Get ready to dive into the world of real estate investment strategies. From understanding the basics to exploring advanced techniques, this guide has got you covered.

Let’s break down the key components of successful real estate investment strategies, one step at a time.

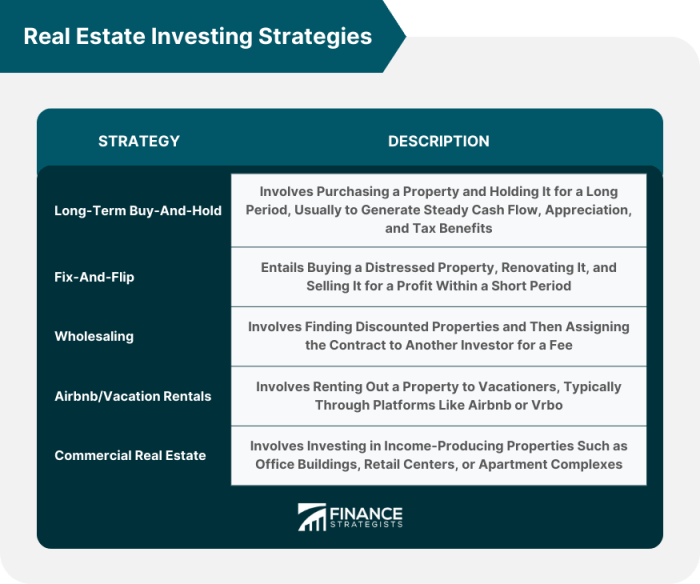

Real Estate Investment Strategies

Real estate investment involves purchasing, owning, managing, renting, or selling real estate for profit. It is a popular form of investment due to the potential for long-term growth, passive income, and tax benefits.

Types of Real Estate Investments

- Residential Properties: Investing in single-family homes, condos, or multi-family units for rental income.

- Commercial Properties: Investing in office buildings, retail spaces, or industrial properties for leasing to businesses.

- Real Estate Investment Trusts (REITs): Investing in publicly traded companies that own, operate, or finance income-producing real estate.

- Fix and Flip: Purchasing properties below market value, renovating them, and selling for a profit.

- Vacation Rentals: Investing in properties in tourist destinations for short-term rentals.

Importance of Having a Strategy in Real Estate Investment

Having a solid strategy in real estate investment is crucial for success and maximizing returns. It helps investors set clear goals, mitigate risks, and make informed decisions. Without a strategy, investors may make impulsive choices, leading to financial losses or missed opportunities.

It’s essential to research the market, understand the risks involved, and develop a plan that aligns with your financial objectives.

Market Analysis

Market analysis plays a crucial role in shaping real estate investment strategies. By analyzing market trends, demand, supply, and other factors, investors can make informed decisions to maximize profits and minimize risks.

Comparison of Market Analysis Tools

- Comparative Market Analysis (CMA): This tool helps investors determine the value of a property by comparing it to similar properties in the same area.

- Market Research Reports: These reports provide data on market trends, demographics, and other factors that can impact real estate investments.

- Real Estate Investment Software: Tools like REI Wise and RealData can help investors analyze cash flow, ROI, and other financial metrics.

Successful Investment Strategies Based on Market Analysis

- Buy Low, Sell High: By identifying undervalued properties in a growing market, investors can purchase properties at a lower price and sell them for a profit when the market appreciates.

- Long-Term Rental Investments: Analyzing rental demand and market trends can help investors identify areas where rental properties can generate steady cash flow over time.

- Flipping Properties: Market analysis can help investors identify properties in need of renovations in up-and-coming neighborhoods, allowing them to renovate and sell for a profit in a short period.

Financing Options

Investing in real estate often requires financing to leverage your capital and maximize returns. There are several financing options available to real estate investors, each with its own set of pros and cons. Understanding these options and how they can impact your investment returns is crucial for making informed decisions.

