Financial stress management sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

In this guide, we’ll delve into the intricacies of financial stress, explore effective strategies for managing it, and uncover lifestyle changes that can lead to a more stress-free financial existence.

Understanding Financial Stress

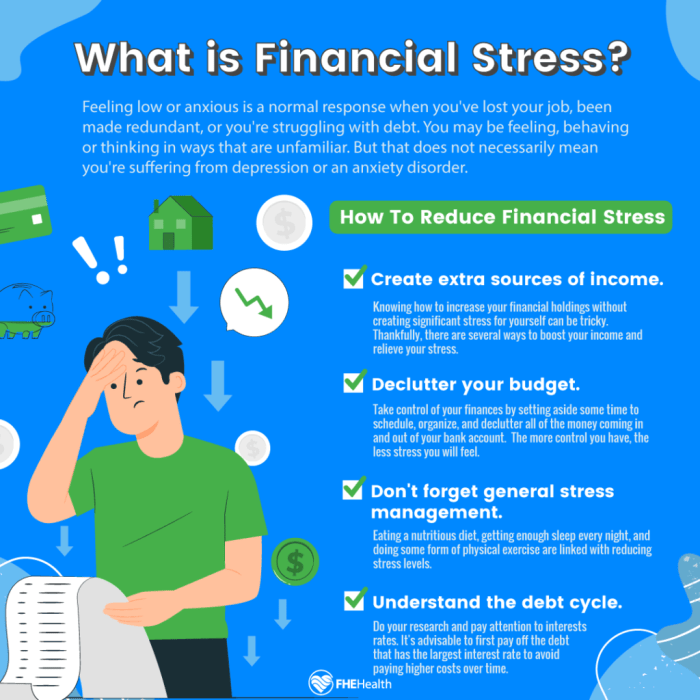

Financial stress is the emotional strain that is caused by financial problems or challenges. This type of stress can have a significant impact on an individual’s mental and physical well-being.

Common Causes of Financial Stress

- Living beyond one’s means and accumulating debt

- Unemployment or underemployment

- Medical expenses and unexpected bills

- Divorce or separation

- Lack of emergency savings

Impact of Financial Stress on Health

Financial stress can lead to a variety of health issues, both mental and physical. It can increase the risk of anxiety, depression, and other mental health disorders. On a physical level, financial stress can manifest in symptoms such as headaches, insomnia, and high blood pressure.

Strategies for Managing Financial Stress

Managing financial stress can be overwhelming, but there are strategies you can implement to regain control of your finances and reduce stress levels.

Creating a Budget

Creating a budget is essential for managing financial stress. Start by tracking your income and expenses to understand where your money is going. Allocate funds for essentials like rent, utilities, groceries, and transportation first. Then, set aside money for savings and paying off debt. Use budgeting tools or apps to help you stay on track and adjust as needed.

Building an Emergency Fund

Having an emergency fund is crucial for dealing with unexpected expenses without going into debt. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This fund can help cover car repairs, medical bills, or other emergencies, reducing financial stress and providing peace of mind.

Seeking Professional Financial Advice

Consider seeking advice from a financial advisor or counselor to help you navigate complex financial situations. They can provide personalized guidance on budgeting, saving, investing, and debt management. A professional can also offer strategies for long-term financial planning and help you set achievable financial goals.

Lifestyle Changes to Reduce Financial Stress

Living a simpler lifestyle can significantly reduce financial stress. By downsizing unnecessary expenses and focusing on what truly matters, you can alleviate the burden of financial strain.

Impact of Mindfulness and Gratitude

Practicing mindfulness and gratitude can have a profound impact on managing financial stress. Being present in the moment and appreciating what you have can shift your focus from scarcity to abundance, reducing anxiety and worry about money.

- Take time each day to appreciate the things you have, whether big or small.

- Practice mindfulness techniques such as meditation or deep breathing to calm your mind and reduce stress.

- Acknowledge your financial challenges without judgment and work on finding solutions with a positive mindset.

Improving Time Management Skills

Effective time management can help reduce financial stress by allowing you to prioritize tasks, set goals, and make better decisions regarding your finances.

Remember, time is money. By managing your time effectively, you can also manage your finances more efficiently.

- Create a daily or weekly schedule to allocate time for budgeting, bill payments, and financial planning.

- Avoid procrastination and tackle financial tasks promptly to prevent last-minute stressors.

- Set realistic deadlines for financial goals and track your progress to stay on top of your financial responsibilities.

Seeking Support for Financial Stress

In times of financial stress, it’s crucial to seek support from various sources to help navigate through the challenges. Whether it’s turning to family and friends for emotional support or seeking professional help, having a strong support system can make a significant difference in managing financial stress effectively.

Family and Friends Support

Family and friends play a vital role in helping individuals cope with financial stress. They can offer emotional support, lend a listening ear, and provide valuable advice or guidance. Sometimes, just talking to someone close can alleviate some of the stress and anxiety associated with financial difficulties. Additionally, loved ones can help brainstorm solutions, offer practical assistance, or simply provide a sense of comfort during tough times.

Financial Counseling or Therapy

Financial counseling or therapy can be beneficial for those dealing with financial stress by providing professional guidance and strategies to improve financial well-being. Counselors or therapists specialized in financial matters can help individuals assess their financial situation, create a budget, set financial goals, and develop a plan to manage debt effectively. They can also offer tools and resources to enhance financial literacy and decision-making skills, ultimately empowering individuals to take control of their finances and reduce stress levels.