Get ready to dive into the world of tracking expenses, where financial management meets coolness. This guide will show you how to track expenses like a boss, using methods that are both traditional and modern. So, grab your notebooks and digital apps, because it’s time to get savvy with your finances!

Introduction to Tracking Expenses

Tracking expenses is the process of recording and monitoring all the money spent over a period of time. It involves keeping a detailed account of where your money is going, helping you understand your spending habits and make informed financial decisions.

It is crucial to track expenses for effective financial management as it allows you to create a budget, identify areas where you may be overspending, and ultimately, save money for future goals or emergencies.

Benefits of Keeping Track of Expenses

- Helps you stay within budget and avoid overspending.

- Allows you to prioritize your spending on essential items.

- Enables you to track patterns in your spending habits and make adjustments accordingly.

- Provides a clear picture of your financial health and helps you set achievable financial goals.

- Helps you identify unnecessary expenses and find ways to cut costs.

Methods of Expense Tracking

![]()

Tracking expenses can be done through various methods, ranging from traditional pen-and-paper approaches to modern digital tools. Each method has its own set of advantages and disadvantages, depending on individual preferences and needs.

Traditional Methods

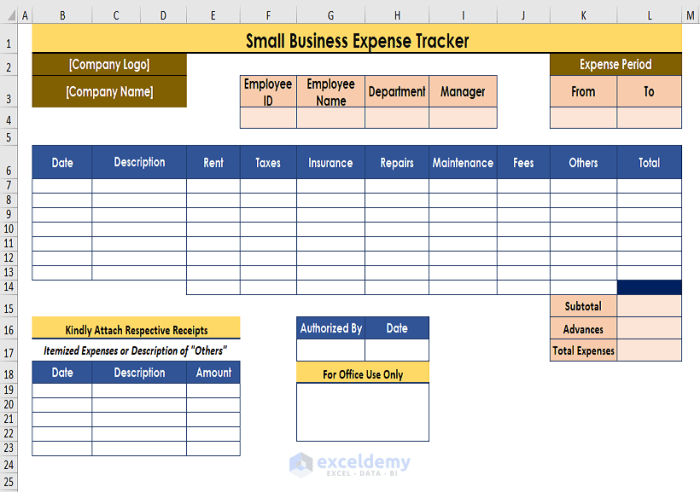

Using a notebook or spreadsheet to track expenses is a common traditional method. With a notebook, you can jot down your expenses manually, categorize them, and keep a running total. Spreadsheets offer a more organized way to input and calculate expenses, with the ability to create formulas for automatic calculations.

Modern Digital Tools

Expense tracking apps have gained popularity for their convenience and efficiency. These apps allow you to input expenses on-the-go using your smartphone, categorize transactions, set budgets, and generate detailed reports. Some apps even offer features like receipt scanning and syncing with bank accounts for automatic expense tracking.

Whichever method you choose, the key is consistency and accuracy in recording your expenses.

Creating an Expense Tracking System

When it comes to creating an expense tracking system, it’s important to tailor it to your individual needs. By designing a personalized system, you can effectively monitor your spending habits and make informed financial decisions.

Tips for Categorizing Expenses Effectively

Organizing your expenses into categories can help you gain a clear understanding of where your money is going. Here are some tips for categorizing expenses effectively:

- Start by creating broad categories such as housing, transportation, groceries, entertainment, and utilities.

- Break down each broad category into more specific subcategories to capture all types of expenses.

- Regularly review and adjust your categories to ensure they accurately reflect your spending patterns.

- Consider using software or apps that automatically categorize your expenses to save time and effort.

Strategies for Setting Budget Limits within the Tracking System

Setting budget limits within your expense tracking system can help you stay on top of your finances and avoid overspending. Here are some strategies to consider:

- Establish realistic budget limits for each expense category based on your income and financial goals.

- Monitor your spending regularly to ensure you are staying within the set budget limits.

- Adjust your budget limits as needed to account for any changes in your financial situation or unexpected expenses.

- Consider using alerts or notifications to remind you when you are approaching or exceeding your budget limits.

Analyzing and Reviewing Expenses

Analyzing and reviewing expenses is crucial for maintaining financial health and making informed decisions. By examining spending patterns and identifying areas of overspending or potential savings, individuals can take control of their finances and work towards achieving their financial goals.

Identifying Spending Patterns

- Review your tracked expenses over a specific period, such as a month or a quarter, to identify trends in your spending habits.

- Look for categories where you consistently spend more than anticipated, such as dining out, entertainment, or shopping.

- Use tools like graphs or charts to visualize your spending patterns and pinpoint areas that require attention.

Importance of Regular Expense Reviews

- Regularly reviewing your expenses helps you stay on top of your financial situation and make adjustments as needed.

- It allows you to track progress towards your financial goals and make informed decisions about where to cut back or reallocate funds.

- Identifying any discrepancies or unauthorized charges early on can prevent larger financial issues down the line.

Techniques for Identifying Areas of Overspending or Potential Savings

- Set spending limits for different expense categories based on your budget and track your progress towards these limits.

- Compare your actual expenses to your budgeted amounts to identify areas where you are overspending.

- Look for opportunities to save money, such as cutting back on unnecessary subscriptions or negotiating better deals on services.

Tips for Effective Expense Tracking

To effectively track expenses, it is crucial to stay disciplined and consistent with your tracking efforts. By forming good habits and keeping up with your expense tracking regularly, you can gain better control over your finances and make more informed decisions.

Recording Cash Transactions and Digital Payments

When it comes to recording cash transactions, make sure to keep all receipts and jot down the details in a notebook or an expense tracking app immediately. For digital payments, utilize online banking tools or apps that categorize your transactions automatically. This way, you can easily keep track of where your money is going without missing any expenses.

Adjusting the Tracking System Based on Evolving Financial Goals

As your financial goals change, your expense tracking system should adapt accordingly. Regularly review and analyze your expenses to see if they align with your current goals. If necessary, make adjustments to your budget and tracking methods to ensure you are on the right track towards achieving your financial objectives.