS

Earnings per Share (EPS) is a metric that shows how much profit a company generates for each outstanding share of its stock. A higher EPS indicates that the company is more profitable on a per-share basis, which can be a positive sign for investors.

Dividend Yield

Dividend Yield is the percentage of a company’s annual dividend payment relative to its stock price. A high dividend yield may attract income-focused investors, while a low yield could indicate that the company is reinvesting profits for growth.

These performance metrics directly impact stock prices. For example, if a company reports strong earnings with a high EPS, investors may bid up the stock price, leading to a potential increase in value. Conversely, a company with a low P/E ratio or declining dividends may see a decrease in stock price as investors perceive it as a risky investment.