Traditional Mortgage

- Traditional mortgages are one of the most common financing options for real estate investments.

- Pros: Lower interest rates, longer repayment terms, and easier qualification criteria compared to other types of loans.

- Cons: Requires a down payment, strict credit requirements, and potential for foreclosure if payments are not made.

Hard Money Loans

- Hard money loans are short-term, high-interest loans typically used for fix-and-flip projects.

- Pros: Quick approval process, less stringent credit requirements, and flexibility in loan terms.

- Cons: Higher interest rates, shorter repayment terms, and increased risk due to the fast-paced nature of fix-and-flip investments.

Private Money Lenders

- Private money lenders are individuals or companies that provide financing for real estate investments.

- Pros: Flexible terms, quick funding, and potential for negotiation on interest rates and repayment terms.

- Cons: Higher interest rates, potential for strained relationships if the investment does not perform well, and limited availability compared to traditional lenders.

Using Leverage in Real Estate Investment

Leverage involves using borrowed money to increase the potential return on investment. While leverage can amplify profits, it also magnifies losses if the investment underperforms. It is essential to carefully consider the risks and rewards of using leverage in real estate investment strategies.

Impact of Financing Options on Investment Returns

The choice of financing option can significantly impact investment returns. Factors such as interest rates, loan terms, and repayment schedules can affect cash flow, profitability, and overall return on investment. It is crucial to analyze the potential impact of different financing options on your investment strategy to optimize returns and minimize risks.

Risk Management

When it comes to real estate investment, there are several key risks that investors need to be aware of in order to protect their investments. These risks can include market fluctuations, unexpected maintenance costs, and potential changes in regulations or zoning laws. However, there are strategies that can be implemented to mitigate these risks and increase the chances of a successful investment.

Diversification

Diversifying your real estate portfolio is a key risk management strategy. By investing in different types of properties in various locations, you can spread out your risk and minimize the impact of any negative events on a single property. This can help protect your overall investment and provide more stability in the long run.

Insurance Coverage

Another important risk management technique is to ensure that your properties are adequately insured. This can help protect you against unexpected events such as natural disasters, accidents, or liability claims. By having the right insurance coverage in place, you can minimize the financial impact of these events and safeguard your investment.

Thorough Due Diligence

Conducting thorough due diligence before making a real estate investment is crucial for risk management. This includes researching the market, inspecting the property, and analyzing potential risks. By doing your homework upfront, you can identify any red flags or issues that could impact your investment and take steps to address them before moving forward.

Emergency Fund

Having an emergency fund set aside specifically for your real estate investments can also help mitigate risks. This fund can be used to cover unexpected expenses, vacancies, or other financial setbacks that may arise. By having a financial cushion in place, you can protect your investments and avoid being caught off guard by unforeseen circumstances.

Exit Strategies

Having exit strategies in real estate investments is crucial for ensuring a successful investment journey. These strategies help investors plan ahead and mitigate risks, allowing them to maximize profits and minimize losses.

Common Exit Strategies

- Fix and Flip: This strategy involves buying a property, renovating it, and selling it quickly for a profit. It is a popular strategy among investors looking for short-term gains.

- Buy and Hold: Investors purchase properties with the intention of renting them out for passive income. They can later sell the property when the market conditions are favorable or hold onto it long-term for continued rental income.

- Wholesale: Investors secure properties below market value and assign the contract to another buyer for a fee. This strategy allows investors to make quick profits without actually owning the property.

- 1031 Exchange: This strategy allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into another like-kind property. It is a tax-efficient way to upgrade or diversify a real estate portfolio.

Impact on Investment Success

Having a well-thought-out exit strategy can significantly impact the overall success of a real estate investment. It provides investors with a clear roadmap on how to exit a deal, whether to maximize profits, minimize losses, or achieve specific financial goals. By understanding and implementing different exit strategies, investors can adapt to market conditions, mitigate risks, and make informed decisions that align with their investment objectives.