Debt reduction strategies pave the way for a journey towards financial liberation, offering a sneak peek into a tale filled with insight and innovation, all with a touch of American high school hip style.

As we delve deeper into the realm of debt reduction strategies, we uncover the keys to unlocking a future free from the shackles of debt.

Understanding Debt Reduction Strategies

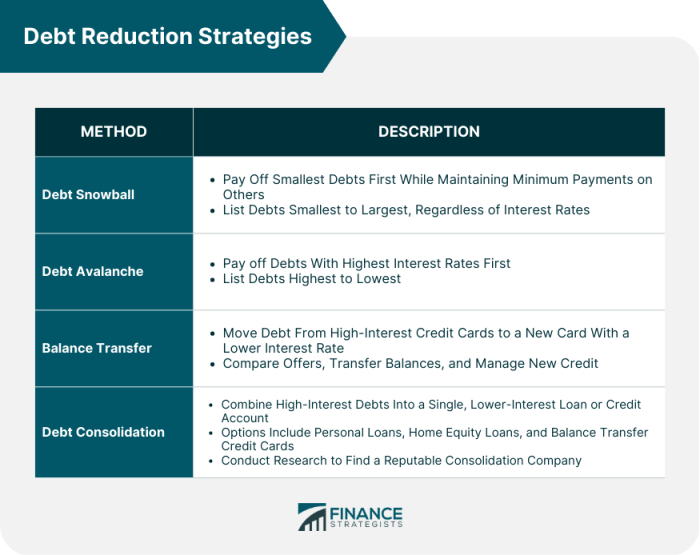

Debt reduction strategies are specific plans or methods individuals use to pay off their debts in a structured and efficient manner. These strategies help people manage their debt more effectively and work towards becoming debt-free.

Importance of Having a Debt Reduction Plan

Having a debt reduction plan is crucial because it provides a roadmap for individuals to follow in order to eliminate their debts. Without a plan, it can be easy to feel overwhelmed and unsure of where to start. A debt reduction plan helps prioritize debts, allocate resources effectively, and stay motivated throughout the process.

- Creating a budget: Establishing a budget helps individuals track their income and expenses, allowing them to identify areas where they can cut back to allocate more funds towards debt repayment.

- Snowball method: This strategy involves paying off debts starting with the smallest balance first, then moving on to larger balances. As each debt is paid off, the freed-up funds are redirected towards the next debt, creating a snowball effect.

- Avalanche method: The avalanche method focuses on paying off debts with the highest interest rates first, saving money on interest payments in the long run. Once the debt with the highest interest rate is paid off, the same amount is applied to the next highest interest debt.

Creating a Budget for Debt Reduction

Budgeting plays a crucial role in debt reduction as it helps individuals track their expenses, prioritize debt payments, and stay on track towards financial freedom.

Significance of Budgeting in Debt Reduction

Creating a budget is the first step towards managing debt effectively. By outlining income, expenses, and debt obligations, individuals can identify areas where they can cut back on spending and allocate more funds towards debt repayment.

- Calculate total income: Start by determining your total monthly income, including wages, bonuses, and any other sources of revenue.

- List all expenses: Make a comprehensive list of all your monthly expenses, including rent, utilities, groceries, and discretionary spending.

- Identify debt payments: List all outstanding debts, including credit card balances, student loans, and any other loans to prioritize repayment.

- Set debt repayment goals: Allocate a specific amount of your income towards debt repayment each month to accelerate the payoff process.

By creating a budget, individuals can gain better control over their finances and make informed decisions to reduce debt effectively.

Tips on Sticking to a Debt Reduction Budget

Sticking to a debt reduction budget requires discipline and commitment. Here are some tips to help you stay on track:

- Avoid unnecessary spending: Cut back on non-essential expenses like dining out, shopping for items you don’t need, or subscribing to services you rarely use.

- Track your spending: Keep a close eye on your expenses to ensure you’re staying within budget and making progress towards debt reduction goals.

- Automate payments: Set up automatic payments for debt obligations to avoid missing deadlines and incurring late fees.

- Reward milestones: Celebrate small victories along the way, such as paying off a credit card or reaching a certain debt reduction milestone, to stay motivated.

Snowball vs. Avalanche Method

When it comes to debt reduction strategies, two popular methods that people often consider are the snowball and avalanche methods. Both approaches have their own unique way of helping individuals pay off their debts, but they differ in terms of the order in which debts are tackled and the overall savings in the long run.

The snowball method involves paying off your debts from smallest to largest, regardless of interest rates. You start by making minimum payments on all your debts except for the smallest one. Once the smallest debt is paid off, you move on to the next smallest debt and so on. The idea behind this method is to build momentum and motivation as you see debts getting eliminated one by one.

Snowball Method

- Start by listing all your debts from smallest to largest.

- Make minimum payments on all debts except for the smallest one.

- Allocate any extra money towards paying off the smallest debt.

