Diving deep into the world of home loan pre-qualification, this introduction sets the stage for an insightful exploration of what it takes to get ahead in the housing market. From understanding the basics to navigating the complexities, buckle up for a wild ride through the ins and outs of pre-qualifying for a home loan.

In this guide, we’ll break down everything you need to know about home loan pre-qualification, from the criteria lenders consider to the process involved, giving you the tools to make informed decisions along the way.

Understanding Home Loan Pre-Qualification

When it comes to home loan pre-qualification, it’s like getting a sneak peek at the possibilities of owning your dream home before diving into the house hunting game. It’s a smart move to make before you start shopping around for that perfect place to call your own.

Definition of Home Loan Pre-Qualification

Home loan pre-qualification is like dipping your toes in the water to test the temperature before taking the plunge. It’s a process where a lender assesses your financial situation to give you an estimate of how much you can borrow for a mortgage. This estimate is based on information provided by you regarding your income, assets, debts, and credit score.

Purpose of Pre-Qualifying for a Home Loan

Getting pre-qualified for a home loan is like having a golden ticket in your back pocket. It gives you a clear idea of your budget and helps you narrow down your house hunting options to properties you can actually afford. Plus, it shows sellers that you’re a serious buyer who has already taken the first step towards securing financing.

Benefits of Getting Pre-Qualified Before House Hunting

- Know Your Budget: Pre-qualification gives you a realistic idea of how much you can borrow, helping you set a budget for your home search.

- Speed Up the Process: With pre-qualification in hand, you can move quickly on making an offer once you find the perfect home.

- Gain Negotiating Power: Sellers are more likely to take you seriously and negotiate with you if you’re pre-qualified for a loan.

- Peace of Mind: Knowing you’re financially ready to make a purchase can reduce stress and uncertainty during the home buying process.

Qualification Criteria

To pre-qualify for a home loan, lenders typically consider various criteria to assess your eligibility. This includes factors such as credit score, income, employment history, and debt-to-income ratio.

Documents and Information Required

When applying for pre-qualification, you will need to provide certain documents and information to the lender. This may include:

- Proof of income (such as pay stubs or tax returns)

- Bank statements

- Proof of assets

- Employment history

- Information on any existing debts or loans

Credit Scores and Income Influence

Your credit score and income play a significant role in the pre-qualification process. Lenders use your credit score to assess your creditworthiness and ability to repay the loan. A higher credit score generally indicates lower risk for the lender. Your income is also crucial, as it helps determine how much you can afford to borrow and repay. Lenders will look at your debt-to-income ratio to ensure you can manage monthly mortgage payments effectively.

Pre-Qualification Process

When it comes to the pre-qualification process for a home loan, there are several important steps to keep in mind. Lenders use this process to determine if an individual is financially ready to take on a mortgage.

Steps Involved in Pre-Qualification Process

- Submission of Financial Information: The first step involves providing details about income, assets, and debts to the lender.

- Lender Evaluation: The lender then assesses the information provided to determine the individual’s financial readiness.

- Pre-Qualification Letter: If approved, the lender issues a pre-qualification letter outlining the amount the individual may be eligible to borrow.

Lender Assessment of Financial Readiness

- Income Verification: Lenders verify income through pay stubs, tax returns, and other financial documents.

- Debt-to-Income Ratio: Lenders analyze the individual’s debt-to-income ratio to ensure they can afford the mortgage payments.

- Credit Check: Lenders review the individual’s credit score and history to assess their creditworthiness.

Timeline for Completing Pre-Qualification Process

- Typically, the pre-qualification process can be completed within a few days to a week, depending on how quickly the individual provides the necessary documentation.

- Once the lender has all the required information, they can evaluate the application and issue a pre-qualification letter promptly.

Comparison with Pre-Approval

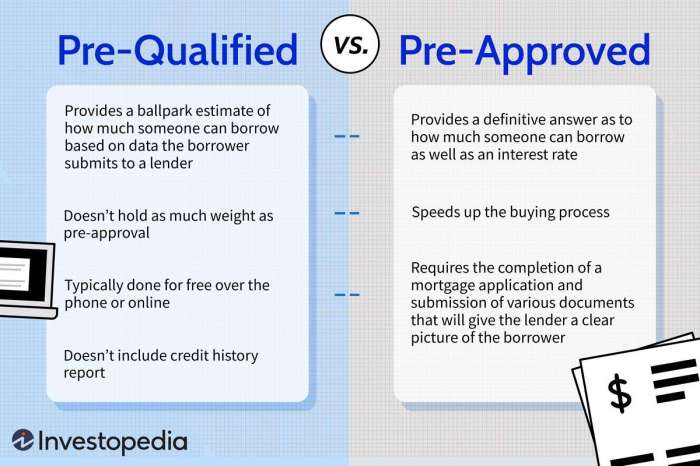

When looking into the home loan process, it’s crucial to understand the key differences between pre-qualification and pre-approval. While both can help you understand your purchasing power, they serve different purposes and have varying levels of commitment.

Differentiate between Home Loan Pre-Qualification and Pre-Approval

- Pre-Qualification: This is an initial step where a lender assesses your financial situation based on the information you provide. It gives you an estimate of how much you may be able to borrow.

- Pre-Approval: Pre-approval is a more thorough process where the lender verifies your financial information, such as income, assets, and credit score. It provides a conditional commitment for a specific loan amount.

Advantages and Disadvantages of Each Process

- Pre-Qualification:

- Advantages: Quick and easy process, no impact on credit score, helps you get a general idea of your budget.

- Disadvantages: Not as reliable as pre-approval, doesn’t guarantee a loan, may lead to disappointment if the actual approval amount is lower.

- Pre-Approval:

- Advantages: Shows sellers you’re serious, helps you stand out in a competitive market, gives you a clear budget to work with.

- Disadvantages: Requires more documentation, may impact your credit score slightly, the approval amount may still change based on the property appraisal.

When to Opt for Pre-Approval Over Pre-Qualification

- If you’re in a competitive market where multiple buyers are vying for the same property, having a pre-approval can give you an edge.

- If you want a more accurate idea of your budget and are ready to move forward with a purchase, pre-approval is the way to go.

- For those looking to speed up the closing process and show sellers that you’re a serious buyer, pre-approval is the better choice.