Get ready to dive into the world of deciphering stock quotes. From understanding stock symbols to decoding price information, this guide will equip you with the knowledge needed to navigate the complexities of the stock market with style and confidence.

Let’s break down the components of a stock quote and unveil the hidden gems that can help you make informed investment decisions.

Overview of Stock Quote

A stock quote provides information about a particular stock’s current trading activity on the market. It is essential for investors to understand stock quotes to make informed decisions about buying or selling stocks.

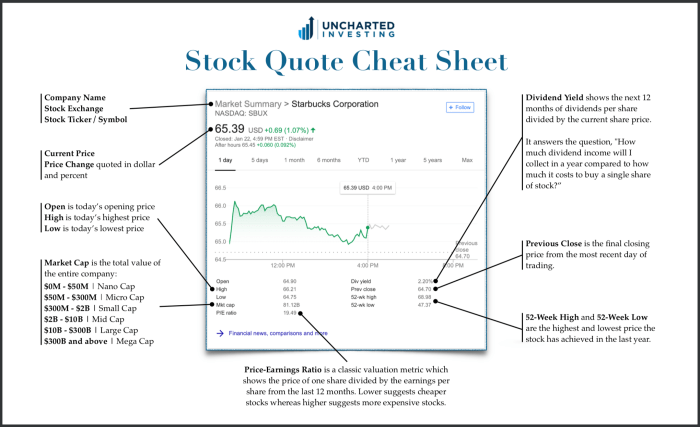

Key Components of a Stock Quote

- The stock symbol: A unique set of letters representing a specific company’s stock on the exchange.

- Current price: The price at which the stock is currently trading.

- Change: The difference between the current price and the previous day’s closing price.

- Percentage change: The percentage difference in the stock’s price from the previous day.

- Volume: The total number of shares traded in a particular period.

- Market capitalization: The total value of a company’s outstanding shares of stock.

Importance of Understanding Stock Quotes

Understanding stock quotes is crucial for investors as it helps them track the performance of their investments, identify trends in the market, and make informed decisions about when to buy or sell stocks. By interpreting the information provided in a stock quote, investors can assess the health of a company, evaluate its growth potential, and determine the best course of action to achieve their financial goals.

Stock Symbol and Company Name

When looking at a stock quote, the stock symbol and company name are essential pieces of information that help investors identify the company they are interested in.

Significance of a Stock Symbol

The stock symbol is a unique series of letters assigned to a publicly traded company. It serves as a shorthand way to represent the company in the stock market. Investors use stock symbols to search for specific companies and track their performance.

Popular Stock Symbols and Company Names

- AAPL: Apple Inc.

- AMZN: Amazon.com Inc.

- GOOGL: Alphabet Inc. (Google)

- MSFT: Microsoft Corporation

Differentiating Stock Symbols and Company Names

In a stock quote, the stock symbol will typically be listed in uppercase letters, while the company name will be written in title case. For example, “AAPL” is the stock symbol for Apple Inc. and “Apple Inc.” is the company name. It’s important to pay attention to these details to avoid confusion when analyzing stock quotes.

Price Information

When looking at a stock quote, you’ll come across different prices that provide valuable information about the stock’s value and trading activity.

Price information is crucial for investors as it helps them make informed decisions about buying or selling stocks.

Bid Price vs. Ask Price

The bid price represents the highest price a buyer is willing to pay for a stock at a given moment, while the ask price is the lowest price a seller is willing to accept. The difference between the bid and ask price is known as the spread.

For example, if a stock has a bid price of $50 and an ask price of $52, the spread is $2.

The bid price reflects demand for the stock, while the ask price reflects supply. A narrow spread indicates high liquidity, while a wide spread may suggest lower liquidity and potentially higher volatility.

Volume and Market Cap

When looking at a stock quote, two important factors to consider are the volume and market cap of a company. Volume refers to the total number of shares traded in a particular stock during a given period of time, usually a day. On the other hand, market cap, short for market capitalization, represents the total value of a company’s outstanding shares of stock in the market.

Volume

Volume is a key indicator of how actively a stock is being traded. High volume usually indicates strong investor interest in the stock, while low volume may suggest a lack of interest or liquidity. Traders often use volume to confirm trends or identify potential reversals in stock prices.

- High volume stocks: Apple Inc. (AAPL), Tesla Inc. (TSLA), Amazon.com Inc. (AMZN)

- Low volume stocks: Camping World Holdings Inc. (CWH), 22nd Century Group Inc. (XXII), Luby’s Inc. (LUB)

Market Cap

Market cap is an important metric that helps investors understand the size and value of a company in the market. It is calculated by multiplying the current stock price by the total number of outstanding shares. Market cap is used to categorize companies into different size segments, such as large-cap, mid-cap, and small-cap.

- High market cap stocks: Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), Facebook Inc. (FB)

- Low market cap stocks: Gogo Inc. (GOGO), Castor Maritime Inc. (CTRM), Aptevo Therapeutics Inc. (APVO)

Stock Exchange Information

When looking at a stock quote, the stock exchange plays a crucial role in determining where the stock is being traded and influencing its price. Different stock exchanges have their own set of rules and regulations, which can impact how a stock is traded and valued.

Types of Stock Exchanges and Their Abbreviations

- NYSE (New York Stock Exchange): One of the largest stock exchanges in the world, located in New York City, known for trading large-cap stocks.

- NASDAQ (National Association of Securities Dealers Automated Quotations): An electronic stock exchange, also located in the US, known for trading technology and growth stocks.

- LSE (London Stock Exchange): The primary stock exchange in the UK, trading a wide range of international stocks.

- TSE (Tokyo Stock Exchange): The largest stock exchange in Japan, trading a variety of Japanese stocks.

Impact of Stock Exchange Information on Trading and Investment

The stock exchange where a company’s stock is listed can have a significant impact on trading and investment decisions. Different exchanges may have different trading hours, liquidity levels, and regulatory requirements, all of which can affect the price and availability of a stock. Investors need to consider these factors when deciding where to buy or sell a particular stock.