Yo, diving into the world of compound interest investments is like discovering a hidden treasure chest full of wealth-building opportunities. From understanding the concept to exploring different types of investments, we’re about to break it down for you in a way that’s both cool and informative. So, buckle up and get ready to level up your financial game!

Now, let’s get into the nitty-gritty details of how compound interest investments can make your money work harder for you.

What is Compound Interest?

Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods on a deposit or loan. This means that interest is earned on the initial investment as well as on any interest that has already been added to the principal.

How Compound Interest Works

Compound interest can be better understood through an example. Let’s say you invest $100 in an account that earns 5% interest annually. In the first year, you would earn $5 in interest, bringing your total to $105. In the second year, you would earn 5% interest on $105, which is $5.25, bringing your total to $110.25. This process continues and the interest earned each year keeps adding up, resulting in exponential growth of your investment over time.

Benefits of Compound Interest in Long-Term Investments

- Accelerated Growth: Compound interest allows your investment to grow at an increasing rate over time, especially when you reinvest the interest earned.

- Wealth Accumulation: By letting your investment compound over a long period, you can accumulate significant wealth due to the exponential growth effect.

- Retirement Savings: Compound interest is particularly beneficial for retirement savings as it helps your money grow faster and larger over the years.

Types of Compound Interest Investments

Compound interest investments come in various forms, each with its own level of risk and potential return. Understanding the different types of investments that utilize compound interest can help investors make informed decisions about where to put their money.

High-Risk vs. Low-Risk Investments

When it comes to compound interest investments, there are high-risk and low-risk options available. High-risk investments, such as stocks or cryptocurrencies, offer the potential for high returns but also come with a greater chance of losing money. On the other hand, low-risk investments, like bonds or certificates of deposit (CDs), provide more stability and security but typically offer lower returns. It’s essential for investors to consider their risk tolerance and investment goals when deciding between high-risk and low-risk investments.

Role of Time and Interest Rates

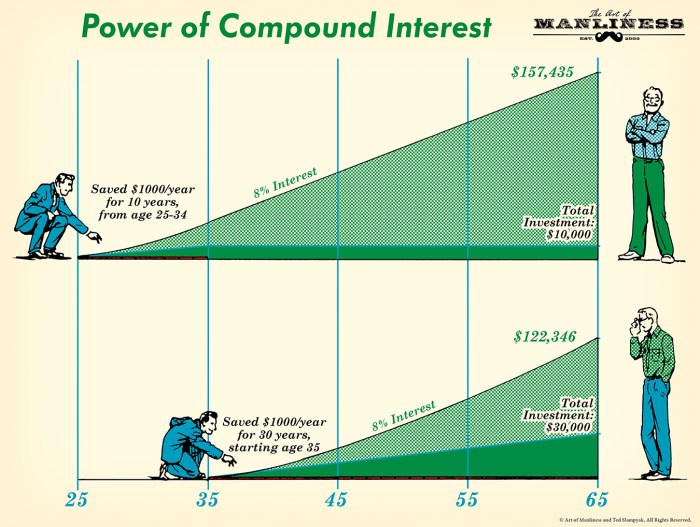

Time and interest rates play a crucial role in compound interest investments. The longer the money remains invested, the more time it has to grow through compounding. Additionally, the interest rate at which the investment grows will impact the overall return. Higher interest rates can lead to accelerated growth, while lower rates may result in slower growth. Understanding how time and interest rates affect compound interest investments can help investors make strategic decisions to maximize their returns over time.

Strategies for Maximizing Compound Interest

Compound interest investments have the potential to grow your wealth significantly over time. To maximize the returns on your investments, it’s essential to implement strategic approaches that can accelerate your earnings. One key strategy is to focus on reinvesting your earnings back into the investment, allowing your money to work for you and generate even more compound interest. Let’s dive into some effective strategies for maximizing compound interest:

Reinvest Earnings

One of the most powerful ways to maximize compound interest is by reinvesting your earnings. When you reinvest your earnings back into the investment, you are essentially compounding on your compounding. This means that not only are you earning interest on your initial investment, but you are also earning interest on the interest you have already earned. Over time, this can lead to exponential growth in your wealth.

Diversify Your Investments

Diversification is another key strategy for maximizing compound interest. By spreading your investments across different asset classes, sectors, or geographic regions, you can reduce risk and potentially increase your overall returns. Diversification helps to protect your portfolio from market fluctuations and ensures that you are not overly exposed to any single investment.

Regular Contributions

Consistently contributing to your investment portfolio is crucial for long-term wealth accumulation. By making regular contributions, you can take advantage of dollar-cost averaging, which helps to smooth out the impact of market volatility on your investments. Regular contributions also allow you to benefit from the power of compounding over time.

Monitor and Adjust Your Portfolio

It’s important to regularly monitor and adjust your investment portfolio to ensure that it aligns with your financial goals and risk tolerance. By reviewing your investments periodically, you can make informed decisions about when to buy, sell, or hold onto investments. Adjusting your portfolio as needed can help you maximize returns and minimize losses.

Factors Affecting Compound Interest Investments

Compound interest investments are influenced by various factors that can impact the growth of your earnings. Understanding these factors is crucial for maximizing your investment returns. Let’s dive into the key elements that affect compound interest investments.

Inflation Impact on Compound Interest Earnings

Inflation plays a significant role in determining the actual value of your compound interest earnings over time. As inflation increases, the purchasing power of your money decreases. This means that even though your investment may be growing with compound interest, its real value could be eroded by inflation. It’s essential to consider the inflation rate when planning your investment strategy to ensure that your returns outpace inflation and retain their purchasing power.

Compound Interest vs. Simple Interest Investments Comparison

When comparing compound interest investments with simple interest investments, the key difference lies in how the interest is calculated. With compound interest, you earn interest not only on the initial principal amount but also on the accumulated interest. This compounding effect leads to exponential growth in your investment over time. On the other hand, simple interest is calculated only on the principal amount, resulting in lower overall returns compared to compound interest. By choosing compound interest investments, you can benefit from the compounding effect and maximize your earnings in the long run.