Get ready to dive into the world of Financial regulations in the U.S. Brace yourself for a rollercoaster of information that will keep you on the edge of your seat as we explore the ins and outs of financial regulations in the good ol’ U.S. of A.

From the importance of these regulations to the key players overseeing them, we’ve got the scoop on everything you need to know.

Overview of Financial Regulations in the U.S.

Financial regulations in the United States play a crucial role in maintaining stability and integrity in the economy. These regulations are designed to protect investors, ensure fair practices in financial markets, and prevent fraud and misconduct.

Importance of Financial Regulations

- Protecting investors from fraudulent activities

- Maintaining market stability and integrity

- Preventing systemic risks in the financial system

History of Financial Regulations in the U.S.

- One of the earliest financial regulations in the U.S. was the Securities Act of 1933, which aimed to regulate securities offerings and prevent fraud in the sale of securities.

- The Securities Exchange Act of 1934 established the Securities and Exchange Commission (SEC) to oversee and enforce federal securities laws.

Key Regulatory Bodies

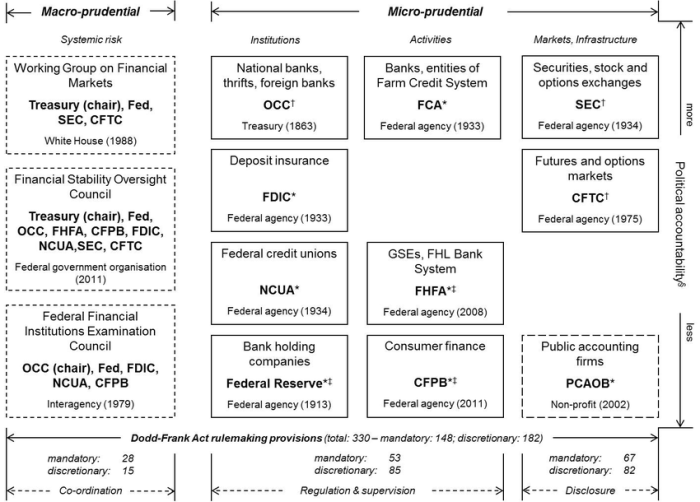

- Securities and Exchange Commission (SEC): Responsible for enforcing securities laws and regulating the securities industry.

- Commodity Futures Trading Commission (CFTC): Oversees the derivatives markets and ensures transparency and integrity in commodity trading.

- Financial Industry Regulatory Authority (FINRA): Regulates brokerage firms and exchange markets to protect investors and maintain market integrity.

Types of Financial Regulations

Financial regulations in the U.S. are essential to maintain stability and protect consumers. Let’s dive into the different types of regulations and how they impact various sectors.

Federal vs. State Regulations

Federal regulations, enforced by agencies like the SEC and FDIC, apply nationwide to ensure uniformity and consistency. State regulations, on the other hand, can supplement federal laws with additional requirements tailored to specific local needs.

Banking Regulations

- Banking regulations, overseen primarily by the Federal Reserve, aim to safeguard deposits, prevent fraud, and maintain the stability of the banking system.

-

Important regulations include the Dodd-Frank Act, which introduced measures to prevent another financial crisis, and the Bank Secrecy Act, which combats money laundering.

Securities Regulations

- The Securities and Exchange Commission (SEC) enforces regulations to protect investors and maintain fair, orderly, and efficient markets.

-

Key regulations include the Securities Act of 1933 and the Securities Exchange Act of 1934, which govern the issuance and trading of securities.

Insurance Regulations

- Insurance regulations, overseen by state insurance departments, aim to ensure solvency, consumer protection, and fair competition in the insurance industry.

-

State-specific regulations dictate licensing requirements, premium rates, and policy terms to protect policyholders.

Compliance and Enforcement

Compliance and enforcement are crucial aspects of financial regulations in the U.S. Financial institutions are required to adhere to specific requirements to ensure the stability and integrity of the financial system.

Compliance Requirements

Financial institutions must comply with various regulations, such as reporting requirements, capital adequacy standards, anti-money laundering rules, and consumer protection laws. These requirements are in place to protect investors, maintain market stability, and prevent financial crimes.

- Reporting Requirements: Financial institutions are required to submit regular reports to regulatory authorities to provide transparency and accountability.

- Capital Adequacy Standards: Institutions must maintain a certain level of capital to ensure they can absorb potential losses and continue operating safely.

- Anti-Money Laundering Rules: Institutions must implement procedures to detect and prevent money laundering activities within their operations.

- Consumer Protection Laws: Institutions must comply with laws that protect consumers from unfair practices and ensure the fair treatment of clients.

Consequences of Non-Compliance

Non-compliance with financial regulations can have severe consequences for institutions. These may include fines, penalties, license revocation, reputational damage, and even criminal charges. Failing to comply with regulations not only puts the institution at risk but also undermines the integrity of the financial system as a whole.

- Financial Penalties: Institutions may face hefty fines for failing to comply with regulations, impacting their financial stability.

- License Revocation: Regulatory authorities have the power to revoke the licenses of institutions that repeatedly violate regulations, leading to the closure of operations.

- Reputational Damage: Non-compliance can damage the institution’s reputation, leading to a loss of trust among clients and investors.

Enforcement Mechanisms

Regulatory authorities employ various enforcement mechanisms to ensure compliance with financial regulations. These mechanisms help monitor and regulate the activities of financial institutions to maintain a fair and transparent financial system.

- On-Site Examinations: Regulatory authorities conduct regular on-site examinations to review the institution’s operations and assess compliance with regulations.

- Investigations: Authorities may launch investigations into suspected violations of regulations, gathering evidence to take appropriate enforcement actions.

- Sanctions: Regulatory authorities can impose sanctions, such as fines or penalties, on institutions found to be non-compliant with regulations.

Impact of Financial Regulations

Financial regulations play a crucial role in protecting consumers, ensuring market stability, and maintaining investor confidence. Let’s delve into how these regulations shape the financial landscape.

Consumer Protection

Financial regulations are designed to safeguard consumers from fraudulent activities, unfair practices, and misleading information in the financial sector. By enforcing transparency and accountability, these regulations help prevent exploitation and empower consumers to make informed decisions.

Market Stability and Investor Confidence

Financial regulations contribute to market stability by setting standards for risk management, capital requirements, and liquidity ratios. This framework helps mitigate systemic risks, reduce volatility, and promote a level playing field for market participants. As a result, investors have greater trust in the financial system, leading to increased confidence and participation in the markets.

Examples of Significant Events

- The 2008 financial crisis prompted the implementation of the Dodd-Frank Act, which introduced sweeping reforms to regulate banks, protect consumers, and prevent future crises.

- The Bernie Madoff Ponzi scheme exposed gaps in regulatory oversight, leading to the establishment of the SEC’s Office of the Whistleblower to encourage reporting of financial misconduct.

- The LIBOR scandal revealed widespread manipulation of interest rates, prompting authorities to strengthen regulations on benchmark rates and enhance market integrity.