- Once the smallest debt is paid off, roll over the amount you were paying towards the next smallest debt.

- Repeat this process until all debts are cleared.

The avalanche method, on the other hand, involves paying off debts with the highest interest rates first. You prioritize debts based on their interest rates, starting with the debt that has the highest interest rate. By focusing on high-interest debts first, you can potentially save more money in the long run by reducing the overall interest paid over time.

Avalanche Method

- List all your debts from highest to lowest interest rate.

- Make minimum payments on all debts except for the one with the highest interest rate.

- Allocate any extra money towards paying off the high-interest debt.

- Once the highest interest debt is paid off, move on to the next highest interest debt.

- Continue this process until all debts are cleared.

When comparing the snowball and avalanche methods, the snowball method may provide a psychological boost by clearing smaller debts first, while the avalanche method may save you more money in interest over time. Ultimately, the best method for you will depend on your personal financial situation and goals.

Debt Consolidation

Debt consolidation is a financial strategy where multiple debts are combined into a single, larger debt, usually with a lower interest rate. This can help simplify debt repayment and potentially lower monthly payments.

Pros and Cons of Debt Consolidation

- Pros:

- Lower interest rates: By consolidating debt, you may be able to secure a lower overall interest rate, saving you money in the long run.

- Simplified repayment: Instead of juggling multiple monthly payments, you only have to worry about one, making it easier to manage your finances.

- Potential credit score improvement: If you make timely payments on your consolidated debt, it can positively impact your credit score.

- Cons:

- Extended repayment period: While monthly payments may be lower, consolidating debt can extend the time it takes to pay off what you owe.

- Additional fees: Some debt consolidation options come with fees or penalties, so it’s important to understand the costs involved.

- Risk of accruing more debt: Once you consolidate your debts, there may be a temptation to continue spending, leading to further financial trouble.

Types of Debt Consolidation Strategies

- Balance Transfer Credit Card: This involves transferring high-interest credit card debt to a new card with a lower interest rate, usually for a promotional period.

- Debt Consolidation Loan: Taking out a personal loan to pay off multiple debts, combining them into one monthly payment with a potentially lower interest rate.

- Home Equity Loan or Line of Credit: Using the equity in your home to secure a loan for consolidating debt, with the risk of losing your home if you default on payments.

- Debt Management Program: Working with a credit counseling agency to create a repayment plan that consolidates your debts and helps you repay them over time.

Negotiating with Creditors

Negotiating with creditors is a crucial step in the debt reduction process. By effectively communicating with your creditors, you can potentially lower your debt, reduce interest rates, or even settle for a lump sum payment. Here are some tips on how to negotiate with creditors for debt reduction:

Importance of Communication in Negotiating with Creditors

Effective communication is key when negotiating with creditors. Be honest about your financial situation and explain why you are struggling to make payments. By demonstrating a willingness to work together and find a solution, creditors may be more inclined to offer you a debt reduction plan.

Successful Negotiation Strategies

- Offer a lump sum payment: If you can afford to pay a portion of your debt in one go, creditors may be willing to accept a lower amount to settle the debt.

- Request a lower interest rate: Politely ask your creditors if they can reduce the interest rate on your debt to make it more manageable for you to repay.

- Explore debt settlement options: In some cases, creditors may be open to settling for a percentage of the total debt amount if you can demonstrate financial hardship.

- Seek the help of a credit counseling agency: Sometimes, working with a credit counseling agency can help you negotiate more effectively with creditors and come up with a repayment plan that works for both parties.

Tracking Progress and Adjusting Strategies

Tracking your progress and adjusting your debt reduction strategies are crucial steps in achieving financial freedom. By monitoring how well your strategies are working and making necessary adjustments, you can stay on track towards your goal of becoming debt-free.

Importance of Tracking Debt Reduction Progress

It is essential to track your debt reduction progress to see how much you have paid off and how much you still owe. This helps you stay motivated and focused on your goal. By keeping a close eye on your progress, you can also identify any areas where you may need to make changes to your strategies.

- Regularly checking your outstanding balances

- Monitoring your credit score for improvements

- Keeping track of your monthly payments and expenses

Ways to Monitor and Evaluate Effectiveness of Debt Reduction Strategies

There are several ways to monitor and evaluate the effectiveness of your debt reduction strategies. By analyzing your progress, you can determine what is working well and what needs improvement.

- Comparing your current debt balance to your initial balance

- Calculating your debt-to-income ratio

- Reviewing your budget to see if you are sticking to your payment plan

Adjusting Strategies Based on Progress and Changing Circumstances

Adjusting your debt reduction strategies is essential to ensure that you are continuously making progress towards your goal. As your financial situation changes or unexpected expenses arise, you may need to adapt your strategies accordingly.

- Increasing your monthly payments if you have extra funds

- Reevaluating your budget and cutting expenses if necessary

- Considering debt consolidation or refinancing options