Get ready to dive into the world of passive income ideas that will make your financial future brighter than ever. From real estate investments to online business ventures, we’ve got the inside scoop on how to make money while you sleep. So sit back, relax, and let’s explore the endless possibilities of passive income together.

Let’s start with the basics and then move on to the nitty-gritty details of each passive income stream.

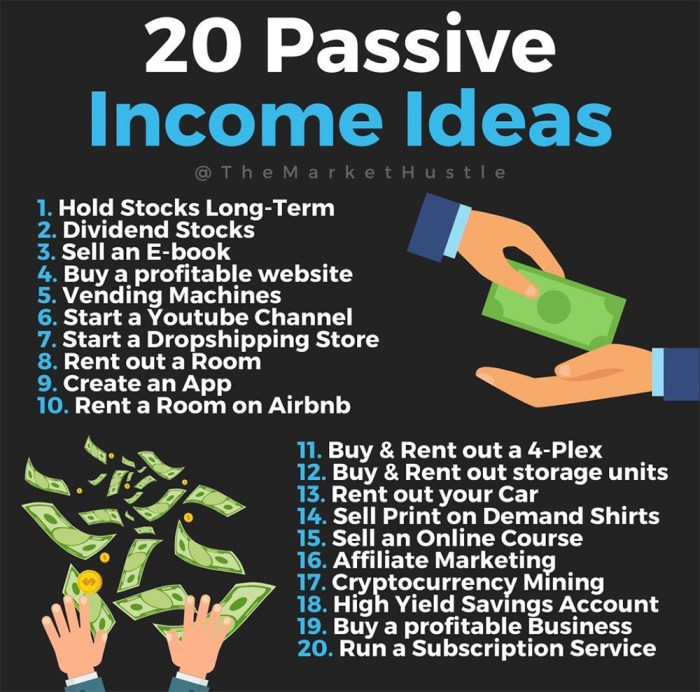

Passive Income Ideas

Passive income is money earned with minimal effort through various sources like investments, royalties, or rental properties. It plays a crucial role in financial planning by providing a steady stream of income without active work.

Popular Passive Income Streams

There are several popular passive income streams that individuals can explore:

- Dividend Stocks: Investing in stocks that pay regular dividends to shareholders.

- Rental Properties: Earning rental income from properties owned and leased out.

- Peer-to-Peer Lending: Investing in loans to earn interest income.

- Affiliate Marketing: Earning commissions by promoting products or services.

Diversifying Passive Income Sources

Diversifying passive income sources is essential to reduce risk and increase overall income potential. By spreading investments across different streams, individuals can protect themselves from fluctuations in a single market or industry.

Financial Independence through Passive Income

Passive income can lead to financial independence by providing a consistent stream of income that covers living expenses without the need for a traditional job. This financial freedom allows individuals to pursue their passions, travel, or retire early.

Real Estate Investments

Real estate is a popular way to generate passive income by investing in rental properties or real estate investment trusts (REITs). Rental properties can provide steady income through monthly rent payments, while REITs offer the opportunity to invest in a diversified portfolio of real estate assets.

Investing in Rental Properties

- Research the local real estate market to identify areas with high rental demand and potential for appreciation.

- Calculate the potential return on investment (ROI) by considering rental income, expenses, and property value appreciation.

- Screen tenants carefully to minimize the risk of late payments or property damage.

- Consider hiring a property management company to handle day-to-day responsibilities and maintenance.

Owning Rental Properties vs. REITs

- Pros of Owning Rental Properties: Direct ownership, potential for higher returns, tax benefits like deductions for mortgage interest and property depreciation.

- Cons of Owning Rental Properties: Active involvement in property management, risks of vacancies and maintenance costs.

- Pros of REITs: Diversification, passive income without property management responsibilities, liquidity.

- Cons of REITs: Market volatility, lack of control over individual property selection.

Maximizing Rental Property Income

- Regularly review and adjust rental rates to match market trends and maximize income.

- Invest in property upgrades and renovations to attract higher-paying tenants and increase property value.

- Implement cost-saving measures like energy-efficient upgrades to reduce expenses and increase profitability.

- Consider short-term rental options like Airbnb or vacation rentals for higher potential income, but be aware of local regulations.

Online Business Ventures

In today’s digital age, online business ventures have become a popular way to generate passive income. With the right strategies and tools, you can create a successful online business that brings in money even while you sleep.

Setting Up an E-commerce Store

Setting up an e-commerce store involves a few key steps to ensure its success. Here are the main steps to get started:

- Choose a niche: Select a specific product or service to focus on.

- Create a website: Set up a user-friendly and visually appealing online store.

- Source products: Find reliable suppliers for your products.

- Market your store: Use social media, , and other marketing strategies to attract customers.

- Optimize for conversions: Make it easy for customers to make purchases on your site.

Affiliate Marketing for Passive Income

Affiliate marketing is a great way to earn passive income by promoting products or services from other companies. Here’s how you can get started:

- Sign up for affiliate programs: Join affiliate programs related to your niche.

- Promote products: Create content that includes affiliate links to products you recommend.

- Drive traffic: Use , social media, and email marketing to drive traffic to your affiliate links.

- Earn commissions: Earn a commission for every sale made through your affiliate links.

Creating and Monetizing a Successful Blog

Blogging can be a lucrative online business if done right. Here are some tips for creating and monetizing a successful blog:

- Choose a niche: Select a niche that you are passionate about and that has the potential for monetization.

- Create valuable content: Produce high-quality, engaging content that provides value to your readers.

- Monetize your blog: Implement strategies like affiliate marketing, sponsored posts, and selling digital products.

- Grow your audience: Engage with your audience, collaborate with other bloggers, and promote your blog to increase traffic.

Investment Opportunities

Investing is a great way to grow your money and generate passive income over time. There are various investment opportunities that can help you achieve financial success without having to actively work for it. Let’s explore some of these options below.

Dividend Stocks for Passive Income

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. By investing in dividend stocks, you can earn a steady stream of passive income without having to sell your shares. These stocks are a popular choice for investors looking to build a portfolio that generates income over the long term.

- Dividend stocks can provide a reliable source of passive income, as companies typically pay dividends regularly.

- Reinvesting dividends can help accelerate the growth of your investment portfolio over time.

- Dividend stocks are relatively stable compared to growth stocks, making them a more conservative investment option.

Index Funds vs. Individual Stock Investments

Index funds are investment funds that track a specific market index, such as the S&P 500. They offer diversification by holding a large number of stocks within the fund. On the other hand, individual stock investments involve purchasing shares of a single company.

- Index funds provide instant diversification, reducing the risk associated with investing in individual stocks.

- Individual stock investments have the potential for higher returns but come with higher risk compared to index funds.

- Index funds are a more hands-off approach to investing, making them ideal for passive income generation.

Peer-to-Peer Lending for Passive Income

Peer-to-peer lending platforms connect borrowers with individual investors looking to lend money for a return. Through peer-to-peer lending, investors can earn passive income through interest payments on the loans they have funded.

- Peer-to-peer lending offers higher returns compared to traditional savings accounts or CDs.

- Investors can diversify their investments across multiple loans to reduce risk.

- However, peer-to-peer lending carries the risk of borrower default, so thorough due diligence is essential.

Investing in Bonds for Passive Income

Bonds are fixed-income securities issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you are essentially lending money to the bond issuer in exchange for regular interest payments.

- Bonds provide a predictable source of passive income through interest payments.

- They are generally considered less risky than stocks, making them a popular choice for conservative investors.

- Bond prices can fluctuate based on interest rates and credit risk, so it’s essential to assess the risk associated with each bond investment.