With capital appreciation strategies at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

What are capital appreciation strategies? How do they play a crucial role in shaping investment portfolios? Let’s dive in and explore the world of maximizing returns through strategic investment choices.

Overview of Capital Appreciation Strategies

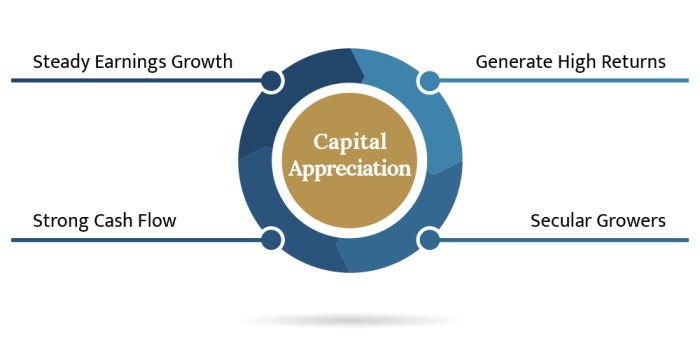

Capital appreciation strategies are investment techniques used to increase the value of an asset over time, typically through buying and holding investments that are expected to increase in price. These strategies focus on long-term growth rather than immediate income generation.

Examples of Popular Capital Appreciation Strategies

- Growth Stocks: Investing in companies with strong potential for growth and increased profitability.

- Real Estate Investment: Buying properties in high-demand areas that are expected to appreciate in value over time.

- Technology Sector Investments: Investing in innovative technology companies that have the potential for rapid growth.

Importance of Capital Appreciation Strategies in Investment Portfolios

Capital appreciation strategies play a crucial role in diversifying and maximizing returns in an investment portfolio. By focusing on assets with growth potential, investors can build wealth over the long term and achieve financial goals such as retirement savings or wealth preservation.

It is essential to carefully assess risk tolerance and investment goals when implementing capital appreciation strategies to ensure alignment with financial objectives.

Long-term vs. Short-term Capital Appreciation

When it comes to capital appreciation strategies, investors often need to decide between long-term and short-term approaches. Let’s break down the key differences and considerations for each.

Long-term Capital Appreciation

Long-term capital appreciation strategies involve holding onto investments for an extended period, typically five years or more. This approach focuses on gradual growth over time and allows investors to ride out market fluctuations. The benefits of long-term strategies include:

- Lower transaction costs: Since trades are less frequent, investors save on fees.

- Compound growth: Investments have more time to grow exponentially.

- Tax advantages: Long-term capital gains are typically taxed at a lower rate.

Assets suitable for long-term strategies include:

Stocks of stable companies, real estate properties, and retirement accounts like 401(k)s.

Short-term Capital Appreciation

Short-term capital appreciation strategies involve buying and selling assets within a shorter timeframe, usually less than a year. This approach aims to capitalize on quick market movements and generate immediate profits. However, short-term strategies come with higher risks, such as:

- Higher transaction costs: Frequent trading leads to more fees.

- Volatility: Short-term investments are more susceptible to market fluctuations.

- Tax implications: Short-term capital gains are taxed at higher rates.

Assets suitable for short-term strategies include:

Day trading stocks, options contracts, and cryptocurrencies.

Diversification in Capital Appreciation

Diversification plays a crucial role in capital appreciation strategies by spreading investment across different asset classes, industries, and regions. This helps reduce the overall risk in the investment portfolio and increases the chances of higher returns over the long term.

Mitigating Risk with Diversification

Diversification helps mitigate risks in investment portfolios by ensuring that a single economic event or market downturn does not have a catastrophic impact on the entire portfolio. By investing in a mix of assets that react differently to market conditions, the overall risk is spread out, reducing the impact of any one investment underperforming.

- Diversifying across asset classes such as stocks, bonds, real estate, and commodities can help balance the risk in a portfolio. For example, when stocks are performing poorly, bonds or real estate investments may provide stability.

- Investing in different industries or sectors can also help mitigate risk. For instance, if one sector experiences a downturn, investments in other sectors may continue to perform well, offsetting potential losses.

- Geographic diversification involves investing in assets across different regions or countries. This can protect against country-specific risks such as political instability, currency fluctuations, or economic downturns in a particular region.

Market Trends Impacting Capital Appreciation

When it comes to capital appreciation strategies, being aware of current market trends is crucial for success. These trends can heavily influence the performance of your investments and ultimately impact the growth of your capital.

Impact of Economic Factors

Economic factors play a significant role in determining the success of capital appreciation strategies. Factors such as interest rates, inflation, and GDP growth can directly affect the value of your investments. For example, in a high inflation environment, the purchasing power of your capital may decrease, impacting the overall appreciation of your investments.

Adapting Strategies to Market Conditions

Adapting your capital appreciation strategies based on market conditions is essential for maximizing returns. For instance, during periods of economic uncertainty, focusing on defensive stocks or diversifying your portfolio can help mitigate risks and ensure steady growth. On the other hand, in a bullish market, taking more aggressive investment approaches may yield higher returns.