Curious about how to invest in gold? Dive into the world of gold investment as we explore the various methods, factors to consider, and tips for success. Whether you’re a seasoned investor or just starting out, this guide will equip you with the knowledge you need to navigate the golden opportunities awaiting you.

Gold has always captivated investors with its allure and stability. Let’s uncover the mysteries behind this precious metal and discover how you can make it work for you.

Introduction to Gold Investment

Investing in gold is a popular way for individuals to diversify their investment portfolios and hedge against economic uncertainties. Gold has been considered a safe haven asset for centuries due to its intrinsic value and limited supply.

Significance of Gold Investment

- Gold is a tangible asset that holds its value over time, making it a reliable store of wealth.

- It acts as a hedge against inflation and currency devaluation, maintaining its purchasing power.

- Gold is globally recognized and accepted, providing liquidity and ease of buying and selling.

Reasons for Investing in Gold

- Portfolio Diversification: Gold helps to reduce overall investment risk by spreading assets across different classes.

- Safe Haven Investment: During times of economic turmoil or geopolitical uncertainty, gold prices tend to rise, offering protection to investors.

- Preservation of Wealth: Gold has historically preserved wealth over the long term, acting as a stable asset in times of market volatility.

Historical Performance of Gold

Gold has shown consistent long-term appreciation, outperforming many other asset classes over the years.

- In the past 20 years, gold has delivered an average annual return of around 10%, showcasing its potential for growth.

- During times of economic crisis, such as the 2008 financial meltdown, gold prices surged significantly, highlighting its role as a safe haven asset.

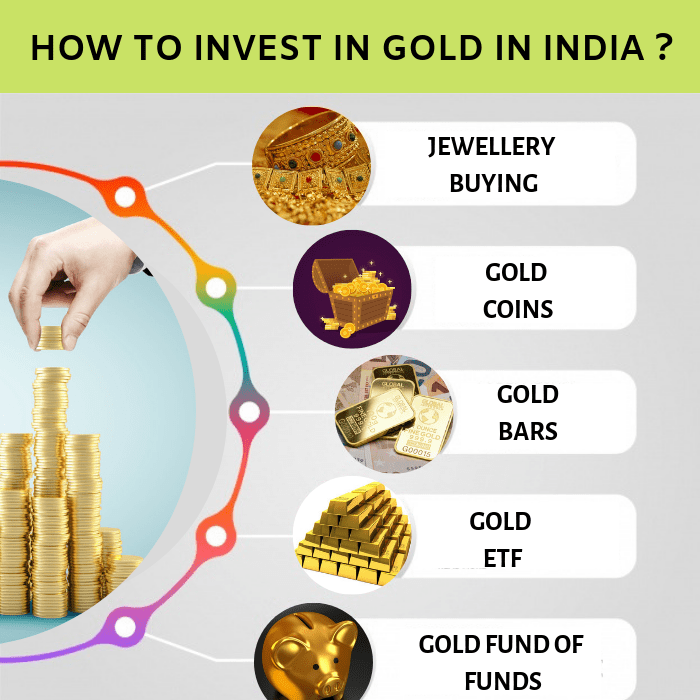

Ways to Invest in Gold

Investing in gold can be done through various methods, each with its own set of pros and cons. Here are some popular ways to invest in gold:

1. Physical Gold

Investing in physical gold involves purchasing gold coins, bars, or jewelry. This method allows investors to have direct ownership of the gold, providing a sense of security. However, storing and insuring physical gold can be costly.

2. Gold ETFs

Gold Exchange-Traded Funds (ETFs) are investment funds that track the price of gold and can be traded on stock exchanges. Investing in gold ETFs provides investors with exposure to the gold market without the need to physically store gold. However, investors do not own the physical gold itself.

3. Gold Mining Stocks

Investing in gold mining stocks involves buying shares of companies that are involved in gold mining operations. The value of these stocks is influenced by the performance of the company and the price of gold. While gold mining stocks can offer leverage to the price of gold, they are also subject to company-specific risks.

4. Gold Futures and Options

Gold futures and options are financial instruments that allow investors to speculate on the future price of gold. These derivatives can offer high returns but also come with high risks and require a good understanding of the market.

5. Gold IRA

A Gold Individual Retirement Account (IRA) is a self-directed retirement account that allows investors to hold physical gold as part of their retirement portfolio. This provides a hedge against inflation and economic uncertainty, but there are strict rules and regulations governing Gold IRAs.

6. Gold Bullion

Investing in gold bullion involves buying gold bars or coins of high purity. This method is popular among investors looking to preserve wealth and protect against economic downturns. However, buying gold bullion may come with high premiums and liquidity issues.

Factors to Consider Before Investing in Gold

Investing in gold can be a lucrative opportunity, but there are several key factors to consider before diving in. These factors can help you make informed decisions and maximize your investment potential.

Role of Gold in a Diversified Investment Portfolio

Gold plays a crucial role in a diversified investment portfolio as it acts as a hedge against inflation and economic uncertainties. By including gold in your portfolio, you can reduce overall risk and increase stability, especially during times of market volatility.

Economic Indicators Impacting Gold Prices

Economic indicators such as interest rates, inflation rates, and geopolitical tensions can significantly impact the price of gold. For example, when inflation is high, investors tend to flock to gold as a safe haven asset, driving up its price. Understanding these economic indicators can help you anticipate price movements and make strategic investment decisions.

Tips for Successful Gold Investment

Investing in gold can be a lucrative venture if done correctly. Here are some expert tips to help you get started, maximize your returns, and avoid common pitfalls.

Diversify Your Portfolio

- Allocate a portion of your investment portfolio to gold to hedge against market volatility.

- Consider investing in different forms of gold, such as physical gold, gold ETFs, or gold mining stocks, to spread risk.

Stay Informed

- Keep up to date with market trends, geopolitical events, and economic indicators that can impact the price of gold.

- Follow expert analysis and research to make informed decisions on when to buy or sell gold.

Long-Term Perspective

- Avoid making impulsive decisions based on short-term fluctuations in the gold price.

- Hold on to your gold investments for the long term to benefit from potential price appreciation over time.

Avoid Emotional Decisions

- Do not let fear or greed drive your investment decisions when it comes to gold.

- Stick to your investment strategy and resist the urge to panic sell during market downturns.

Seek Professional Advice

- Consult financial advisors or gold investment experts to get personalized guidance on your investment approach.

- Consider working with reputable gold dealers or brokers to ensure the authenticity of your gold purchases.