Diving deep into the world of Understanding mutual fund fees, buckle up as we take a ride through the intricate web of fees associated with mutual funds. Get ready to uncover the hidden truths behind these financial mysteries in a way that will keep you hooked from start to finish.

As we navigate through the different types of fees, their impact on returns, and the importance of understanding them, you’ll gain a fresh perspective on how fees play a crucial role in the world of investments.

Understanding Mutual Fund Fees

Mutual funds typically come with various fees that investors need to be aware of in order to make informed decisions. These fees can have a significant impact on the overall returns of an investment and understanding them is crucial for maximizing profits and minimizing losses.

Types of Fees Associated with Mutual Funds

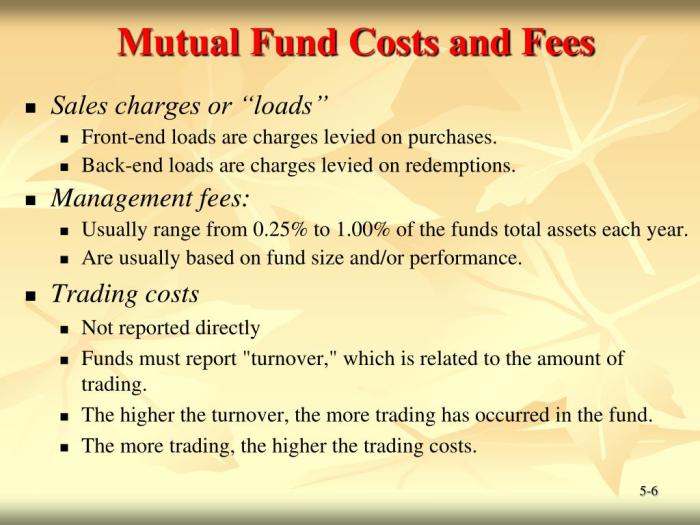

- Management Fees: These are fees paid to the fund manager for managing the portfolio.

- Expense Ratio: This represents the total percentage of a fund’s assets that is used to cover operating expenses.

- Load Fees: These are sales charges that investors may need to pay when buying or selling shares of a mutual fund.

- Performance Fees: These fees are based on the fund’s performance relative to a benchmark.

How Mutual Fund Fees Impact Overall Returns

- High fees can eat into your returns over time, reducing the amount of money you ultimately take home.

- Even seemingly small differences in fees can have a significant impact on long-term returns.

- Choosing funds with lower fees can help you keep more of your investment gains.

Importance of Understanding Mutual Fund Fees for Investors

- Knowing the fees associated with a mutual fund helps investors make more informed decisions about where to put their money.

- By understanding fees, investors can compare different funds and choose those that offer the best value for their money.

- Awareness of fees can help investors avoid unnecessary costs and potentially increase their overall returns.

Types of mutual fund fees

Investors may encounter various types of fees when investing in mutual funds, each impacting their overall returns. One of the key fees to consider is the expense ratio, which is a measure of the fund’s operating costs expressed as a percentage of its total assets. Understanding how expense ratios are calculated can help investors make informed decisions about their investments.

Expense Ratios

Expense ratios are calculated by dividing a mutual fund’s total operating expenses by its average total assets. These expenses can include management fees, administrative costs, and other operational expenses. A lower expense ratio typically indicates a more cost-effective fund, allowing investors to keep more of their returns.

Front-end Load Fees vs. Back-end Load Fees

Front-end load fees are charges that investors pay when purchasing mutual fund shares, usually deducted upfront from the initial investment. On the other hand, back-end load fees are charged when investors sell their shares, often on a sliding scale depending on how long the shares have been held. These fees can erode potential returns over time, so it’s essential for investors to consider the impact of loads on their investment strategy.

Transparency in fee disclosure

Transparency in fee disclosure refers to the clear and detailed information provided to investors regarding the fees associated with mutual funds. This transparency is crucial for investors to make informed decisions about their investments.

Regulations governing fee disclosure

- The Securities and Exchange Commission (SEC) requires mutual funds to disclose all fees and expenses in a standardized format in the fund’s prospectus.

- The Investment Company Act of 1940 mandates that mutual funds disclose the management fees, 12b-1 fees, and other expenses that investors may incur.

- The Department of Labor’s ERISA regulations also require 401(k) plans to disclose all fees and expenses to plan participants.

Benefits of transparency in fee disclosure

- Helps investors understand the total cost of investing in a mutual fund, enabling them to compare different funds and make informed decisions.

- Prevents investors from being surprised by hidden fees or expenses, promoting trust and confidence in the investment process.

- Promotes accountability and ethical practices among fund managers, as they are required to disclose all fees upfront.

Information investors should look for

- Management fees: The fees charged by the fund manager for managing the fund’s portfolio.

- 12b-1 fees: Distribution and marketing fees that are included in the fund’s operating expenses.

- Expense ratio: The total annual expenses of a fund expressed as a percentage of its average net assets.

- Transaction costs: Costs associated with buying and selling securities within the fund.

- Shareholder fees: Fees charged when investors buy or sell shares of the fund.

Impact of fees on investment performance

When it comes to investing in mutual funds, the impact of fees on investment performance cannot be overlooked. High fees can significantly eat into your returns over time, affecting your long-term investment growth. Let’s dive into how fees can erode your investment returns and explore strategies to minimize their impact.

Erosion of Investment Returns

High fees can have a compounding effect on your investment returns over time. Even seemingly small differences in fees can lead to substantial variations in your final investment balance. For instance, consider two investors who each invest $10,000 in a mutual fund with an annual return of 7% over 30 years. The only difference is the fees they pay – Investor A pays 0.5% in fees annually, while Investor B pays 1.5% in fees annually. By the end of the 30-year period, Investor A would have accumulated approximately $63,000 more than Investor B due to lower fees.

Minimizing Fee Impact

- Choose low-cost index funds or ETFs: These investment options typically have lower expense ratios compared to actively managed funds, helping you save on fees.

- Look for no-load funds: Avoid funds that charge sales commissions or loads, as these fees can eat into your returns.

- Regularly review and rebalance your portfolio: By staying on top of your investments and rebalancing when necessary, you can ensure you are not overpaying for underperformance.

- Consider fee waivers or discounts: Some funds offer fee waivers or discounts based on factors like account size or investment tenure. Take advantage of these opportunities to reduce your overall fees.