Inflation-protected investments set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From exploring the different types of investments to understanding the benefits and risks associated with them, this journey into the world of financial security is one you won’t want to miss.

As we delve deeper into the realm of inflation-protected investments, a world of opportunities and challenges unfolds, providing a unique perspective on how to navigate the ever-changing landscape of financial markets.

Types of Inflation-Protected Investments

Inflation-protected investments are crucial for preserving the value of your money in the face of rising prices. Let’s explore the different types available in the market.

Treasury Inflation-Protected Securities (TIPS)

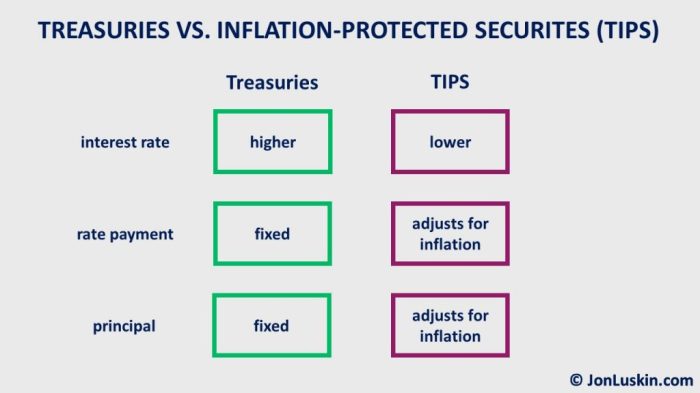

TIPS are bonds issued by the U.S. Treasury that provide protection against inflation. They adjust their principal value based on changes in the Consumer Price Index (CPI), ensuring that investors receive a return above inflation.

Comparing TIPS with other Inflation-Protected Investments

Other inflation-protected investments include inflation-linked bonds issued by corporations and governments, as well as inflation-indexed annuities. While TIPS are backed by the U.S. government and offer a guaranteed real return, other investments may have higher yields but come with varying levels of risk.

Commodities like Gold as a Hedge Against Inflation

Gold has long been considered a hedge against inflation due to its intrinsic value and limited supply. Investors often turn to gold during times of economic uncertainty or high inflation as it tends to hold its value or even increase in price when the purchasing power of fiat currencies declines.

Inflation-Protected Real Estate Investments

Real estate investments such as rental properties or Real Estate Investment Trusts (REITs) can also serve as a hedge against inflation. Rental income from properties tends to increase with inflation, providing a steady stream of cash flow that maintains its value over time.

Benefits of Inflation-Protected Investments

Investing in inflation-protected assets can offer numerous advantages to investors seeking to preserve their wealth and combat the erosive effects of inflation. By including these investments in a diversified portfolio, individuals can better shield their purchasing power and maintain financial stability in the face of rising prices and economic uncertainties.

Safeguarding Purchasing Power

Inflation-protected investments are specifically designed to keep pace with inflation, ensuring that investors’ real returns remain positive even as prices rise. These assets typically adjust their value based on changes in the Consumer Price Index (CPI) or other inflation metrics, thereby safeguarding the purchasing power of the invested capital over time. This feature helps mitigate the risk of losing money’s value due to inflationary pressures.

Stable Income Stream

One key benefit of inflation-protected investments is their ability to generate a stable income stream regardless of inflationary pressures. Bonds or securities linked to inflation indexes can provide investors with regular interest payments that adjust for inflation, offering a reliable source of income that maintains its real value over time. This can be particularly valuable for retirees or individuals seeking steady cash flow amid changing economic conditions.

Outperformance During Inflationary Periods

Inflation-protected investments have historically demonstrated the ability to outperform traditional assets like stocks and bonds during periods of high inflation. When inflation rates spike, the value of these assets tends to rise in tandem, providing investors with a hedge against inflation-induced losses in other parts of their portfolio. By allocating a portion of their investments to inflation-protected securities, individuals can better weather inflationary storms and preserve their overall wealth more effectively.

Risks Associated with Inflation-Protected Investments

When considering investing in inflation-protected securities, it’s crucial to be aware of the potential risks involved. Understanding these risks can help you make informed decisions and manage your investment portfolio effectively.

Interest Rate Changes Impact

Interest rate changes can have a significant impact on the performance of inflation-protected investments. When interest rates rise, the value of these securities may decline, leading to potential losses for investors. Conversely, if interest rates fall, the value of inflation-protected securities may increase. It’s important to monitor interest rate movements and their potential effects on your investment.

Potential Drawbacks of Solely Investing in Inflation-Protected Assets

While inflation-protected investments provide a hedge against inflation, relying solely on these assets can have drawbacks. One major drawback is the limited diversification of your investment portfolio. By focusing only on inflation-protected securities, you may miss out on opportunities for growth in other asset classes. Additionally, the returns on inflation-protected investments may not always outpace inflation, leading to lower overall returns compared to other investment options.

Strategies to Mitigate Risks

To mitigate the risks associated with inflation-protected investments, consider diversifying your portfolio across different asset classes. This can help spread risk and potentially improve overall returns. Additionally, staying informed about economic indicators, such as inflation rates and interest rate movements, can help you make informed decisions about your investments. Regularly reviewing and rebalancing your investment portfolio can also help manage risks effectively.

Considerations for Investing in Inflation-Protected Assets

When considering adding inflation-protected investments to your portfolio, there are several key factors to keep in mind. These assets can play a crucial role in safeguarding your wealth against the erosive effects of inflation over time.

Role of Inflation Expectations

Inflation expectations are a vital component when determining the suitability of inflation-protected investments. Investors should closely monitor forecasts and market sentiment regarding future inflation rates to gauge the potential performance of these assets.

Influence of Economic Indicators

Economic indicators such as the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) can significantly impact the performance of inflation-protected assets. These indicators provide insights into inflation trends and help investors make informed decisions.

Aligning Investments with Financial Goals

To align inflation-protected investments with long-term financial goals, it’s essential to consider your risk tolerance, investment timeline, and overall portfolio objectives. These assets can provide a hedge against inflation but should be part of a diversified investment strategy.