Diving into the world of FICO scores, we unravel the mystery behind these three digits that hold so much power over our financial lives. From deciphering how they’re calculated to understanding their impact on our financial future, this journey promises to be enlightening and empowering.

Let’s break it down and make sense of the complex world of FICO scores, one step at a time.

Understanding FICO Scores

FICO scores are credit scores used by lenders to assess the creditworthiness of individuals. These scores are calculated based on various factors such as payment history, credit utilization, length of credit history, new credit accounts, and credit mix.

Importance of FICO Scores

FICO scores play a crucial role in financial decisions as they determine whether an individual qualifies for loans, credit cards, or other forms of credit. A higher FICO score indicates a lower credit risk, making it easier to secure loans at favorable interest rates.

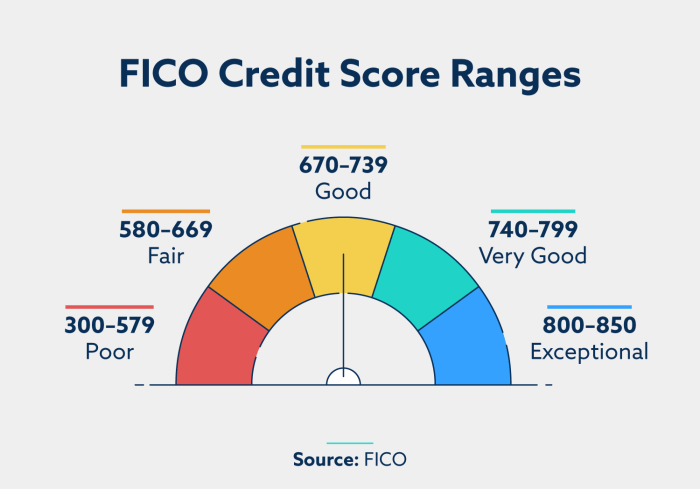

Range of FICO Scores

- FICO score range: 300-579

- FICO score range: 580-669

- FICO score range: 670-739

- FICO score range: 740-799

- FICO score range: 800-850

Higher FICO scores signify lower credit risk and better borrowing terms.

Impact of FICO Scores on Loan Approvals and Interest Rates

- FICO scores greatly influence loan approvals, with higher scores increasing the likelihood of approval.

- Higher FICO scores also result in lower interest rates on loans, saving borrowers money over the life of the loan.

Factors Influencing FICO Scores

Understanding the key factors that impact your FICO score is crucial for managing your credit effectively. Different aspects of your financial behavior contribute to this important number, which lenders use to assess your creditworthiness.

Payment History

- Payment history carries the most weight in determining your FICO score, accounting for about 35% of the total score.

- Consistent on-time payments can significantly boost your score, while late payments or defaults can have a negative impact.

-

Remember, even one missed payment can lower your score, so always strive to make timely payments.

Credit Utilization

- Credit utilization ratio, or the amount of credit you’re using compared to your total available credit, makes up about 30% of your FICO score.

- Keeping this ratio low, ideally below 30%, shows lenders that you’re using credit responsibly and can positively affect your score.

Length of Credit History

- Your credit history’s length contributes around 15% to your FICO score.

- Having a longer credit history can demonstrate your credit management skills and provide a more robust financial profile to lenders.

New Credit

- Opening multiple new credit accounts within a short period can raise red flags for lenders and impact about 10% of your FICO score.

- Applying for new credit sparingly can help maintain a stable credit profile and prevent unnecessary score drops.

Credit Mix

- The diversity of credit accounts you have, such as credit cards, loans, and mortgages, makes up the remaining 10% of your FICO score.

- Having a healthy mix of credit types shows that you can manage various financial responsibilities effectively.

Improving FICO Scores

Improving your FICO score is crucial for better financial opportunities. By implementing strategies to boost your score, you can qualify for lower interest rates on loans and credit cards, ultimately saving you money in the long run.

Make Timely Payments and Reduce Debt

One of the most impactful ways to improve your FICO score is by making all your payments on time. Late payments can significantly lower your score. Additionally, reducing your overall debt can also positively impact your score.

- Set up automatic payments to ensure you never miss a due date.

- Create a budget to prioritize paying off high-interest debts first.

- Avoid maxing out your credit cards as high credit utilization can harm your score.

Maintain a Good Credit Utilization Ratio

Your credit utilization ratio, which is the amount of credit you are using compared to your total available credit, plays a significant role in your FICO score. Keeping this ratio low can help improve your score.

- Try to keep your credit utilization below 30% to demonstrate responsible credit usage.

- Avoid closing old accounts as this can reduce your overall available credit, potentially increasing your credit utilization ratio.

Impact of Opening or Closing Accounts

Deciding whether to open new accounts or close existing ones can impact your FICO score. Understanding how these actions affect your credit profile is key to maintaining a good score.

- Opening new accounts can initially lower your score due to hard inquiries and reduced average account age.

- Closing accounts can also impact your score by reducing your total available credit, potentially increasing your credit utilization ratio.

Monitoring and Managing FICO Scores

Regularly monitoring and managing your FICO scores is crucial for maintaining good financial health and reaching your goals. By staying informed about your credit standing, you can take proactive steps to improve your scores and correct any errors that may arise.

Tools and Resources for Monitoring FICO Scores

- Online credit monitoring services like Credit Karma or Credit Sesame provide free access to your credit scores and reports.

- Many credit card companies offer complimentary FICO score tracking as part of their services.

- You are entitled to one free credit report per year from each of the three major credit bureaus – Equifax, Experian, and TransUnion. Take advantage of this to review your credit history.

Importance of Regularly Checking and Reviewing FICO Scores

Regularly checking your FICO scores allows you to spot any unusual activity or errors on your credit report promptly. It also helps you track your progress in building good credit and identify areas for improvement.

Errors on Credit Reports and Disputing Inaccuracies

Errors on your credit reports, such as incorrect personal information or fraudulent accounts, can negatively impact your FICO scores. If you find inaccuracies, you should dispute them with the credit bureaus by providing supporting documentation to have them corrected.

Best Practices for Managing FICO Scores

- Pay your bills on time to establish a positive payment history.

- Keep your credit card balances low and avoid maxing out your credit limits.

- Avoid opening multiple new accounts within a short period, as this can lower your average account age.

- Regularly review your credit reports and FICO scores to stay informed about your credit standing.

- Seek professional help or credit counseling if you are struggling to manage your debts effectively.