Get ready to dive into the world of leveraging debt, where financial jargon meets real-world applications. Brace yourself for an enlightening journey filled with insights and strategies that will change your perspective on debt forever.

In this guide, we’ll explore the concept of leveraging debt, the types of debt that can be leveraged, effective strategies, investment opportunities, and the risks involved. So, buckle up and let’s navigate through the intricate world of debt leverage together.

Understand the concept of leveraging debt

Leveraging debt is a financial strategy where individuals or companies borrow funds to invest in assets or projects that have the potential to generate a higher return than the cost of the debt. It essentially involves using borrowed money to increase the potential return on investment.

Benefits of leveraging debt

- Increased potential for higher returns: By leveraging debt, individuals or companies can amplify their gains if the investments perform well.

- Asset growth: Leveraging debt allows for the acquisition of assets that would otherwise be out of reach, leading to potential wealth accumulation.

- Tax advantages: Interest payments on debt can often be tax-deductible, providing a tax benefit to the borrower.

Risks of leveraging debt

- Interest costs: Borrowing money comes with interest payments, which can eat into profits if the investments do not perform as expected.

- Financial strain: If investments underperform or unexpected expenses arise, the burden of debt repayment can become challenging.

- Market volatility: Economic downturns or changes in interest rates can impact the value of investments, potentially leading to losses.

Examples of leveraging debt

- Real estate investments: Using a mortgage to purchase rental properties with the aim of generating rental income that exceeds the cost of borrowing.

- Business expansion: Taking out a loan to fund the expansion of a business, with the expectation that the growth in revenue will outweigh the interest payments.

- Stock market investments: Borrowing funds to invest in stocks or securities with the goal of achieving higher returns than the interest on the borrowed amount.

Types of debt that can be leveraged

When it comes to leveraging debt, there are various types of debt that individuals and businesses can utilize to achieve their financial goals. Understanding the differences between good debt and bad debt is crucial in determining which types of debt are suitable for leveraging. Let’s explore the common types of debt that can be leveraged and how they can impact financial leverage strategies.

Good Debt vs. Bad Debt

- Good Debt: Good debt is typically used to finance assets that have the potential to increase in value over time, such as a mortgage for a home or a loan for education. This type of debt can help build wealth and improve financial stability.

- Bad Debt: Bad debt, on the other hand, is used to finance depreciating assets or non-essential purchases, such as high-interest credit card debt or personal loans for luxury items. This type of debt can hinder financial growth and lead to financial instability.

Types of Debt for Leveraging

- Mortgage Debt: Mortgage debt is a common type of debt that can be leveraged to purchase real estate properties. By using mortgage debt, individuals and businesses can acquire assets that can potentially appreciate in value over time.

- Business Loans: Business loans are another form of debt that can be leveraged by companies to invest in their operations, expand their business, or finance new projects. When used strategically, business loans can help businesses grow and increase profitability.

- Student Loans: Student loans are a type of debt that can be leveraged to invest in education and skill development. While student loans can be considered good debt due to the potential for increased earning potential, it is important to manage them wisely to avoid financial strain.

Strategies for leveraging debt

When it comes to leveraging debt, it’s crucial to have a solid plan in place to ensure optimal financial results. By strategically utilizing debt, individuals and businesses can take advantage of opportunities for growth and increased wealth. Let’s explore some key strategies for effectively leveraging debt.

Importance of having a clear plan

Having a clear plan is essential when leveraging debt. It helps in identifying the purpose of taking on debt, whether it’s for investments, expansion, or other financial goals. A clear plan also Artikels the repayment strategy and helps in managing debt effectively.

- Define your financial goals: Before taking on debt, identify your financial objectives and how leveraging debt can help you achieve them.

- Assess your borrowing capacity: Understand your financial position and borrowing capacity to ensure you can comfortably manage the debt.

- Create a repayment plan: Develop a structured repayment plan to avoid falling into a debt trap and ensure timely payments.

