Get ready to dive into the world of stocks with a cool twist! Tips for buying stocks is all about making smart investment choices in the ever-changing stock market. So, buckle up and let’s explore the ins and outs of this exciting financial journey.

In this guide, we’ll break down everything from understanding stocks to managing risks, giving you the lowdown on how to level up your stock game like a true boss.

Understanding Stocks

Investing in stocks can be a great way to build wealth over time, but it’s important to understand the basics before diving in. Here’s a breakdown of what stocks are and how they work:

Stocks represent ownership in a company, meaning when you buy shares of a company’s stock, you essentially own a small piece of that company. This ownership comes with certain rights, such as voting on company decisions and receiving dividends if the company profits.

Importance of Stock Prices

- Stock prices play a crucial role in determining the value of your investment. If a company’s stock price goes up, your investment grows in value, and vice versa.

- Stock prices are influenced by various factors, including company performance, industry trends, economic conditions, and investor sentiment.

- Monitoring stock prices can help you make informed decisions about buying, selling, or holding onto your investments.

Risks and Rewards of Investing in Stocks

- Investing in stocks comes with risks, such as market volatility, company bankruptcy, and economic downturns. It’s important to be prepared for the possibility of losing money.

- On the flip side, investing in stocks also offers potential rewards, including the opportunity for high returns and the possibility of building long-term wealth.

- Diversifying your portfolio and doing thorough research can help mitigate risks and maximize the rewards of investing in stocks.

Researching Stocks

Researching individual stocks is crucial for making informed investment decisions. By analyzing various factors, you can assess the potential risks and rewards of investing in a particular company.

Financial statements and ratios play a significant role in stock analysis as they provide valuable insights into a company’s financial health and performance. Key financial documents like income statements, balance sheets, and cash flow statements can help you evaluate a company’s profitability, liquidity, and overall stability. Ratios such as price-to-earnings (P/E), debt-to-equity, and return on equity can offer further insights into a company’s valuation and financial strength.

Market trends and news also play a vital role in stock selection. Keeping up with market developments, industry trends, and company-specific news can help you identify potential investment opportunities or risks. Understanding how external factors can impact a company’s stock price is essential for making well-informed decisions.

Analyzing Financial Statements

Financial statements provide a snapshot of a company’s financial performance over a specific period. Analyzing these statements can help you understand how well a company is performing and whether it is a good investment opportunity.

- Income Statement: Shows a company’s revenues, expenses, and profits over a specific period.

- Balance Sheet: Provides information about a company’s assets, liabilities, and shareholders’ equity at a given point in time.

- Cash Flow Statement: Reveals how much cash is generated and used by a company during a specific period.

Remember to look for trends, compare data over multiple periods, and analyze key financial ratios to get a comprehensive view of a company’s financial health.

Monitoring Market Trends and News

Staying informed about market trends and news can help you identify investment opportunities and potential risks. Market trends, economic indicators, and company-specific news can all impact stock prices and overall market sentiment.

- Industry Trends: Understanding the broader industry landscape can help you identify growing sectors and potential investment opportunities.

- Company News: Keep track of company announcements, earnings reports, and other developments that could impact a company’s stock price.

- Market Sentiment: Pay attention to investor sentiment, economic indicators, and geopolitical events that can influence stock prices.

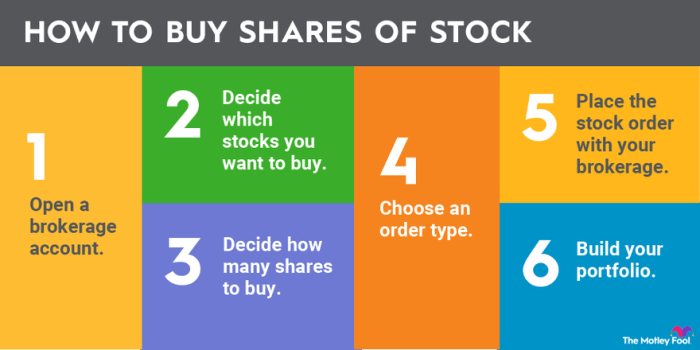

Choosing a Broker

When it comes to buying stocks, choosing the right broker is crucial. Brokers act as the middlemen between you and the stock market, so you want to make sure you find one that meets your needs.

Types of Brokers

- Full-Service Brokers: These brokers offer a wide range of services, including investment advice and portfolio management. However, they typically charge higher fees.

