With Financial metrics for startups at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling American high school hip style filled with unexpected twists and insights.

Financial metrics are the heartbeat of any startup, guiding them through the rollercoaster journey of entrepreneurship. From revenue metrics to key performance indicators, these numbers paint a vivid picture of a startup’s financial health and future potential. So, buckle up and get ready to dive into the world of financial metrics for startups!

Importance of Financial Metrics for Startups

Financial metrics are essential for startups as they provide valuable insights into the financial health and performance of the business. By tracking key financial metrics, startups can better understand their revenue, expenses, profitability, and overall financial stability. This information is crucial for making informed decisions, setting strategic goals, and identifying areas for improvement.

Examples of Key Financial Metrics

- Cash Burn Rate: This metric helps startups understand how quickly they are spending their available cash. It is important for managing cash flow and ensuring sustainability.

- Customer Acquisition Cost (CAC): CAC measures how much it costs to acquire a new customer. By tracking this metric, startups can optimize their marketing and sales strategies to improve efficiency.

- Monthly Recurring Revenue (MRR): MRR is a key indicator of a startup’s revenue stream. It helps in predicting future revenue and evaluating the success of subscription-based business models.

- Gross Margin: Gross margin reflects the percentage of revenue that exceeds the cost of goods sold. It indicates the profitability of a startup’s core business operations.

How Tracking Financial Metrics Helps Startups

Tracking financial metrics enables startups to make data-driven decisions and prioritize resources effectively. By analyzing these metrics regularly, startups can identify trends, measure performance against goals, and adjust strategies to achieve sustainable growth. Additionally, financial metrics help startups communicate their financial health to investors, lenders, and other stakeholders, fostering trust and credibility.

Types of Financial Metrics

Financial metrics are essential tools for startups to track and evaluate their performance. There are various types of financial metrics that play a crucial role in determining the health and success of a startup. Two key categories of financial metrics are leading and lagging metrics.

Leading vs. Lagging Financial Metrics

Leading financial metrics are indicators that provide insight into future performance. They are proactive in nature, helping startups anticipate trends and make informed decisions. Examples of leading metrics include customer acquisition cost, customer retention rate, and website traffic.

On the other hand, lagging financial metrics are backward-looking indicators that measure past performance. They reflect the results of actions taken in the past and are often used to evaluate the effectiveness of strategies. Examples of lagging metrics include revenue, profit margin, and cash flow.

Importance of Revenue Metrics for Startups

Revenue metrics are fundamental for startups as they directly reflect the financial health and growth potential of the business. Tracking revenue metrics such as total revenue, revenue growth rate, and average revenue per customer helps startups understand their sales performance and identify areas for improvement. By analyzing revenue metrics, startups can set realistic revenue goals, allocate resources effectively, and scale their business sustainably.

Significance of Profitability Metrics

Profitability metrics play a crucial role in assessing a startup’s financial health and sustainability. Metrics such as gross profit margin, net profit margin, and return on investment (ROI) help startups evaluate their profitability and efficiency. Profitability metrics enable startups to measure the effectiveness of their business operations, identify cost-saving opportunities, and optimize pricing strategies. Ultimately, profitability metrics guide startups in achieving long-term financial success and stability.

Key Performance Indicators (KPIs) for Startups

In the world of startups, Key Performance Indicators (KPIs) play a crucial role in measuring the success and growth of a business. These metrics provide valuable insights into various aspects of a startup’s performance, helping founders make informed decisions and track progress towards their goals.

Essential KPIs for Revenue Growth

When it comes to revenue growth, startups need to closely monitor key metrics that indicate the health of their business in terms of generating income. Some essential KPIs related to revenue growth include:

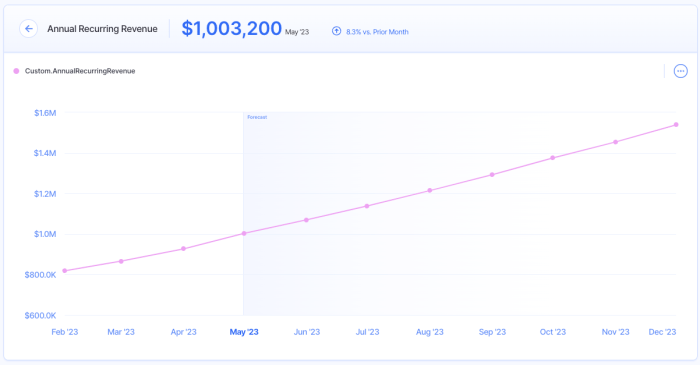

- Monthly Recurring Revenue (MRR): This metric measures the predictable revenue generated by a startup from subscriptions or recurring services on a monthly basis.

