Diving deep into the world of personal loan interest rates, get ready for a wild ride filled with twists and turns that will leave you craving more. From understanding the basics to exploring complex calculations, this topic is sure to keep you on the edge of your seat.

Get ready to unlock the mysteries behind personal loan interest rates and discover the key factors that can make or break your financial decisions.

Overview of Personal Loan Interest Rates

Personal loan interest rates refer to the percentage of the principal amount that a lender charges as interest on a personal loan. This rate determines how much extra you will pay on top of the borrowed amount.

Factors that influence personal loan interest rates:

1. Credit Score

Your credit score plays a significant role in determining the interest rate you will be offered. A higher credit score often leads to lower interest rates, while a lower credit score may result in higher rates.

2. Income and Employment Status

Lenders also consider your income level and employment status when determining the interest rate for a personal loan. A stable income and secure job can lead to lower interest rates.

3. Loan Amount and Term

The amount you borrow and the repayment term can affect the interest rate. Generally, smaller loan amounts and shorter terms may come with higher interest rates compared to larger loans with longer terms.

4. Economic Conditions

Overall economic conditions, including market interest rates and inflation, can also impact personal loan interest rates. Changes in the economy can lead to fluctuations in interest rates.

Comparison of fixed vs. variable interest rates for personal loans:

Fixed Interest Rates

– Fixed interest rates remain the same throughout the loan term, providing predictability in monthly payments.

– Borrowers are protected from interest rate hikes, but may miss out on potential savings if market rates decrease.

Variable Interest Rates

– Variable interest rates can fluctuate based on market conditions, potentially leading to lower rates at times.

– Borrowers may benefit from lower rates but also face the risk of increased payments if interest rates rise.

Types of Personal Loan Interest Rates

When it comes to personal loans, understanding the different types of interest rates is crucial for managing your finances effectively. Two common types of interest rates are simple and compound interest rates.

Simple Interest Rates

Simple interest rates are calculated based on the principal amount of the loan. The interest is calculated as a percentage of the principal, and the total amount due is the principal plus the interest. For example, if you borrow $1,000 at a simple interest rate of 5% for one year, you would owe $1,050 at the end of the year.

Compound Interest Rates

Compound interest rates, on the other hand, take into account the accumulated interest in addition to the principal amount. This means that the interest is calculated on the initial principal as well as the accumulated interest from previous periods. Compound interest rates can result in higher overall repayment amounts compared to simple interest rates.

Impact of Credit Scores

Your credit score plays a significant role in determining the interest rate you receive on a personal loan. A higher credit score typically results in a lower interest rate, while a lower credit score may lead to a higher interest rate. Lenders use credit scores to assess the risk of lending to an individual, with lower credit scores indicating higher risk.

Maintaining a good credit score is essential for securing favorable interest rates on personal loans, as it can save you money in the long run. Understanding the different types of interest rates and how they affect loan repayment can help you make informed decisions when borrowing money.

Understanding Interest Rate Calculations

When it comes to personal loans, understanding how interest rates are calculated is crucial. The interest rate directly impacts how much you will end up paying back on top of the initial amount borrowed.

Interest on personal loans is typically calculated using a simple interest formula. The formula for calculating interest payments on a personal loan is:

Interest = Principal x Rate x Time

Where:

– Principal is the amount of money borrowed

– Rate is the annual interest rate

– Time is the length of time the money is borrowed for

Impact of Varying Interest Rates

- Low Interest Rate: If you have a low interest rate on your personal loan, you will end up paying less in interest over the life of the loan. This means you can save money in the long run.

- High Interest Rate: Conversely, a high interest rate will result in higher interest payments over time. This can significantly increase the total cost of the loan and make it more expensive.

Shopping for the Best Personal Loan Interest Rates

When looking for the best personal loan interest rates, it’s important to do your research and compare offers from different lenders to ensure you’re getting the most favorable terms. Here are some strategies to help you find the best interest rates and potentially negotiate for lower rates.

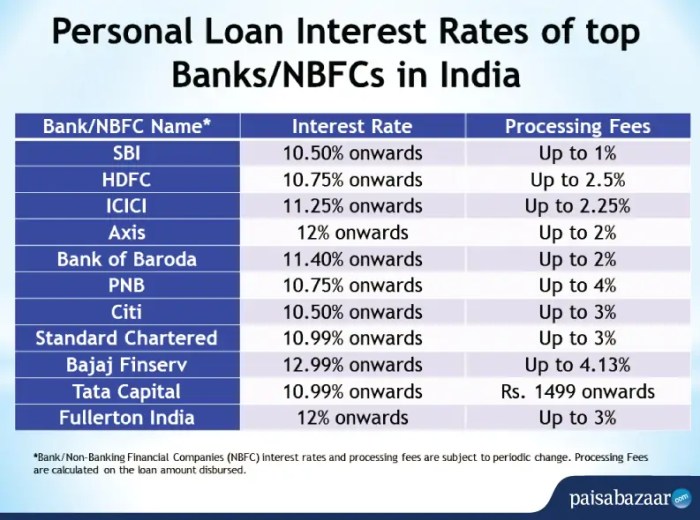

Comparing Offers from Different Lenders

- Check interest rates from multiple lenders: Compare the interest rates, fees, and terms offered by different financial institutions to identify the most competitive option.

- Consider credit unions and online lenders: Sometimes, credit unions and online lenders offer lower interest rates compared to traditional banks. Don’t overlook these options when shopping for a personal loan.

- Look for promotional offers: Some lenders may run promotional offers or discounts on interest rates for a limited time. Keep an eye out for these deals to potentially secure a lower rate.

Negotiating for Lower Interest Rates

- Highlight your creditworthiness: If you have a good credit score and a strong financial profile, use this as leverage to negotiate for a lower interest rate with the lender.

- Ask for a rate match: If you’ve received a better offer from another lender, you can try negotiating with your current lender to see if they can match or beat the rate to retain your business.

- Consider a cosigner: If you have a cosigner with excellent credit, you may be able to secure a lower interest rate on your personal loan. Lenders often consider the creditworthiness of both the borrower and the cosigner.