Credit card debt management is like navigating the intricate hallways of high school, but with a twist – your financial future hangs in the balance. Get ready to dive into the world of managing credit card debt with a cool, laid-back vibe that’s all about finding your financial groove.

As we delve deeper, we’ll uncover the secrets to smart financial decisions and effective debt management strategies that will set you on the path to financial freedom.

Overview of Credit Card Debt Management

Managing credit card debt is crucial for maintaining financial stability and avoiding potential pitfalls in the long run. It involves creating a plan to pay off outstanding balances and avoid accumulating more debt than you can afford to repay.

Importance of Managing Credit Card Debt

- Prevents high-interest charges: By managing credit card debt effectively, you can avoid paying excessive interest rates on outstanding balances.

- Improves credit score: Timely payments and lower debt-to-income ratios can positively impact your credit score, making it easier to qualify for loans and better financial opportunities.

- Reduces financial stress: Having a plan in place to manage credit card debt can alleviate the stress and anxiety that often comes with financial insecurity.

Consequences of Not Managing Credit Card Debt Effectively

- Accumulation of interest: Failing to manage credit card debt can lead to the accumulation of high-interest charges, making it harder to pay off balances in the future.

- Damage to credit score: Late payments and high debt levels can negatively impact your credit score, limiting your ability to secure loans or credit in the future.

- Legal action: In extreme cases, creditors may take legal action against you for unpaid debts, leading to further financial complications and potential legal consequences.

Strategies for Managing Credit Card Debt

When it comes to managing credit card debt, there are several strategies that individuals can implement to regain control of their finances and work towards becoming debt-free.

Debt Consolidation vs. Debt Settlement

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments. On the other hand, debt settlement involves negotiating with creditors to settle debts for less than what is owed. While debt consolidation can help lower interest rates and simplify payments, debt settlement may negatively impact credit scores and result in taxes on forgiven debt.

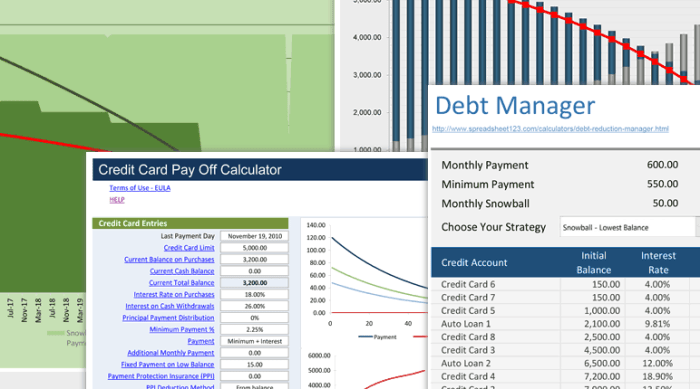

Snowball and Avalanche Methods for Paying Off Credit Card Debt

The snowball method involves paying off debts from smallest to largest balance, regardless of interest rates. This method can provide a sense of accomplishment by quickly eliminating smaller debts. In contrast, the avalanche method focuses on paying off debts with the highest interest rates first, potentially saving more money on interest payments in the long run.

Creating a Budget for Debt Repayment

Creating a budget for debt repayment is crucial when managing credit card debt. It helps you allocate your resources efficiently and stay on track with your financial goals. By following specific steps and tracking your expenses, you can effectively manage your credit card debt.

Steps to Create a Budget for Debt Repayment

- List all your debts: Start by making a list of all your credit card debts, including the outstanding balances, interest rates, and minimum monthly payments.

- Calculate your total income: Determine your total monthly income, including salaries, bonuses, side hustles, or any other sources of revenue.

- Set a realistic budget: Allocate a portion of your income to cover your essential expenses such as rent, utilities, groceries, and transportation. Then, designate a specific amount to repay your debts.

- Prioritize high-interest debts: Focus on paying off debts with the highest interest rates first to minimize the overall interest costs.

- Track your expenses: Monitor your spending habits to identify areas where you can cut back and allocate more funds towards debt repayment.

Importance of Tracking Expenses

Tracking expenses plays a vital role in managing credit card debt effectively. It allows you to identify unnecessary purchases, overspending patterns, and areas where you can reduce costs to free up more money for debt repayment. By keeping a close eye on your expenses, you can stay within your budget and make progress towards becoming debt-free.

Negotiating with Creditors

When it comes to managing credit card debt, negotiating with creditors can be a crucial step in reducing the amount you owe. By engaging in a dialogue with your credit card company, you may be able to come to an agreement that benefits both parties involved. Here’s a breakdown of the process and some tips for successful negotiation.

The Process of Negotiating with Creditors

- Initiate contact: Reach out to your creditor either by phone or in writing to express your willingness to negotiate your debt.

- Explain your situation: Be honest about your financial difficulties and provide any relevant information that supports your request for debt reduction.

- Propose a solution: Offer a specific repayment plan that you can realistically afford, whether it involves a lump sum payment or lower monthly installments.

- Negotiate terms: Be prepared to discuss and potentially counteroffer the terms presented by your creditor until you reach a mutually acceptable agreement.

- Get it in writing: Once an agreement is reached, make sure to get all the details in writing to avoid any misunderstandings in the future.

Tips for Successful Negotiation with Credit Card Companies

- Stay calm and professional: Maintain a respectful and composed attitude during negotiations to increase the chances of a positive outcome.

- Do your research: Understand your rights as a debtor and familiarize yourself with potential debt relief options before engaging with creditors.

- Be persistent: Don’t be afraid to push for a better deal or ask for clarification if something is unclear during the negotiation process.

- Seek professional help if needed: Consider enlisting the assistance of a credit counselor or debt settlement company to help you navigate the negotiation process.

Potential Outcomes of Negotiating with Creditors

- Debt settlement: Your creditor may agree to accept a reduced amount as payment in full, allowing you to settle the debt for less than what you owe.

- Revised payment terms: You may be able to negotiate lower interest rates, extended repayment periods, or waived fees to make it easier for you to manage your debt.

- Forbearance or hardship programs: Some creditors offer temporary relief programs that allow you to pause or reduce payments during times of financial hardship.

Seeking Professional Help for Credit Card Debt

Seeking professional help for managing credit card debt can be a smart move when you feel overwhelmed or unsure about how to handle your financial situation effectively. Professionals can provide guidance, resources, and support to help you navigate the complexities of debt management.

Credit Counseling, Debt Management Plans, and Bankruptcy

- Credit Counseling: Credit counseling agencies offer financial education, budgeting assistance, and debt management plans to help you regain control of your finances. They can negotiate with creditors on your behalf and provide personalized advice to improve your financial situation.

- Debt Management Plans: These plans involve consolidating your debts into one monthly payment, which is then distributed to your creditors by a credit counseling agency. Debt management plans typically have lower interest rates and fees, making it easier for you to pay off your debt over time.

- Bankruptcy: Bankruptcy should be considered as a last resort due to its long-term financial consequences. It can provide relief from overwhelming debt by liquidating assets or creating a repayment plan, but it can impact your credit score and financial future for years to come.

Finding Reputable Credit Counseling Agencies

- Check for accreditation: Look for agencies accredited by organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) to ensure they meet industry standards.

- Research reviews and ratings: Read online reviews and check with the Better Business Bureau to see if there have been any complaints or issues reported about the agency.

- Ask for referrals: Seek recommendations from friends, family, or financial advisors who have experience working with credit counseling agencies to find a reputable and trustworthy organization.