Tips for managing debt leverage ratios

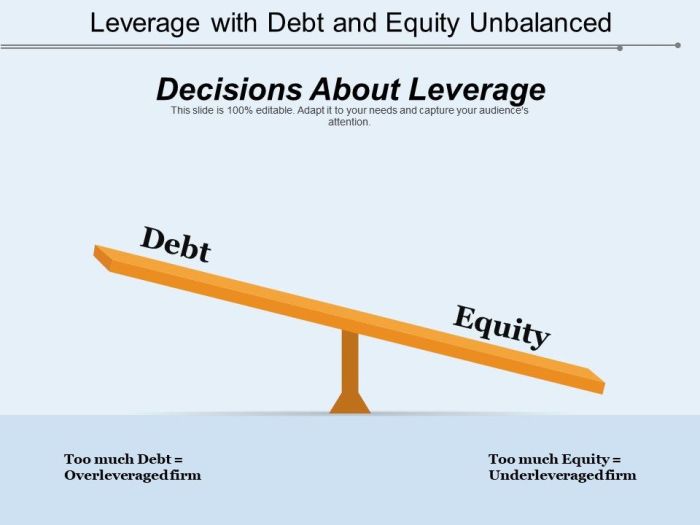

Managing debt leverage ratios is crucial to maintain financial stability and avoid overleveraging. Here are some tips to help you manage your debt leverage ratios effectively.

- Monitor your debt-to-income ratio: Keep track of your debt-to-income ratio to ensure you’re not overburdened with debt payments.

- Diversify your debt portfolio: Spread your debt across different types of loans to reduce risk and improve financial flexibility.

- Regularly review your debt obligations: Periodically review your debt obligations to assess the impact on your financial health and make necessary adjustments.

Leveraging debt for investments

Investing with borrowed money can be a powerful strategy for growing wealth, but it also comes with risks. Let’s explore how debt can be used to finance investments, the advantages and disadvantages of using debt to invest, and examples of successful investment strategies using leveraged debt.

Using Debt to Finance Investments

When you leverage debt to invest, you are essentially using borrowed money to purchase assets with the expectation of generating a return higher than the cost of the debt. This can amplify your gains if the investments perform well, but it can also lead to increased losses if they underperform.

Advantages and Disadvantages of Leveraging Debt for Investments

- Advantages:

- Increased potential for higher returns: By using leverage, you can amplify the gains on your investments.

- Ability to diversify your portfolio: Leveraging debt allows you to invest in a wider range of assets than you could with just your own funds.

- Disadvantages:

- Increased risk: Using borrowed money to invest magnifies the impact of losses, potentially leading to significant financial setbacks.

- Interest costs: You will need to pay interest on the borrowed funds, which can eat into your investment returns.

Successful Investment Strategies with Leveraged Debt

One common strategy is to use leverage to purchase real estate properties. By taking out a mortgage to buy a property, you can benefit from potential appreciation in the property’s value while using the rental income to cover the mortgage payments.

For example, if you buy a property for $200,000 with a 20% down payment and the property appreciates to $250,000, you’ve effectively doubled your equity investment.

Risks and considerations when leveraging debt

When it comes to leveraging debt, there are certain risks and considerations that individuals need to be aware of in order to make informed decisions. It’s important to understand the potential downsides before diving into leveraging debt for investments or other purposes.

Identifying potential risks associated with leveraging debt

- Increased financial risk: By taking on debt to invest, you are amplifying the potential losses if the investment does not perform as expected.

- Interest rate fluctuations: Changes in interest rates can impact the cost of borrowing, affecting your overall returns on the investment.

- Liquidation issues: If you are unable to meet your debt obligations, you may be forced to sell assets at a loss to repay the debt.

Discussing how to mitigate risks when using debt for leverage

- Establishing a risk management plan: Create a strategy to monitor and manage the risks associated with leveraging debt, including setting limits on how much debt to take on.

- Diversifying investments: Spreading your investments across different asset classes can help reduce the impact of a single investment performing poorly.

- Maintaining an emergency fund: Having cash reserves can help cover debt payments in case of unexpected financial setbacks.

Explaining the importance of conducting thorough research before leveraging debt

- Researching investment opportunities: Before taking on debt to invest, thoroughly research the potential returns and risks associated with the investment.

- Understanding debt terms: Make sure to fully comprehend the terms of the debt you are taking on, including interest rates, payment schedules, and any potential penalties.

- Seeking professional advice: Consider consulting with a financial advisor or investment expert to gain a better understanding of the risks involved in leveraging debt.