- Customer Lifetime Value (CLV): CLV helps startups understand the total revenue expected from a customer throughout their relationship with the business.

- Customer Acquisition Cost (CAC): CAC shows how much it costs to acquire a new customer, helping startups assess the effectiveness of their marketing and sales strategies.

Examples of KPIs for Operational Efficiency

Operational efficiency is essential for startups to optimize resources and streamline processes. Monitoring specific KPIs can help startups identify areas for improvement and enhance overall efficiency. Some examples of KPIs that measure operational efficiency include:

- Inventory Turnover Ratio: This metric indicates how quickly a startup is selling its inventory and replenishing stock, reflecting the efficiency of inventory management.

- Employee Productivity: Tracking the productivity of employees through metrics such as revenue per employee or output per hour can help startups assess workforce efficiency.

- Customer Support Response Time: This KPI measures how quickly customer queries or issues are addressed, reflecting the effectiveness of customer support operations.

Monitoring KPIs for Strategic Objectives

By monitoring KPIs related to revenue growth and operational efficiency, startups can align their efforts with strategic objectives and make data-driven decisions. Regularly tracking these metrics allows founders to identify trends, spot potential challenges, and take proactive steps to achieve their goals. With a clear understanding of their performance metrics, startups can adjust strategies, allocate resources effectively, and drive sustainable growth in a competitive market.

Financial Modeling for Startups

Creating a financial model for a startup is crucial for planning and decision-making. It involves projecting future financial performance based on historical data and assumptions.

Forecasting Financials and Projecting Growth

Financial models help startups forecast their revenue, expenses, and cash flow. By analyzing these projections, founders can make informed decisions about resource allocation and growth strategies. It is essential to update the financial model regularly to reflect changing market conditions and business dynamics.

- Start by gathering historical financial data and market research to establish a baseline.

- Identify key assumptions such as pricing, customer acquisition costs, and growth rates.

- Build a dynamic model using spreadsheet software, incorporating revenue streams, expenses, and funding sources.

- Run different scenarios to assess the impact of variables on financial outcomes.

Remember, financial projections are estimates and should be based on realistic assumptions to maintain credibility.

Role of Financial Modeling in Securing Funding

Financial models play a critical role in securing funding for startups by demonstrating the potential return on investment to investors. A well-developed financial model can showcase the startup’s growth trajectory, profitability, and scalability, making it more attractive to potential investors.

- Investors rely on financial models to evaluate the startup’s financial health and growth prospects.

- Accurate financial projections can instill confidence in investors and increase the likelihood of securing funding.

- Regularly updating the financial model with actual performance data can help track progress and adjust strategies accordingly.

Benchmarking Financial Metrics

Benchmarking financial metrics against industry standards is crucial for startups to assess their performance and progress in comparison to competitors. By comparing key financial indicators with industry benchmarks, startups can gain valuable insights into their strengths and weaknesses, identify areas for improvement, and make informed decisions to achieve sustainable growth.

Identifying Relevant Benchmarks

- Research Industry Reports: Startups can access industry-specific reports and studies to identify standard financial metrics used by successful companies in the same sector.

- Networking: Connecting with other entrepreneurs and industry experts can provide valuable insights into common financial benchmarks and best practices.

- Consulting Firms: Working with consulting firms specializing in startup industries can help startups gain access to relevant benchmarking data and analysis.

Setting Realistic Financial Goals

- Comparative Analysis: Benchmarking allows startups to set realistic financial goals by comparing their performance with industry averages and top performers.

- Identifying Areas for Improvement: By benchmarking financial metrics, startups can pinpoint areas where they are underperforming and develop strategies to enhance their financial performance.

- Tracking Progress: Regular benchmarking helps startups track their progress over time, adjust their strategies as needed, and stay on course to achieve their financial goals.