Get ready to dive into the world of financial stress management like never before. We’re about to unravel the secrets to a stress-free financial life, packed with tips and strategies to help you take control of your money and your mental well-being.

Let’s explore the impact of financial stress on mental health, common causes, and effective strategies for managing it.

Understanding Financial Stress

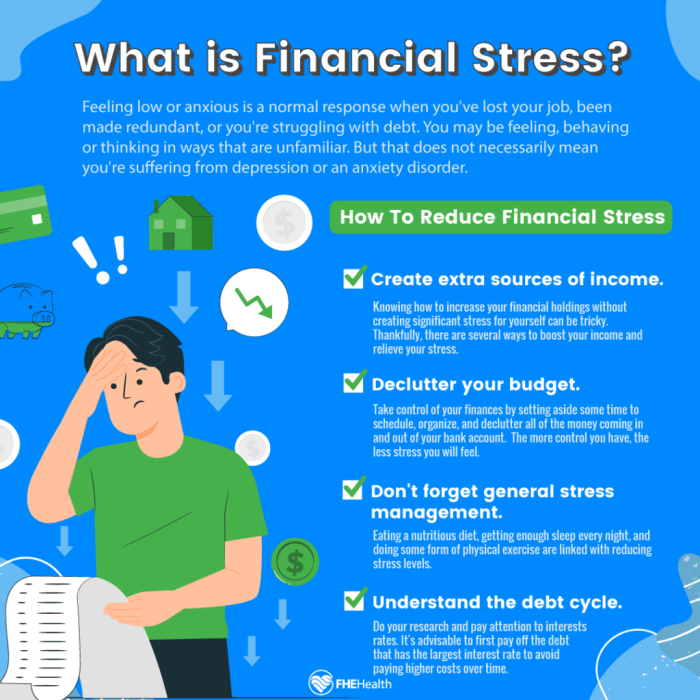

Financial stress is the anxiety and worry that arises from financial problems or burdens, impacting an individual’s mental health. It can lead to feelings of overwhelm, fear, and even physical symptoms like headaches or insomnia.

Common causes of financial stress include:

Lack of Emergency Savings

Not having enough savings to cover unexpected expenses like medical bills or car repairs can create a sense of uncertainty and worry.

High Levels of Debt

Dealing with significant amounts of debt, such as credit card debt or student loans, can be overwhelming and lead to constant stress about making payments.

Income Insecurity

Uncertainty about job stability, irregular income, or low wages can all contribute to financial stress as individuals struggle to make ends meet.

Financial stress can manifest in daily life through behaviors like overspending, avoiding checking bank account balances, or feeling constant anxiety about money. It can also impact relationships and overall well-being, making it crucial to address and manage effectively.

Strategies for Managing Financial Stress

Financial stress can be overwhelming, but with the right strategies, you can take control of your finances and reduce the pressure it brings. By implementing budgeting techniques, setting financial goals, and building an emergency fund, you can create a more stable financial future for yourself.

Budgeting Techniques to Alleviate Financial Pressure

- Track your expenses: Keep a record of all your spending to identify where your money is going.

- Create a budget: Allocate specific amounts to different expense categories and stick to them.

- Cut unnecessary expenses: Identify areas where you can reduce spending and reallocate that money towards more important priorities.

- Use cash envelopes: Allocate cash to different spending categories to prevent overspending.

Tips for Setting Financial Goals to Reduce Stress

- Set specific and measurable goals: Define clear objectives that you can track and work towards.

- Prioritize your goals: Focus on the most important financial milestones first to make steady progress.

- Break down big goals: Divide large goals into smaller, achievable steps to stay motivated.

- Regularly review and adjust goals: Assess your progress and make changes as needed to stay on track.

Importance of Building an Emergency Fund for Financial Security

Having an emergency fund can provide a safety net during unexpected financial challenges, such as job loss, medical emergencies, or car repairs. It can help you avoid going into debt and provide peace of mind knowing you have a financial cushion to fall back on in times of need.

Experts recommend saving 3-6 months’ worth of living expenses in an emergency fund to cover unexpected costs.

Seeking Professional Help

When dealing with financial stress, seeking professional help can be a valuable resource in navigating through challenges. Financial advisors, credit counseling services, and therapy/counseling are all options that individuals can explore to manage their financial stress effectively.

Role of Financial Advisors

Financial advisors play a crucial role in helping individuals create financial plans, set realistic goals, and make informed decisions about their finances. They can provide personalized advice on budgeting, investing, retirement planning, and debt management. By working with a financial advisor, individuals can gain clarity on their financial situation and develop strategies to alleviate stress related to money management.

Benefits of Credit Counseling Services

Credit counseling services offer guidance on managing debt, improving credit scores, and creating a realistic repayment plan. These services can negotiate with creditors on behalf of individuals, consolidate debts, and provide education on financial literacy. By enrolling in credit counseling, individuals can regain control over their finances, reduce debt-related stress, and work towards a more stable financial future.

Therapy/Counseling for Coping with Financial Stress

Therapy or counseling can be beneficial for individuals struggling with the emotional impact of financial stress. Mental health professionals can help individuals identify and address underlying issues contributing to financial stress, develop coping strategies, and improve overall well-being. By seeking therapy or counseling, individuals can receive emotional support, learn effective stress management techniques, and build resilience in dealing with financial challenges.

Lifestyle Changes for Reducing Financial Stress

When it comes to managing financial stress, making lifestyle changes can have a significant impact on your overall well-being. By embracing minimalism, adopting a frugal lifestyle, and decluttering your life, you can take positive steps towards reducing financial stress and achieving greater peace of mind.

Impact of Minimalism on Financial Well-being

Embracing minimalism involves simplifying your life by focusing on what truly matters and letting go of excess material possessions. By prioritizing experiences over things and living with less, you can significantly reduce your expenses, save money, and ultimately decrease financial stress. Minimalism encourages mindful spending, thoughtful consumption, and a greater sense of contentment with less.

Benefits of Adopting a Frugal Lifestyle

Living frugally means being intentional with your spending, making conscious choices to save money, and avoiding unnecessary expenses. By budgeting wisely, seeking out deals and discounts, and prioritizing needs over wants, you can stretch your dollars further and alleviate financial pressure. A frugal lifestyle promotes financial discipline, resourcefulness, and a greater appreciation for the value of money.

Decluttering for Reducing Financial Stress

Decluttering your living space can have a positive impact on your mental and financial well-being. By simplifying your surroundings, organizing your possessions, and letting go of items you no longer need, you can create a sense of order and clarity in your life. Decluttering can also help you identify unnecessary spending habits, avoid impulse purchases, and prioritize what truly matters, leading to reduced financial stress and a greater sense of control over your finances.