Behavioral biases in investing set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From overconfidence to loss aversion, these biases play a crucial role in shaping investment decisions with a touch of American high school hip style.

As we delve deeper into the realm of behavioral biases in investing, we uncover the fascinating ways in which human psychology influences financial choices, ultimately impacting investment outcomes.

Introduction to Behavioral Biases in Investing

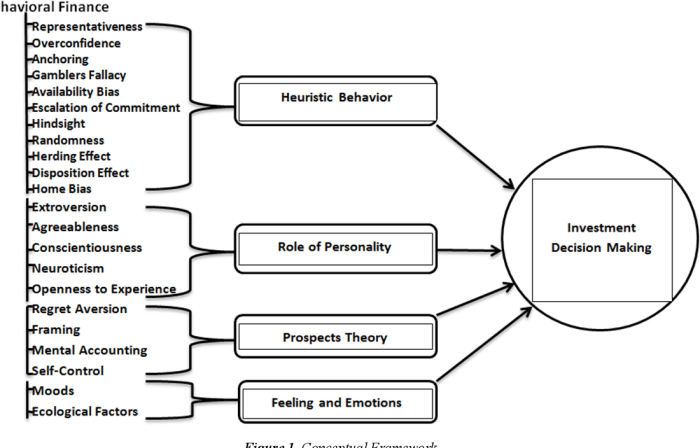

Behavioral biases in investing refer to the systematic patterns of deviation from rationality that investors often exhibit when making financial decisions. These biases are influenced by psychological factors, emotions, and cognitive shortcuts, leading investors to make irrational choices that can impact their investment outcomes.

Understanding these biases is crucial for investors as it helps them recognize their own behavioral tendencies and avoid making impulsive or emotionally-driven decisions. By being aware of these biases, investors can make more informed and rational choices, ultimately improving their overall investment performance.

Examples of Common Behavioral Biases

- Overconfidence Bias: Investors tend to overestimate their abilities and knowledge, leading them to take on excessive risks.

- Loss Aversion: Investors feel the pain of losses more strongly than the pleasure of gains, causing them to hold onto losing investments for too long.

- Confirmation Bias: Investors seek out information that confirms their existing beliefs while ignoring contradictory evidence, leading to biased decision-making.

Impact of Behavioral Biases on Investing

- Suboptimal Portfolio Diversification: Biases can lead to a lack of diversification in a portfolio, increasing risk exposure.

- Market Timing Mistakes: Emotional biases can result in poor market timing decisions, such as buying high and selling low.

- Irrational Herding Behavior: Investors may follow the crowd without conducting proper research, leading to suboptimal investment choices.

Overconfidence Bias

Overconfidence bias is a cognitive bias where individuals believe their abilities or knowledge are greater than they actually are. In investing, this bias can lead investors to make decisions based on overly optimistic assessments of their skills, leading to potentially risky investment choices.

Effects of Overconfidence Bias

Overconfidence can lead to excessive trading as investors may believe they have superior stock-picking abilities, resulting in frequent buying and selling that can increase transaction costs and reduce overall returns. Additionally, overconfidence can cause investors to take on too much risk by underestimating the potential downsides of their investments.

- Example 1: An investor who consistently outperforms the market for a period may become overconfident in their abilities and start making riskier investments without fully evaluating the potential consequences.

- Example 2: A trader who believes they have a unique insight into the market may engage in frequent trading, leading to higher transaction costs and lower overall returns.

Mitigating Overconfidence Bias

To mitigate the impact of overconfidence bias on investing, investors can:

- Keep detailed records of their investment decisions and outcomes to objectively evaluate their performance.

- Seek advice from financial professionals or mentors to gain different perspectives and challenge their own assumptions.

- Implement a systematic investment strategy with predefined rules to reduce the influence of emotions and overconfidence on decision-making.

Loss Aversion Bias

Loss aversion bias is a behavioral bias where investors tend to feel the pain of losses more intensely than the pleasure they feel from gains. This bias can lead to irrational decision-making in investing as individuals go to great lengths to avoid losses, even if it means missing out on potential gains.

Impact of Loss Aversion Bias

Loss aversion bias can impact investor behavior by causing them to make decisions based on fear of losing rather than rational analysis of potential returns. This can lead to missed opportunities for growth and a reluctance to take necessary risks in the market.

Examples of Poor Decision-Making

- Investors holding onto losing investments for too long, hoping they will turn around, instead of cutting their losses.

- Selling winning stocks too early to lock in gains, while holding onto losing positions in the hopes of breaking even.

- Refusing to diversify a portfolio out of fear of losses, even though it may reduce overall risk.

Managing and Overcoming Loss Aversion Bias

One technique for managing loss aversion bias is to set clear investment goals and stick to a predetermined strategy, regardless of short-term market fluctuations.

Another approach is to regularly review and rebalance your portfolio to ensure it aligns with your long-term financial objectives, rather than reacting emotionally to market movements.

Seeking advice from a financial advisor or mentor can also provide an outside perspective and help mitigate the impact of loss aversion bias on your investment decisions.

Confirmation Bias

Confirmation bias is a cognitive bias that influences investment choices by causing investors to seek out information that confirms their existing beliefs, while ignoring or dismissing evidence that contradicts those beliefs.

Impact on Investment Choices

Confirmation bias can significantly limit diversification in investment portfolios as investors tend to only consider information that aligns with their preconceived notions. This can lead to poor investment outcomes as investors may overlook critical data that could potentially improve their decision-making process.

- Investors might only focus on news articles or reports that support their investment thesis, leading them to miss out on important market trends or risks.

- Confirmation bias can also lead to a false sense of security, causing investors to hold onto losing investments longer than they should, in the hope that the market will eventually turn in their favor.

- Additionally, investors may disregard expert opinions or alternative viewpoints that challenge their beliefs, further reinforcing their biased investment decisions.

Counteracting Confirmation Bias

To counteract confirmation bias in investment decision-making, investors can take proactive steps to mitigate its impact.

- Encourage diverse perspectives by seeking out opinions that differ from your own, and actively considering alternative viewpoints before making investment decisions.

- Conduct thorough research by analyzing both positive and negative information related to an investment opportunity, rather than solely focusing on information that confirms your initial beliefs.

- Implement a structured decision-making process that includes input from multiple sources and considers conflicting viewpoints to ensure a more balanced assessment of investment opportunities.