Get ready to dive into the world of Roth IRAs, where financial wisdom meets opportunity. Let’s explore the ins and outs of this unique retirement account and discover the hidden treasures it holds for your future.

As we unravel the layers of benefits associated with a Roth IRA, you’ll be equipped with valuable insights to make informed decisions about your financial well-being.

Introduction to Roth IRA

A Roth IRA is a retirement savings account where you contribute post-tax income, meaning you don’t get a tax deduction for your contributions like you would with a traditional IRA. The key benefit of a Roth IRA is that your withdrawals in retirement are tax-free, including any earnings on your investments. This makes it a popular choice for individuals looking to maximize their tax savings in retirement.

Differences from Traditional IRA

- Roth IRA contributions are made with post-tax dollars, while traditional IRA contributions are made with pre-tax dollars.

- Withdrawals from a Roth IRA in retirement are tax-free, whereas withdrawals from a traditional IRA are taxed as ordinary income.

- Roth IRAs have no required minimum distributions (RMDs) during the account holder’s lifetime, unlike traditional IRAs which have RMDs starting at age 72.

Eligibility Criteria

- To open a Roth IRA, you must have earned income, such as wages, salaries, tips, or self-employment income.

- Your modified adjusted gross income (MAGI) must be below a certain limit to contribute to a Roth IRA, with the limit changing annually.

- There are income limits for contributing directly to a Roth IRA, but individuals with higher incomes can still make contributions through a backdoor Roth IRA conversion.

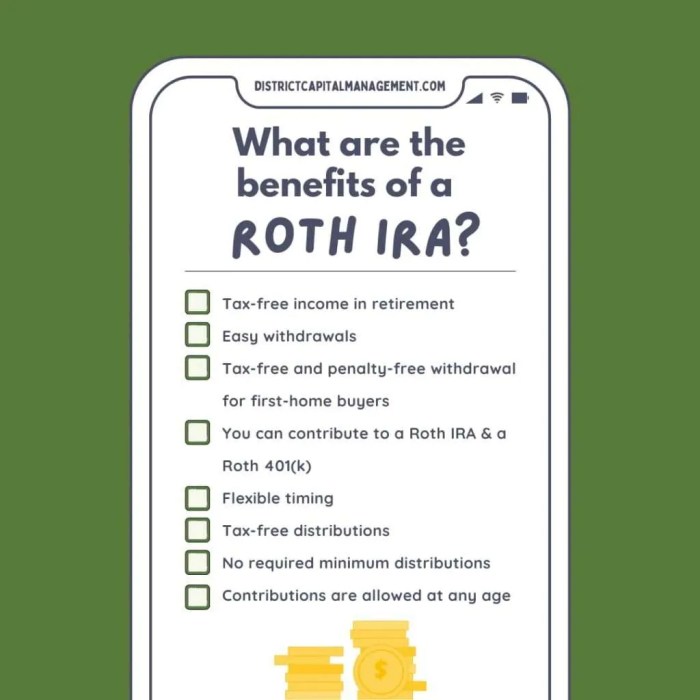

Tax Benefits

One of the key advantages of a Roth IRA is the tax benefits it offers compared to other retirement accounts. With a Roth IRA, contributions are made with after-tax income, meaning you don’t get a tax deduction upfront like with a Traditional IRA or 401(k). However, the real benefit comes in the form of tax-free growth and withdrawals.

Tax-Free Growth

- Contributions to a Roth IRA grow tax-free, allowing your investments to compound over time without being subject to capital gains taxes or other investment taxes. This can result in significant savings over the long term.

- Unlike a Traditional IRA or 401(k) where you would pay taxes on your withdrawals in retirement, a Roth IRA allows you to enjoy tax-free withdrawals, providing a source of tax-free income during your retirement years.

Investment Flexibility

When it comes to a Roth IRA, one of the major advantages is the investment flexibility it offers. Unlike traditional retirement accounts, a Roth IRA allows you to invest in a wide range of options beyond just stocks and bonds.

Investment Options

Within a Roth IRA, you can choose to invest in not only stocks and bonds but also mutual funds, ETFs, real estate, and even alternative investments like precious metals or cryptocurrencies. This diversity of options allows you to create a well-rounded investment portfolio tailored to your risk tolerance and financial goals.

Flexibility Comparison

Comparing with other retirement accounts like 401(k)s or traditional IRAs, a Roth IRA stands out for its flexibility in investment choices. While 401(k)s often limit you to a selection of mutual funds or company stock, and traditional IRAs may have restrictions on certain types of investments, a Roth IRA gives you the freedom to explore various investment opportunities.

Example Investment Strategies

- Diversified Portfolio: Spread your investments across different asset classes to reduce risk.

- Long-Term Growth Stocks: Invest in companies with strong growth potential for capital appreciation.

- Dividend-Paying Stocks: Generate a steady stream of income through dividends from established companies.

- Real Estate Investment Trusts (REITs): Add real estate exposure to your portfolio without owning physical properties.

Estate Planning Benefits

Roth IRAs can play a crucial role in estate planning, allowing individuals to pass on their wealth efficiently to their beneficiaries. By understanding the advantages of utilizing a Roth IRA in estate planning, individuals can make informed decisions to secure their financial legacy.

Passing on a Roth IRA to Beneficiaries

When passing on a Roth IRA to beneficiaries, they can benefit from tax-free distributions as long as the account has been open for at least five years. This means that beneficiaries can receive the funds without incurring tax liabilities, providing them with a valuable financial asset for the future.

Rules and Considerations for Beneficiaries Inheriting a Roth IRA

- Beneficiaries inheriting a Roth IRA must be aware of the required minimum distributions (RMDs) if they are not the spouse of the original account holder.

- Non-spouse beneficiaries have the option to take distributions over their lifetime or within five years of inheriting the account, depending on their preference and financial goals.

- It is important for beneficiaries to understand the implications of their choices, as taking distributions over a longer period can maximize the tax benefits of a Roth IRA.

Withdrawal Rules and Penalties

When it comes to withdrawing funds from a Roth IRA, there are specific rules and penalties in place that account holders need to be aware of.

Early withdrawals from a Roth IRA may result in penalties and restrictions. Typically, if you withdraw earnings from your Roth IRA before the age of 59 ½ and before the account has been open for at least five years, you may be subject to both taxes and penalties.

Penalties for Early Withdrawals

- Withdrawals of earnings before age 59 ½: If you withdraw earnings before reaching the age of 59 ½, you may be subject to a 10% early withdrawal penalty on top of having to pay income taxes on the earnings.

- Penalties for withdrawing contributions early: While you can withdraw the contributions you made to a Roth IRA at any time without penalties, if you withdraw earnings on those contributions early, you may face penalties.

Exceptions for Penalty-Free Withdrawals

- First-time home purchase: You may be able to withdraw up to $10,000 in earnings penalty-free to use towards the purchase of a first home.

- Qualified higher education expenses: Withdrawals for qualified higher education expenses for yourself, your spouse, children, or grandchildren may be penalty-free.

- Unreimbursed medical expenses: If you have unreimbursed medical expenses that exceed a certain percentage of your adjusted gross income, you may be able to make penalty-free withdrawals.