Yo, diving into the world of finance and mental health, where your bank account balance and your peace of mind collide in unexpected ways. Get ready to explore how these two worlds intertwine and impact each other, creating a rollercoaster of emotions and financial decisions.

In this journey, we’ll uncover the deep-rooted relationship between financial stability and mental well-being, shedding light on the struggles many face when trying to balance both aspects of their lives.

Introduction to Finance and Mental Health

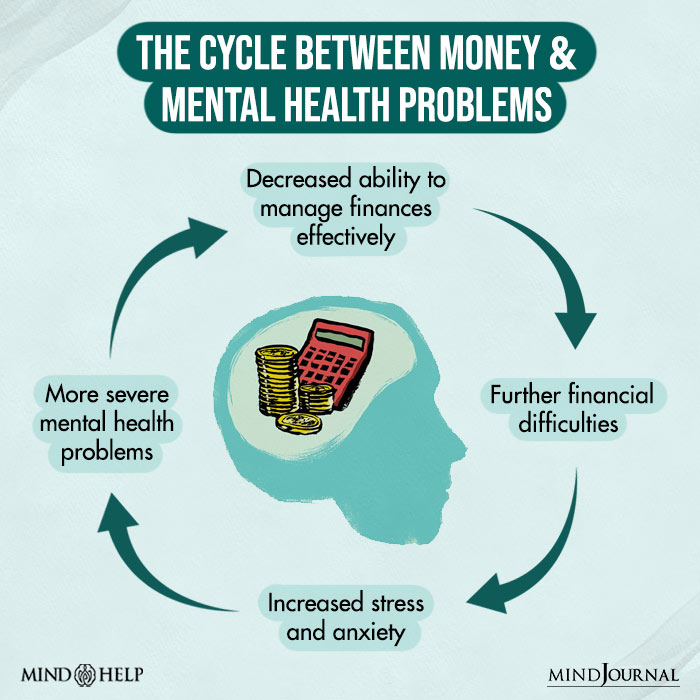

Finance and mental health are closely intertwined, with each having a significant impact on the other. The relationship between financial well-being and mental health is complex and multifaceted.

Financial well-being can greatly affect mental health, as financial stress and instability can lead to increased anxiety, depression, and other mental health challenges. The constant worry about money, debt, and financial obligations can take a toll on a person’s overall mental well-being.

Common Mental Health Challenges Related to Financial Stress

- Increased anxiety levels due to financial uncertainty and instability.

- Feelings of hopelessness and helplessness when faced with mounting debt or financial difficulties.

- Depression stemming from the pressure to meet financial obligations and the fear of financial ruin.

- Strained relationships with family and friends due to financial stress and the inability to participate in social activities.

- Physical health issues resulting from prolonged stress and anxiety related to financial problems.

Importance of Financial Literacy

Financial literacy plays a crucial role in maintaining overall mental health and well-being. When individuals have a solid understanding of financial concepts and practices, they are better equipped to make informed decisions, manage their money effectively, and reduce financial stress, which can have a significant impact on mental health.

Lack of financial knowledge can often lead to various mental health issues such as anxiety, depression, and even relationship conflicts. For example, individuals who are unaware of how to budget or manage debts may constantly feel overwhelmed by financial obligations, leading to increased stress and anxiety. Moreover, the pressure of not being able to meet financial goals or provide for oneself and loved ones can significantly impact one’s mental well-being.

To improve financial literacy and enhance mental health, individuals can take proactive steps such as attending financial education workshops, reading books or articles on personal finance, seeking guidance from financial advisors, or using online resources like budgeting apps. By gaining a better understanding of topics such as budgeting, investing, saving, and debt management, individuals can feel more confident in their financial decisions and reduce the negative impact of financial stress on their mental health.

Financial Stress and Mental Health

Financial stress can have a significant impact on mental health, leading to increased anxiety, depression, and overall decreased well-being. The constant worry about finances can consume thoughts, disrupt sleep patterns, and strain relationships, ultimately taking a toll on one’s mental health.

Effects of Financial Stress on Mental Health

- Increased anxiety and constant worry about financial obligations.

- Feelings of helplessness and hopelessness, leading to depression.

- Physical symptoms such as headaches, muscle tension, and fatigue due to stress.

- Strained relationships with family and friends due to financial strain.

Coping Mechanisms for Dealing with Financial Stress

- Creating a budget and sticking to it to gain a sense of control over finances.

- Seeking support from a therapist or counselor to process emotions related to financial stress.

- Engaging in stress-reducing activities such as exercise, meditation, or hobbies.

- Exploring financial resources and assistance programs available in the community.

Real-Life Impact of Financial Stress on Mental Health

One example is Sarah, who lost her job during the pandemic and struggled to make ends meet. The constant financial pressure led to severe anxiety and panic attacks, affecting her ability to function in daily life. Through therapy and financial counseling, Sarah was able to develop coping strategies and regain a sense of stability in her mental health.

Seeking Professional Help

When facing financial or mental health challenges that seem overwhelming, it’s crucial to seek professional help. Professionals can provide the guidance and support needed to navigate these complex issues and improve overall well-being.

Types of Professionals

- Financial Advisors: These professionals specialize in managing finances, creating budgets, and planning for the future. They can offer tailored advice to help individuals make informed decisions about their money.

- Therapists: Trained mental health professionals who can provide counseling and therapy to address emotional and psychological challenges related to financial stress.

- Counselors: Offer guidance and support for individuals struggling with both financial difficulties and mental health concerns. They can provide coping strategies and resources to manage stress effectively.

Benefits of Therapy/Counseling

Therapy or counseling can be incredibly beneficial for individuals experiencing financial difficulties. These professionals can help individuals:

- Identify the root causes of financial stress and develop coping mechanisms to better manage it.

- Address any underlying mental health issues contributing to financial struggles.

- Learn healthy ways to deal with stress and anxiety related to money matters.

- Improve overall emotional well-being and quality of life.