- Discount Brokers: These brokers offer fewer services but charge lower fees. They are a good option for those who prefer a hands-off approach to investing.

- Online Brokers: Online brokers allow you to trade stocks through an online platform. They often have lower fees and provide tools for independent research and trading.

Evaluating Brokers

- Brokerage Fees: Compare fees across different brokers to ensure you are getting the best deal. High fees can eat into your profits over time.

- Account Minimums: Some brokers require a minimum deposit to open an account. Make sure you can meet this requirement before choosing a broker.

- Customer Service: A broker with good customer service can help you navigate the complexities of the stock market. Look for brokers with responsive support teams.

Platform Usability and Tools

- Platform Usability: A user-friendly platform can make trading stocks much easier. Look for brokers with intuitive interfaces and mobile apps for trading on the go.

- Trading Tools: Some brokers offer advanced tools for technical analysis, research, and monitoring your investments. Consider your trading style and the tools you need before making a decision.

Building a Diversified Portfolio

Diversification is a key strategy in investing that involves spreading your investments across different assets to reduce risk. By diversifying your portfolio, you can minimize the impact of any single investment performing poorly.

Importance of Diversification

Diversification helps in reducing the overall risk of your portfolio by not putting all your eggs in one basket. It allows you to capture gains in different sectors while minimizing losses in others.

- Invest in various industries: Spread your investments across industries to avoid being heavily impacted by the performance of a single sector.

- Include different asset classes: Incorporate stocks, bonds, and other assets to diversify your portfolio and reduce overall risk.

- Consider international markets: Investing in global markets can provide additional diversification and exposure to different economies.

Sector Allocation and Asset Allocation

Sector allocation refers to the distribution of your investments across different industries, while asset allocation involves dividing your portfolio among various asset classes.

| Sector Allocation | Asset Allocation |

|---|---|

| Spread investments across sectors like technology, healthcare, and energy to reduce sector-specific risks. | Allocate your portfolio among stocks, bonds, real estate, and cash equivalents to achieve a balanced mix of assets. |

| Monitor sector performance and adjust allocation based on market trends. | Consider your risk tolerance and investment goals when determining the right mix of assets for your portfolio. |

Timing the Market

Investors often try to time the market by predicting when to buy and sell stocks, but this strategy comes with challenges and risks. Trying to predict short-term movements in the market can be unpredictable and risky, especially for novice investors.

Long-term Investing vs Short-term Trading

- Long-term investing involves holding onto stocks for an extended period, often years, to benefit from the overall growth of the market. This strategy requires patience and a focus on company fundamentals rather than short-term price fluctuations.

- Short-term trading, on the other hand, involves buying and selling stocks quickly to capitalize on short-term price movements. This approach can be more speculative and requires a higher level of active monitoring and trading skills.

Dollar-Cost Averaging in Volatile Markets

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount of money in the market, regardless of price fluctuations. This approach helps smooth out the impact of market volatility on your investment returns over time. By consistently investing a fixed amount, you can buy more shares when prices are low and fewer shares when prices are high, ultimately reducing the risk of making poor investment decisions based on short-term market fluctuations.

“The key to successful investing is not predicting the future, but managing risk and controlling emotions.”

Managing Risks

When it comes to investing in stocks, it’s crucial to understand the risks involved and how to manage them effectively. By identifying common risks and implementing risk management strategies, you can protect your investments and navigate the unpredictable nature of the stock market.

Setting Stop-Loss Orders

One important risk management strategy is setting stop-loss orders. This allows you to automatically sell a stock if it reaches a certain price, limiting your potential losses. By setting a stop-loss order, you can protect yourself from significant declines in stock prices and prevent emotional decision-making.

- Set stop-loss orders at a level that aligns with your risk tolerance and investment goals.

- Regularly review and adjust your stop-loss orders based on market conditions and the performance of your investments.

- Consider using trailing stop-loss orders to protect profits and limit potential losses as the stock price moves in your favor.

Handling Emotional Decision-Making

Emotions can often cloud judgment and lead to poor decision-making in stock trading. It’s essential to develop a disciplined approach and avoid making impulsive decisions based on fear or greed.

- Stick to your investment strategy and avoid making drastic changes based on short-term market fluctuations.

- Focus on the long-term goals of your investment portfolio and avoid getting swayed by daily market noise.

- Consider seeking advice from a financial advisor or mentor to gain perspective and avoid emotional biases in your decision-making process.