Yo, diving into the world of Financial implications of a home purchase, get ready for some real talk about money and homeownership. From down payments to mortgage options, we’re breaking it down for you in a way that’s straight up.

Let’s talk numbers, baby. From property taxes to insurance, we’re spilling the tea on what you need to know before you make that big purchase.

Financial Implications of a Home Purchase

When buying a home, there are several financial factors to consider that can impact your overall costs and long-term finances.

Down Payment and Overall Costs

A down payment is a lump sum of money paid upfront towards the purchase price of the home. The size of the down payment affects the overall cost of the home and can determine the loan amount and interest rates.

Types of Mortgage Options

There are various mortgage options available, such as fixed-rate mortgages, adjustable-rate mortgages, FHA loans, and VA loans. Each type of mortgage has different terms, interest rates, and repayment options that can influence your long-term financial commitment.

Property Taxes and Insurance

Property taxes and insurance are essential costs to consider when budgeting for a home purchase. Property taxes are determined by the local government and can vary based on the value of the property, while insurance protects your investment and can be a significant expense.

Budgeting for Homeownership

Creating a realistic budget is crucial when it comes to homeownership. It’s essential to consider not only the monthly mortgage payments but also maintenance costs and unexpected expenses that may arise.

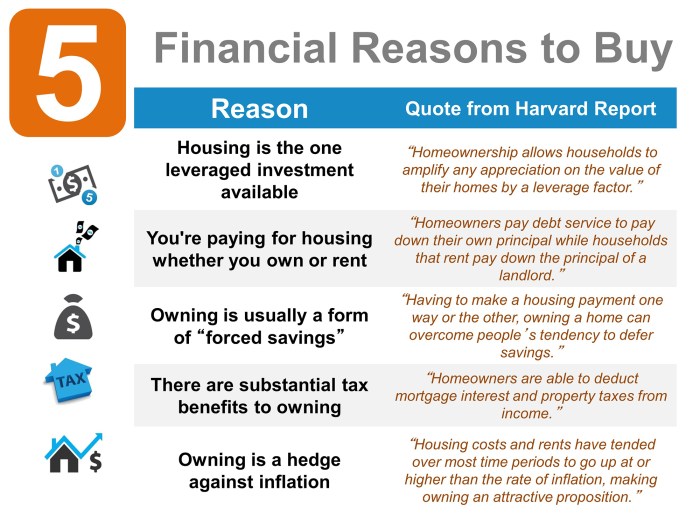

Comparing Renting vs. Buying

When comparing renting versus buying a home in the long run, buying often proves to be more financially beneficial. While renting may seem cheaper initially, homeownership allows you to build equity and potentially increase your net worth over time.

Significance of an Emergency Fund

Having an emergency fund is vital for homeownership as unexpected expenses can arise at any time. Whether it’s a leaky roof or a broken appliance, having a financial cushion can help you cover these costs without putting a strain on your budget.

Credit Score and Financing

Having a good credit score is crucial when it comes to obtaining a mortgage for a new home. Lenders use your credit score to assess your creditworthiness and determine the interest rate you will be offered on your loan.

Impact of Credit Scores on Mortgage Approval and Interest Rates

- Your credit score plays a significant role in whether you will be approved for a mortgage or not. Lenders prefer borrowers with higher credit scores as they are seen as less risky.

- Higher credit scores typically result in lower interest rates on your mortgage loan, saving you money over the life of the loan.

- Conversely, lower credit scores may lead to higher interest rates or even rejection of your mortgage application.

- It’s important to maintain a good credit score by making timely payments, keeping credit card balances low, and avoiding opening multiple new credit accounts.

Strategies to Improve Credit Scores Before Applying for a Mortgage

- Regularly check your credit report for errors and dispute any inaccuracies.

- Pay off outstanding debts, especially high-interest credit card balances, to lower your credit utilization ratio.

- Avoid opening new lines of credit before applying for a mortgage, as this can temporarily lower your credit score.

- Consider becoming an authorized user on someone else’s credit card with a good payment history to boost your credit score.

Relationship Between Debt-to-Income Ratio and Loan Approval

- Lenders also consider your debt-to-income ratio (DTI) when evaluating your mortgage application.

- DTI is calculated by dividing your total monthly debt payments by your gross monthly income.

- A lower DTI ratio indicates that you have more disposable income to cover your mortgage payments, making you a more attractive borrower.

- Lenders typically prefer a DTI ratio of 43% or lower for conventional mortgages.

Additional Costs and Fees

When purchasing a home, there are several additional costs and fees that buyers need to consider beyond the purchase price. These costs can significantly impact the overall financial commitment of owning a home.

Common Additional Costs

- Closing Costs: These are fees paid at the closing of a real estate transaction and typically include loan origination fees, attorney fees, title insurance, and more.

- Appraisal Fees: Lenders require an appraisal to assess the market value of the property, and buyers are responsible for covering this cost.

- Inspection Fees: Home inspections are crucial to identify any potential issues with the property before purchase, and buyers should budget for this expense.

Impact of HOA Fees

HOA fees, or Homeowners Association fees, are recurring payments made by homeowners to cover shared community expenses and maintenance. These fees can vary widely depending on the neighborhood and amenities provided. It’s important to factor in HOA fees when budgeting for homeownership, as they can significantly impact the overall cost of owning a home.

Renovation or Repair Costs

When considering a home purchase, buyers should also account for potential renovation or repair costs. Older homes or properties in need of updates may require additional investments to make them livable or to increase their resale value. It’s crucial to factor in these costs when determining the affordability of a home purchase.