With 401(k) withdrawal penalties at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

When it comes to managing your retirement savings, understanding 401(k) withdrawal penalties is crucial. This guide will dive deep into the penalties, exceptions, and impact on your financial future.

Overview of 401(k) Withdrawal Penalties

401(k) withdrawal penalties are fees imposed on individuals who withdraw money from their retirement savings account before reaching a certain age, typically before 59 ½. These penalties are in place to discourage early withdrawals and ensure that the funds are used for their intended purpose – retirement savings.

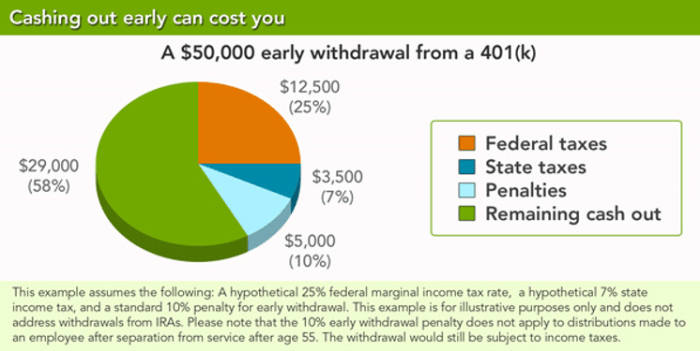

Common penalties incurred for early withdrawals include a 10% penalty on the withdrawn amount in addition to income taxes that are due on the distribution. This can significantly reduce the amount of money available for retirement and impact long-term financial goals.

Purpose of 401(k) Withdrawal Penalties

- Encourage long-term savings habits: By imposing penalties on early withdrawals, individuals are encouraged to leave their retirement savings untouched until they reach retirement age.

- Protect retirement funds: The penalties help protect the funds in the 401(k) account from being used for non-retirement purposes, ensuring financial security in retirement.

- Provide a financial safety net: Penalties serve as a deterrent to prevent individuals from tapping into their retirement savings as a quick source of cash in times of financial need.

Early Withdrawal Penalties

When it comes to withdrawing funds from your 401(k) before the age of 59 ½, you may face some hefty penalties that can significantly impact the amount you receive.

The penalties associated with early withdrawals from a traditional 401(k) account typically include a 10% early withdrawal penalty on top of income tax that you will owe on the withdrawn amount. This means that if you withdraw $10,000 early, you could end up losing $1,000 right off the bat.

On the other hand, Roth 401(k) accounts have a different penalty structure. While you can withdraw your contributions at any time penalty-free, any earnings withdrawn before the age of 59 ½ may be subject to a 10% early withdrawal penalty, in addition to income tax. This penalty only applies to the earnings portion of the withdrawal, not the original contributions.

Comparison of Early Withdrawal Penalties

- Traditional 401(k) account: 10% early withdrawal penalty on the entire withdrawn amount, in addition to income tax.

- Roth 401(k) account: 10% early withdrawal penalty only on the earnings portion of the withdrawal, in addition to income tax.

Exceptions to Penalties

When it comes to avoiding or minimizing 401(k) withdrawal penalties, there are certain exceptions that individuals can take advantage of. By meeting specific criteria, one can qualify for penalty exemptions, allowing for penalty-free withdrawals in certain situations.

Hardship Withdrawals

In cases of severe financial hardship, individuals may be able to withdraw funds from their 401(k) without facing early withdrawal penalties. This could include situations such as medical expenses, purchasing a primary residence, or preventing eviction or foreclosure.

Age-Related Exemptions

Once an individual reaches the age of 59 and a half, they are typically able to make penalty-free withdrawals from their 401(k) account. This is because they have reached the age of retirement and are considered eligible for penalty exemptions.

Qualified Reservist Distribution

For members of the military reserves who are called to active duty for at least 180 days, there is an exemption available for penalty-free withdrawals from their 401(k) accounts. This is known as a Qualified Reservist Distribution and can help alleviate financial burdens during active service.

Substantially Equal Periodic Payments

Another way to avoid penalties on 401(k) withdrawals is by setting up Substantially Equal Periodic Payments (SEPP). This method allows individuals to take consistent withdrawals based on their life expectancy, helping to avoid early withdrawal penalties.

First-Time Homebuyer Exemption

Individuals who are first-time homebuyers may qualify for penalty-free withdrawals from their 401(k) accounts for up to $10,000 to use towards purchasing a home. This exemption can provide financial assistance to those looking to invest in their first home.

Impact on Retirement Savings

Paying withdrawal penalties from your 401(k) can have significant long-term consequences on your retirement savings. These penalties can eat into your hard-earned funds, reducing the amount available for your retirement years. It is essential to understand the impact and explore strategies to mitigate these negative effects.

Strategies to Mitigate Negative Impact

- Consider exploring loan options: Instead of a withdrawal, see if you qualify for a 401(k) loan. This way, you can access funds without penalties and repay them over time.

- Reevaluate your budget: Look for areas where you can cut back to minimize the need for tapping into your retirement savings prematurely.

- Explore alternative sources of income: Consider taking on a part-time job or freelancing to supplement your income and reduce the need for withdrawals.

- Consult a financial advisor: Seek professional advice to help you navigate the situation and come up with a plan to protect your retirement savings.

Recommendations for Individuals Facing 401(k) Withdrawal Penalties

- Only withdraw funds as a last resort: Exhaust all other options before tapping into your retirement savings to avoid penalties and preserve your nest egg.

- Understand the rules and implications: Familiarize yourself with the terms and conditions of your 401(k) plan to make informed decisions about withdrawals.

- Consider the tax implications: Remember that withdrawals from a traditional 401(k) are subject to income tax, which can further reduce the amount you receive.

- Focus on rebuilding your savings: After a withdrawal, prioritize replenishing your retirement savings to ensure you stay on track for a comfortable retirement.