Diving into the world of credit card debt management, we uncover the essential strategies and pitfalls that can make or break your financial well-being. From understanding credit card terms to practical tips for effective management, this guide has got you covered. Get ready to take control of your finances and pave the way towards a debt-free future.

As we delve deeper, we’ll explore the nuances of credit card debt management, shedding light on the importance of financial literacy and responsible spending habits.

Importance of Credit Card Debt Management

Managing credit card debt is crucial for financial health. It allows individuals to maintain control over their finances and avoid falling into a cycle of debt that can be difficult to break free from. By effectively managing credit card debt, individuals can take steps towards achieving financial stability and peace of mind.

Consequences of Not Managing Credit Card Debt

- Accumulation of high-interest charges: Failing to manage credit card debt can result in the accrual of high-interest charges, leading to an increase in the total amount owed.

- Negative impact on credit score: Not managing credit card debt effectively can harm an individual’s credit score, making it more challenging to access credit in the future.

- Stress and anxiety: The burden of overwhelming credit card debt can cause stress and anxiety, impacting overall well-being and quality of life.

Benefits of Proper Credit Card Debt Management

- Improved credit scores: By managing credit card debt responsibly, individuals can improve their credit scores over time, opening up opportunities for better interest rates and loan approvals.

- Financial stability: Proper management of credit card debt can contribute to overall financial stability, allowing individuals to plan for the future and achieve their financial goals.

- Reduced debt burden: Effective debt management strategies can help individuals reduce their debt burden and work towards becoming debt-free.

Strategies for Credit Card Debt Management

Managing credit card debt effectively is crucial to maintaining financial stability. Here are some strategies to help you tackle your credit card debt:

Tips on Creating a Budget to Manage Credit Card Debt

Creating a budget is the first step towards managing credit card debt. Start by listing all your sources of income and all your expenses. Differentiate between essential expenses and discretionary spending. Allocate a portion of your income towards paying off your credit card debt each month. Stick to your budget to avoid accumulating more debt.

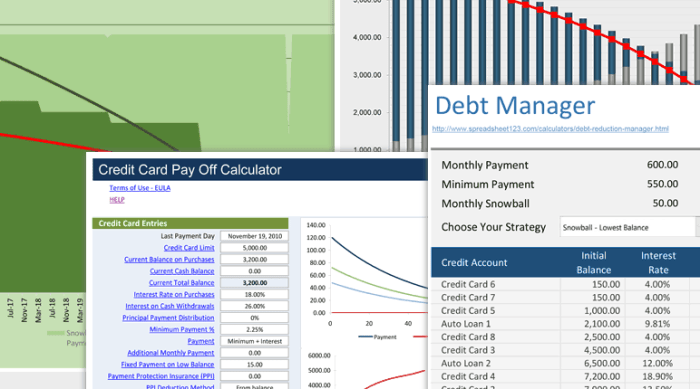

Snowball and Avalanche Methods for Paying Off Credit Card Debt

The snowball method involves paying off the smallest debt first while making minimum payments on the larger debts. Once the smallest debt is paid off, move on to the next smallest debt. This method provides a sense of accomplishment and motivation as you see debts being eliminated one by one. On the other hand, the avalanche method involves paying off the debt with the highest interest rate first. This method helps save money on interest payments in the long run.

Debt Consolidation Options and Their Impact on Managing Credit Card Debt

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your debt repayment process and potentially lower your monthly payments. However, it is essential to carefully consider the terms and fees associated with debt consolidation to ensure it is the right choice for your financial situation. Be cautious of falling into the trap of accumulating more debt after consolidating.

Understanding Credit Card Terms and Conditions

When it comes to managing credit card debt effectively, understanding the terms and conditions of your credit card agreement is crucial. Let’s delve into some common credit card terminologies and how they impact your debt and repayment.

Credit Card Terminologies

Before we dive into the details, it’s essential to grasp some key terms:

- APR (Annual Percentage Rate): This is the interest rate charged on outstanding balances on your credit card. It’s crucial to know your card’s APR as it directly affects how much interest you’ll pay on your debt.

- Minimum Payment: The minimum amount you must pay each month to keep your account in good standing. Paying only the minimum can result in a longer repayment period and higher overall interest costs.

- Credit Limit: The maximum amount you’re allowed to borrow on your credit card. Exceeding this limit can lead to penalties and fees.

Interest Rates and Debt Repayment

Understanding how interest rates work is key to managing credit card debt efficiently:

- Interest compounds on your outstanding balance, meaning you end up paying interest on top of interest if you carry a balance.

- Tip: Paying more than the minimum payment can help reduce the amount of interest you pay over time.

Importance of Reading the Fine Print

Reading and understanding the fine print of your credit card agreement is vital for several reasons:

- It helps you know what fees and penalties you might incur for late payments, exceeding your credit limit, or other violations.

- Understanding the terms can empower you to make informed decisions about your spending and repayment strategies.

Avoiding Common Pitfalls in Credit Card Debt Management

To effectively manage credit card debt, it is crucial to avoid common pitfalls that can lead to financial struggles. By recognizing these mistakes and implementing strategies to prevent them, individuals can maintain control over their debt and improve their financial well-being.

Late Payments and High Interest Charges

Late payments on credit card bills can result in significant penalties, increased interest rates, and damage to one’s credit score. To avoid these pitfalls, it is essential to set up automatic payments or reminders to ensure bills are paid on time. Additionally, creating a budget and tracking expenses can help individuals stay on top of their financial obligations and avoid accumulating unnecessary debt.

Impact of Minimum Payments

Making only the minimum payment on a credit card each month may seem like a convenient option, but it can have long-term consequences. By paying only the minimum amount due, individuals end up paying more in interest over time and prolonging the repayment period. To avoid this pitfall, it is recommended to pay more than the minimum whenever possible to reduce the overall debt faster and minimize interest charges.